This article has been adapted from a blog, (‘Level 13 financial ramblings’) with the kind permission of its author.

SAN TEH’S cement business continues to be its main revenue driver. Since FY 04, the cement business has stayed in the black after many years of losses.

Following its excellent FY06 results, FY07 has also proven to be a successful year.

This year will see a major milestone with the listing of its cement operations on the Shanghai Stock Exchange.

First, some overview on its FY07 performance. Turnover rose 26% to $162.7 million and profit after taxation improved 14% to $11.9 million.

Sales in the cement operation went up by 31% to $128.3 million and the operating profit increased 39% to $21.0 million.

The average cement-selling price was higher at RMB256 per ton as compared to RMB240 per ton in FY06, according to the company’s announcement on SGXNet.

In FY08, the average cement selling prices are expected to hover at RMB250 to 260 per ton on the back of strong fixed-asset investment and GDP growth in China.

However, the bad news is that cost increases have hit San Teh in Q1 08: Coal prices which averaged RMB400 per ton in 2007 rose to RMB620 per ton.

Profits in the plastic division continued to be depressed due to the rising PVC resin prices. The low occupancy rate in the newly opened hotel in Suzhou has resulted in a loss for the hotel division in FY07.

Since 2006, the government of China, through The National Development and Reform Commission (NDRC), has started closing down the smaller cement companies with outdated capacity.

Such a drastic step is a very important factor for the China cement industry in the next few years. Although new capacity supply should stay at high levels, the volume of outdated capacity being shuttered should keep net capacity increases low compared with the increase in new demand.

Oversupply should gradually ease in the next few years for the above reason. The main objective for the closure of outdated capacity is to reduce discharge and save energy as the remaining players have a more efficient manufacturing process and at the same time weed out rouge companies operating without government permit.

As its plant in Fujian Longyan is running at full capacity, San Teh has decided to build a new cement plant in Dali with an output per year of 1 million tons.

It is expected to contribute positively to the bottom line starting from the second half of FY08 and contribute around 33% of the cement revenue from FY09.

| San Teh S$’000 |

2005 |

2006 | 2007 | Q1 ‘08 |

Revenue |

114,141 | 128,601 | 162,669 | 33,462 (-9.5%) |

| Net profit | 3,518 | 9,943 | 10,815 | 5,566 (+13.7%) |

| EPS |

1.23 cents | 3.46 cents | 3.75 cents | 1.92 cents |

The exciting thing about San Teh is that it is preparing its cement operation for a listing on the Shanghai Stock Exchange by the end of this year.

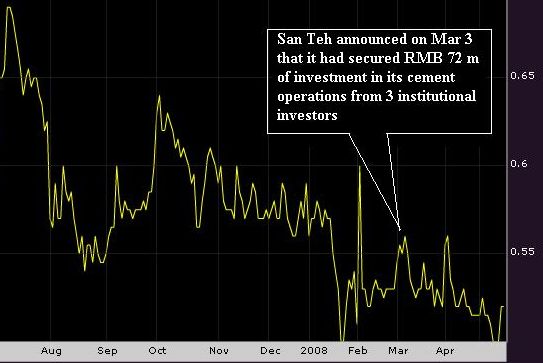

Ahead of that one of the three largest cement groups in China, the Southern Cement Group, together with two other institutional investors, recently invested RMB72.0 million for a 6.67% interest in San Teh’s cement operation.

Based on this, the whole cement operation is estimated to be worth a whopping RMB1,079 million (S$210 million).

Assuming the plastic and hotel business is worthless as they are making losses, San Teh's share price should be at the S$0.72 level.

Stock price 54 cents; NTA 93 cents

The current share price of around 54 cents is already significantly below San Teh’s NTA of S$0.93 as at 31st December 2007.

The institutions are going in as pre-IPO investors. Could they have overpaid? Chances of that are not high, in my view. Southern Cement Group is one of the three biggest cement businesses in China.

From San Teh's point of view, the cement operation should be listed at as high a price as possible. I believe upon listing, the public will have to buy at a price higher than the pre-IPO investors.

By how much I don't know. But the current huge discount of its stock price to its book value is not justified. This discount gap, in my view, should narrow considerably once the cement operation has been listed successfully.

Currently, it is difficult to peg a value for the cement operation. But once listed, the price is available for all to see.

Besides, San Teh will receive cash from the public for a stake in their cement company at IPO. A few days ago, Asia Cement soared 38% in its trading debut in Hong Kong. The only risk now is of San Teh postponing its listing plans due to poor market sentiment in Shanghai.

Personally, I feel that San Teh should divest away its other business (hotel & pipes) and concentrate on the cement operations as the outlook of the cement industry is still rosy at least for the next 2-3 years although I am aware that other cement companies are also expanding their manufacturing capacity.

San Teh’s financial position is healthy and its expansion strategy is right on track to become a mid-sized cement manufacturer.

"Level 13" is a 30-year-old retail investor with 4 years of investing experience.