WITH CORPORATE governance and accounting issues continuing to hang over S-chips, the management of some China-based companies are taking steps to give shareholders and investors some assurance.

Just two weeks ago, when China Sunsine directors met in China for a board meeting, the CFO took two independent directors to the three banks which collectively hold the company’s cash hoard of RMB286 million.

CFO Koh Choon Kong (

The two directors and Mr Koh, himself a Singaporean, went to ICBC Bank, China Construction Bank and Agricultural Bank of China.

“The IDs saw on the computer screens, the printouts, all the transactions – the information was all there,” recounted Mr Koh when he met SIAS Research members last night (Aug 4) in its ‘Face to Face with CFO’ series of talks.

To laughter from them, Mr Koh whipped out his Blackberry and showed a picture of the independent directors at the ICBC Bank.

When a SIAS Research member said that a bank statement didn’t necessarily confirm the existence of the cash, Mr Koh pointed out that these banks were no small, untrustworthy operations. “ICBC is now the world’s largest bank by market cap, and China Construction Bank is No.2 or No.3. Agricultural Bank is a private entity.”

Mr Koh went on to say that China Sunsine’s executive chairman, Mr Xu Cheng Qiu, has managed the company’s financials very well. “No hanky panky. We are in for the long term. My chairman holds 62% stake in the company,” he assured SIAS Research members at the meeting held at Soul Cravings Café on Neil Road.

Someone asked: What percentage of the chairman’s shares has been pledged to banks?

None, said Mr Koh pointing to the company’s report which listed Success More, the investment vehicle of Mr Xu, as holding 293 million shares.

All the shares can easily be confirmed - in a printed statement through the company registrar for a nominal fee - to be held with the Central Depository (CDP) under Success More, instead of being pledged to any institution such as a stock brokerage.

As background, China Sunsine is a leading specialty chemical producer and probably the largest producer of rubber accelerators in PRC and the world, with 50,000 tonnes per annum (TPA) of accelerators capacity and 20,000 TPA planned for TMQ/Insoluble Sulphur.

It serves all the global top 10 tyre manufacturers - Bridgestone, Michelin, Goodyear, Continental, Pirelli, Sumitomo, Yokohama, Hankook, Cooper, Kumho Tires - and more than 600 other customers in the PRC and the world.

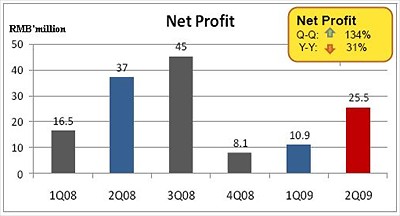

For Q2 of this year, China Sunsine has just reported a sharp recovery in its financials. Net profit margin rose from just above 5% in Q1 this year to 14.3%.

Its sales volume of 11.1 tonnes in Q2 was a record for the company. That contributed to a sharp rise in quarter-on-quarter net profit (see chart below).

The following are some of the questions raised last night and Mr Koh’s answers:

Q China Sunsine appointed a leading distributor, Malaney, in India recently. What was the sales volume Malaney was doing for its previous principal?

Mr Koh: We can’t disclose the numbers as we have signed confidentiality agreements. Put it this way, it is promising because Malaney has the network of contacts. It is one of the strongest players for distribution of rubber chemicals in India. Last year, our exposure to the Indian market was very low - only a couple of hundred tonnes. We want to grow our market share in India.

Q What can China Sunsine do about improving the liquidity of its shares? The stock needs regular information flow for more liquidity.

Mr Koh: There’s more trading these few days after AmFraser Securities set a 42-cent target price for our shares (which recently traded at 26.5 cents). I do meet investors, like at this SIAS event. I have just met remisiers and dealers at CIMB and Phillip Securities. Today, I went to UOB Kay Hian and and tomorrow I am going to DBS. There are also institutional sales people and analysts I meet.

Q What’s your capex for next year? And last year?

Mr Koh: Capex will be RMB 60-80 million this year, excluding any unannounced projects. As for last year, look at our cashflow statement: Acquisition of plant, property and equipment was RMB 77 million in 2008 and RMB 81 million in 2007.

Q Will you be making any cash calls?

Mr Koh: Unlikely. There’s no decision made.

Q Do you have any convertible bonds?

Mr Koh: No.

Q You said you will spend RMB 20 million on waste water treatment. That's expensive as it costs only around RMB 10 million to build a plant. How much do you expect to put aside regularly to meet international eco-friendly standards?

Mr Koh: That’s a good one. Over the last few years, we have invested over RMB 100 million in waste water treatment and waste gas treatment. The RMB 20 million is for an upgrade of our plant in Facility 2. This is our competitive advantage over the small players in China who may be indifferent to regulations and risk being shut down by the authorities. We instead comply 100% with PRC environmental regulations. Our clients do come to our plants and do inspections.

Q Are your raw materials oil-based? Do you hedged against oil prices?

Mr Koh: One of the key raw materials is aniline, which is a derivative of benzene which comes from crude oil. We buy at spot prices.

Q So if spot prices go up, you pass on the cost to the customers? What if they resist you?

Mr Koh: If prices go up, it would be industry-wide.

Q You are at the mercy of raw materials prices…..

Mr Koh: We check our raw materials prices every day. If it goes up, we increase our prices. We pass on the cost to customers. We are the largest player, and that helps a bit.

Q How much do raw materials comprise of your final-product cost?

Mr Koh: Raw materials take up about 70% of our total cost of goods sold. The rest will be depreciation, utility, energy, overheads, wastewater treatment, and labour. That does not include shipping and distribution costs.

Recent stories:

SGX, CHINA SUNSINE, S-REITS: What analysts say now...

CHINA SUNSINE: Hardly spinning its wheels despite global slowdown

For insights into the chairman: CHINA SUNSINE’S TAO of management