BARGAIN HUNTING in the sea of red?

Singapore-listed China stocks may under-perform in bear markets, but one must concede China’s GDP growth of close to 10% is still the highest among major economies.

In comparison, Singapore is expecting GDP growth of up to 5% this year, said Prime Minister Lee Hsien Loong during his National Day rally speech.

NextInsight short-listed 12 “bargain” S-chips below using the following criteria:

1. Dividend yield greater than 3%

2. Trading at discount to net assets

3. Positive free cash (operating cash > capex)

Close to 10% of S-chips met the above ‘fundamental value’ criteria (See figure 1 below). Of this, more than half were trading at less than 4 times historic PE:

|

Company Name |

Stock Price |

Mkt Cap S$mln |

Sales |

Historic |

Discount to Book |

Dividend |

|

Asia Environment |

$0.205 |

87.8 |

96.2 |

3.9 |

39% |

9.8% |

|

Hongwei Tech |

$0.150 |

33.8 |

66.1 |

2.6 |

40% |

9.4% |

|

Sky China Petroleum |

$0.115 |

33.8 |

40.8 |

1.8 |

48% |

8.1% |

|

Changtian Plastics |

$0.155 |

102.3 |

131.5 |

2.1 |

30% |

7.1% |

|

Asia Power |

$0.170 |

68.9 |

129.8 |

5.0 |

23% |

6.5% |

|

Hongguo |

$0.205 |

81.4 |

153.5 |

3.6 |

20% |

6.4% |

|

China Precision |

$0.240 |

96.0 |

159.7 |

4.3 |

9% |

5.6% |

|

Reyoung Pharm |

$0.165 |

55.0 |

150.3 |

4.7 |

41% |

5.5% |

|

Synear Food |

$0.290 |

398.8 |

460.4 |

6.3 |

30% |

4.9% |

|

Bio-Treat |

$0.150 |

133.7 |

291.8 |

4.8 |

68% |

5.3% |

|

China Sky Chemical |

$0.455 |

370.6 |

475.1 |

2.4 |

35% |

4.6% |

|

China Sun Bio-chem |

$0.165 |

133.8 |

347.2 |

3.1 |

57% |

4.2% |

Bargain S-Chips (source: NextInsight / Bloomberg, as at 22 Sep 2008)

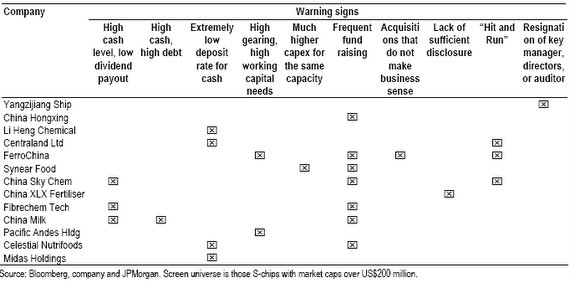

Considering the risky nature of S-chips, what are some potholes to avoid when stock-picking from the “bargain department”?

There are 10 barometers that suggest to seasoned investors there’s more than meets the eye. Many of these include detailed checks on cash, which is harder to manipulate than earnings.

In its recent report, JP Morgan identified the following companies as passing their “warning alerts” screen: COSCO Corp, Yanlord Land, Delong Holdings, People's Food, Chin Fishery, Hsu Fu Chi, China Aviation Oil and EPURE Intl.

Among them, China Fishery, People’s Food and Hsu Fu Chi have the following attributes (using consensus estimates for the non-rated companies):

- FY09E P/E < 10x;

- FY07-09E EPS growth CAGR > 20%;

- FY08E dividend yield > 2%;

- Net-working-capital-to-sales ratio < 15%.

Does your 'bargain gem' fail any of these 10 warning alerts?

Readers should note there could be sound reasons behind some of these “warning alerts”, so the discerning investor would investigate further before writing any stock off.

1. Extremely low deposit rate for cash

This is a major warning alert.

Using China’s annualized cash rates as an example:

| 0.72% | Demand deposits |

| 1.8% | 3-month time deposit |

| 2.5% | 12-month time deposit |

It is thus reasonable to expect interest on bank deposits for S-chips to exceed 1%.

JP Morgan screen

- Deposit rate for cash <1%

- Total cash/market cap > 5%

2. High cash reserves, but high debt

A high-cash and high-debt scenario indicates poor financial discipline since companies can logically cut finance costs by paying down their debt with excess cash.

Investors begin to wonder there is “balance sheet management” around the book closure date, or in the worst case scenario, a possibility of fraud or embezzlement of cash.

JP Morgan screen

-

total debt/market cap > 30%

-

total cash/market cap > 30%

3. Much higher capital expenditure for the same capacity

If a company's fixed asset investment per ton of production capacity increases sharply over its expansion schedule, investors begin to wonder if the increasing depreciation expense that shows up on the profit and loss statement could in fact be excesses in other operating expenses.

Inability to sustain growth

4. High gearing, high working capital requirement

High working capital requirements, low net margin and high gearing will slow growth.

JP Morgan screen

- High net working capital to sales ratio (>20%)

- High gearing ratio (>35%)

- Net working capital to sales ratio – net margin > 15%

5. Frequent fund-raising

JP Morgan screen

Issues of new shares or convertible bond more than twice during 2004-2007.

Changes of key officers

6. Hit-and-run

When a controlling shareholder dilutes its stake to below 50% within a few years of listing, there may be reason for investors to ask questions. Another situation would be a passive investor holding the controlling stake.

7. Resignation of key managers, directors or auditor

Most auditor replacements in Asia are related to unsettled disputes on accounting practices. Investors should be alert if senior managers resign without a proper reason. If the company was doing well, why would they leave instead of enjoying the corporate spoils? Often, the resignations potentially indicate corporate governance issues that investors were unaware of before, said JP Morgan.

Poor corporate governance

8. Acquisitions that do not make sense

Investors require acquisitions to show synergy, and a fair acquisition price. This is especially so if the seller is an interested party or an affiliated company. Volume and size of transactions could mask sharp unwarranted jumps in certain accounting items.

9. Lack of sufficient disclosure

This could include failure to disclose large payments related to subsidiaries acquired from a related party, and such payments were subsequently highlighted by independent auditors.

10. High cash reserves, but low dividend payout

JP Morgan screen

- net cash/market cap > 10%

- rising cash level in the past two fiscal years

- dividend payout ratio < 20%

Yangzijiang looks fine -- only thing flagged was resignation of key executive (aiyah, resignations are common everywhere).

Midas - should be fine too. Singaporean CEO.

Pac Andes should be fine too -- they hv been around for so long and are run by non-Mainland Chinese.

Centraland -- in the midst of delisting.

Synear Food -- maybe next to delist. Boss is the same fellow at Centraland. Must be fed up with SG listing. Hahaha....

The rest... anyone can comment?