Excerpts from analysts' reports

AmFraser says Sing Holdings is strongly undervalued, fair value 56 cents

Analyst: Sarah Wong

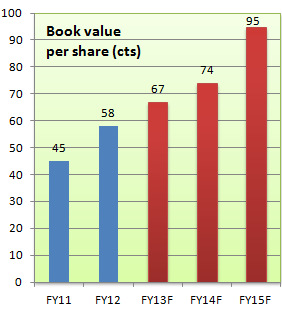

· Growing asset values. Sing Holdings boasts of potential strong growth in book values over the next three years.  Sing Holdings' stock closed at 44 cents recently, a substantial discount to its growing book value as estimated by AmFraser Research.We estimate sales of current and future development projects to propel Sing Holdings’ book value per share to S$0.95 by FY2015.

Sing Holdings' stock closed at 44 cents recently, a substantial discount to its growing book value as estimated by AmFraser Research.We estimate sales of current and future development projects to propel Sing Holdings’ book value per share to S$0.95 by FY2015.

Its current book value stands at S$0.63, a figure still significantly higher than Sing Holdings’ current share price of a mere S$0.415.

· Strongly undervalued; Maintain BUY with FV of S$0.56. We maintain that Sing Holdings presents deep value as a niche developer, and investors stand to gain exposure into a growing NAV story Sing Holdings presents.

Trading at only 0.65x P/B and at a steep discount of more than 55% to our RNAV estimate of S$0.93, we believe there is minimal downside risks to Sing Holdings.

Sing Holdings remains our choice pick for a value play—maintain BUY with an unchanged fair value of S$0.56 based on 40% discount to RNAV. BUY.

Recent story: SING HOLDINGS: On Robin plot ratio, new property strategy and dividends

AmFraser downgrades Saizen REIT to 'hold' as yen depreciates

Analyst: Eileen Goh

· Bearing short-term pain. Amid aggressive monetary easing measures by the Bank of Japan (BoJ) in a bid to jumpstart its stuttering economy and end deflation, the Japanese Yen has experienced substantial depreciatory pressures in recent months.

Saizen REIT has outperformed the market benchmark index over the past 12 months. The Japanese Yen has weakened from JPY/S$64.6 in May 2012 to JPY/S$80.3 currently. Due to a weakening yen, Saizen REIT will inevitably have to bear the near-term pain of a declining NAV and distributions in S$ terms.

Saizen REIT has outperformed the market benchmark index over the past 12 months. The Japanese Yen has weakened from JPY/S$64.6 in May 2012 to JPY/S$80.3 currently. Due to a weakening yen, Saizen REIT will inevitably have to bear the near-term pain of a declining NAV and distributions in S$ terms.Based on our revised FV of S$0.220, this represents a potential capital upside of only 5.8%.