Early sign of a revival of CPO price?

UOB Kayhian reported this morning that there are preliminary indications of stronger exports of palm oil this month (December).

Malaysian exports for the first 10 days of the month were 619,180 tonnes compared with 320,081 tonnes during the same period in November.

“This could be an early signal of a revival in palm oil demand,” according to the report.

Excerpts:

FFB crops from smallholder encountering difficulties to sell.

Millers are shortening their collection time to turn away some Fresh Fruit Bunch (FFB) from smallholders. This is due to the high CPO inventory sitting at millers’ tanks and the problem is serious in Sabah, which produces approximately 30% of Malaysia’s total palm oil output. This will likely to lead to a drop in palm oil supply and could be a good price support.

Tight credit to limit the new planting season.

Edible oil production could be dampened by the lack of credit availability to producers. In Brazil, growers are finding it harder to get loans sufficient to cover the rising costs of fertiliser, pesticides and seed. This could limit planting by the second-largest soyabean producers in 2009.

Also, HSBC would scale back lending to forestry schemes in Malaysia and Indonesia and review links with Canadian oil sands, the British company told Reuters. HSBC will cut ties with a third of forestry clients in Malaysia and Indonesia, including palm oil, soy and timber industries.

Sector Impact

The above factors would lead to lower edible oil production and inventory, which is positive to prices.

Like other oil palm plays, IndoAgri stock (above) has fallen sharply as crude palm oil price crashed.

Valuation/Recommendation

Maintain OVERWEIGHT. We expect a recovery in oil price in 2009 to an average of RM1,800/tonne due to the prospect of lower production growth resulting from a decline in the biological yield cycle and seasonally lower production, larger edible demand for palm oil and higher mandate for biodiesel use in Indonesia, Malaysia, Colombia and a few other countries.

Our stock picks are:

* Wilmar International (BUY/Target: S$2.88),

* Astra AgroLestari (BUY/Target: Rp8,750) and

* Kuala Lumpur Kepong (BUY/Target:RM8.60).

For small- and mid-cap stocks, we prefer Indonesia-based plantation companies.

Our stock picks for regional small- and mid-caps are:

* Indofood Agri Resources (BUY/Target: S$0.80),

* London Sumatra Indonesia (BUY/Target: Rp3,000),

* Golden Agri (BUY/Target: S$0.33) and

* Sampoerna Agro (BUY/Target: Rp1,350).

*****

Morgan Stanley: A key risk is a sharp slowdown in China's economy.

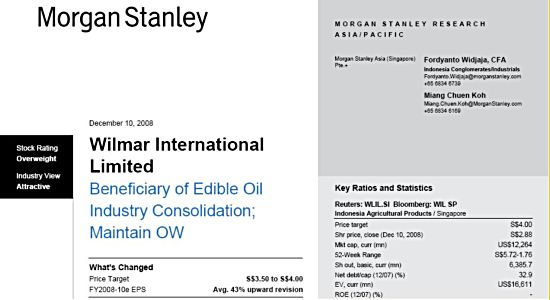

This morning, Morgan Stanley raised its price target on Wilmar International (recent price: $2.88) to $4 from $3.50 due to the company's dominant position in the global palm oil and China soybean industries.

Morgan Stanley said it has raised Wilmar's 2008-10 EPS estimates by an average of 43 pct, about 13 pct higher than consensus, as it is confident on the company's profit outlook after it posted strong third quarter earnings amid a sharp downturn in soft commodity prices.

"Lower soft commodity prices and tight banking liquidity could drive out marginal players from the industry, benefiting Wilmar, which could inorganically expand its operations at any point along the edible oil value chain," Morgan Stanley said.

"We expect Wilmar to impress the market with firm profit margins, good earnings growth and further market share gains going forward," it said.

Recent story: PALM OIL: Prices have slumped, does recovery lie ahead?

You are welcomed to post a comment or question at our forum.