YOU ARE likely to think that stocks are cheap. Only thing is, will they get cheaper? Will earnings fall off the cliff?

These are valid questions but putting them aside, consider the big picture as painted by US fund manager Pring Turner Capital Group (www.pringturner.com).

In a recent newsletter, it laid down its case that yes, the daily news is bad, but it believes that this very gloomy downturn is setting the scene for a US bull market that will roar to life soon.

“We believe the market has more than discounted all the bad news out there and is putting the finishing touches on the bottoming process for stocks. Yes, a significant advance is set to begin that will take stocks much higher in the year ahead.”

Pring Turner sets out four reasons for its confidence.

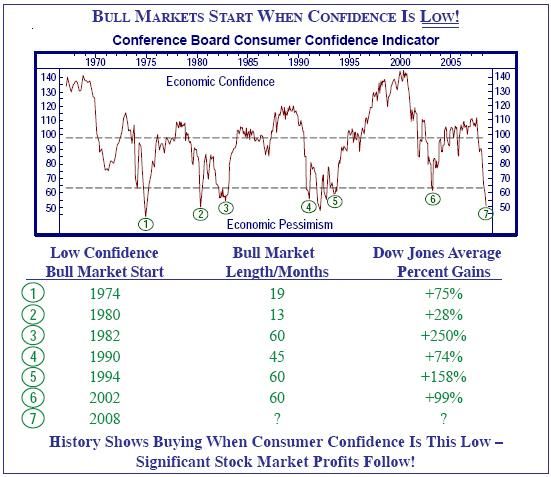

The most compelling one may be that American consumers’ level of confidence has reached a 28-year low. In the past 40 years, whenever attitudes tumbled to this pessimistic extreme, stocks had already greatly digested and discounted the bad news.

The chart below says it eloquently. It's worth a close look as it seems to show how easily one could have predicted the birth of a new US bull market.

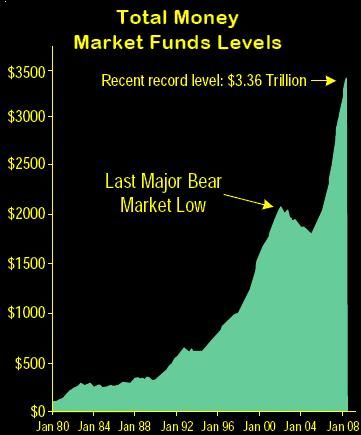

Pring Turner argued that the second positive sign is the enormous cash pile investors have sitting in money market funds.

“This record amount of cash is fuel for the next bull market advance. In fact, cash levels in money funds as a percent of the total value U.S. stocks equals a record high 27%!”

This level is higher than the start of any bull market of the past 30 years. “A little improvement in the news, an end to the oil price spike, and a shift in investor attitudes toward optimism will open the floodgates of money fund assets flowing back into stocks.”

* Retreat in oil prices: It argues that the recent prices are at unsustainable levels. “We think the most likely outcome will be a significant decline in oil to US$100 or lower before the year is over. This positive surprise for investors will be a major catalyst for the next bull market lift-off.”

* Bull markets always follow bear markets: Cycles are just inevitable. In the depths of a bear market, investors are always faced with intensely negative news and many times a “crisis atmosphere” which pushes stock prices temporarily lower.

"Bull markets begin in the middle of all the bad news. Historically the bull markets rewarded investors with gains on average exceeding 90%."

For the full article by Pring Turner, click here.