Mr Chu Ki, the CEO (right) and Mr Ong Hong Hoong, the Corporate Development Director. Photo by Terence Wong

“CHANGE IS the only constant. You have to constantly improve your business model to stay abreast of the competitors.”

These words by Mr Chu Ki, CEO of Heng Tai Consumables, left a deep impression on me as my colleague and I left his office with several fund managers.

Heng Tai is a good case study of how its business model has been strengthened over time.

We had arranged for 4 Taiwanese fund managers to meet Mr Chu and Mr Ong Hong Hoon, the company’s Corporate Development Director.

History

Heng Tai – in which Arisaig Partners owns 9% - was founded in 1994 to mainly handle the distribution of fast-moving consumer goods in China; trade imported goods in Mainland China; and export Chinese goods to international markets.

As demand for quality fast-moving consumer goods grew in China, Heng Tai acquired its own storage facilities in Shanghai to handle premium and perishable goods such as frozen meat and chilled seafood. In Zhongshan, Heng Tai built the Fresh Produce Logistics Centre, which was completed in 2006.

The centre boasts a total land area of 78,000 sq m, with 16,000 sq m trading arena and 4,800 sq m of temperature-controlled warehouse. This offers its customers a centralized trading arena, logistics hub and quality temperature controlled storage facilities.

Subsequently, the Company acquired a logistics company, which came with a well-equipped fleet of truck, including chill, multi-temperature and dry trucks, equipped with Global Positioning System. In 2007, the Group diversified into the agriculture sector for its sustainable growth.

Today, the Group manages 81,000 mu (5,400 hectares) of land throughout China for the production of quality fruits and vegetables. Heng Tai contracts the farming out for 53,800 mu.

It harvests a wide variety of fresh produce including root and leafy vegetables (such as cabbage, broccoli, potatoes and choy sum), flowering plants (e.g. tomatoes) and fruits (e.g. navel oranges, grapes). Production is standardised and effective monitoring ensures production complies with international safety standards, such as the GLOBALGAP, HACCP, ISO 9001/22000.

The Group has also devoted funds to R&D of crops.

The Group continuously seeks opportunities to acquire more farmland and plans to set up a fresh cut processing plant and an organic fertilizer plant in the near future.

On the surface, Heng Tai’s business model does not seem to have focus. Its trading business requires marketing efforts and cashflow management skills, while logistics and warehouse management are about planning and efficiency.

Agriculture needs a lot of interaction with the local authority, farmers and an extensive distribution network to sell the harvest.

Aries Consulting & fund managers meeting Heng Tai management. Photo by Terence Wong

Where is its competitive strength?

Mr Chu explained the need for Heng Tai to progress up the value chain. “We started off at the bottom of the value chain with the lowest possible margins. But having had trading experience in China for 20 years, we have built up our network and knowledge of the different geographical markets.

”The Group now represents approximately 150 brands and 2,500 SKU and we distribute these products across China, focusing on fast moving consumer products and fresh produce. We focus on the smaller brands for better margins. These smaller players need our help to penetrate the market.”

Heng Tai’s networks include wholesale markets in major cities such as Beijing, Shanghai, Guangzhou, Xian, Chengdu and Hong Kong; major international retailers such as Park'N Shop, Lotus, Lawson, RT-Mart, Carrefour as well as the overseas market especially in the ASEAN countries.

“Our trading division has also expanded into airline catering and bakery. We are also importing a lot of beef, mutton, dairy and seafood from Australia and New Zealand. We intend to grow this division via organic growth.”

“For our logistic division, we operate it as a separate SBU, a profit centre. Apart from Zhongshan, we have another sophisticated hub in Shanghai, which provides world-class storage facilities and delivery fleet. Our customer base include major wholesalers and retailers, which will enable us to achieve consistent growth in the future.

“Our warehousing and logistics division complements our trading division perfectly. By controlling our delivery schedule and storage space, we reduce a lot of inefficiencies that used to exist between our trading division and our outsourced logistic partners.”

Why agriculture?

“The Company explored many options such as retailing and F&B. We decided on agriculture as this ties in with the products that we are selling via our trading division. We know what the market wants to buy and we can produce at a reasonable cost and bring the products to consumers on a cost-efficient basis.”

“The agricultural division probably gives us the best gross margins around 35%. Logistics is around 25% and trading is around 15%,” Mr Chu added.

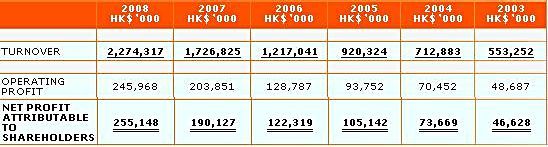

Financials for the year ended June 30.

Key shareholders

This is truly a public listed company. The management owns around 20% of the issued share capital. 80% is in the hands of the public. A HK-based fund, Keywise Capital, owns 14%; JPM, 10%; Arisaig Partners, 9%; and Pope Asset, 6%. That leaves around 41% in the hands of the retail investors.

Financials

Heng Tai has performed admirably over the past few years. From a revenue base of HKD 553 million in 2003, the Company’s sales have jumped five-fold to HKD 2.3 billion as at 30 June 2008. Net profit has improved six-fold from HKD 47 million in FY2003 to HKD 255 million in FY2008.

Shareholders’ equity has soared 11-fold over these 6 years to HKD 2 billion. The slowdown in the global economy is likely to affect the sales revenue of Heng Tai’s trading division. This will have an indirect impact on its logistics division. The agriculture division, being anti-cyclical, is likely to have better returns in 2009, barring any acts of God.

It is the standard policy of the company to commit a dividend payout ratio of 25 to 30% subject to the availability of the Cash reserve. However, given the present global business conditions and that the company is capital hungry for expansion, the company said its dividend payout program may have to be deferred until after year 2010.