NASI LEMAK, as everyone knows, is a humble but popular dish.

Our stock portfolio, which was cobbled together after a meal of nasi lemak, has outgrown its humble connotations.

It has continued to gain in value because a few stock picks have turned out to be delicious, very delicious. And most of the other picks have chalked up decent gains.

Luckily, there has been no rotten pick.

A NextInsight reader, having tracked the portfolio earnestly, put it this way: "Your nasi lemak now got abalone and wagyu beef liao!"

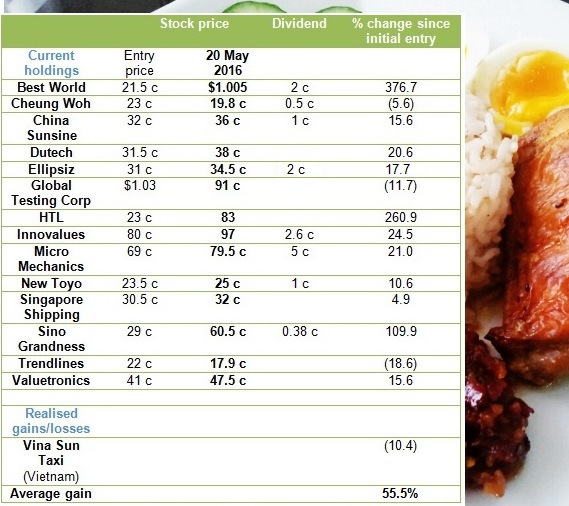

That enriched portfolio, which began life in Aug 2015 and saw several additions and one deletion along the way, looks (or tastes) as follows:  Note: Dividends are cumulative from the time the stocks were added to the portfolio.

Note: Dividends are cumulative from the time the stocks were added to the portfolio.

For simplicity, assuming equal allocation for each stock, the portfolio has gained 55.5% since it began life nine months ago.

Naturally, we feel good that the gain is far and away superior to the Straits Times Index which lost 9.9% in the past nine months. Add in, say, 3 percentage points for dividends, and the index is down 6.9%.

| ♦ Super trio with gains of 377%, 261% and 110% |

|

» Best World International: This direct-selling company has become a market darling on strong earnings in FY15 and 1Q of this year (for more, see: CIMB highlights BEST WORLD, MM2, DUTECH, NERA)

» Sino Grandness: After languishing for over a year, this Chinese F&B company has been re-rated after submitting its application for the IPO of its beverage subsidiary, Garden Fresh, in Hong Kong (for more, see: SINO GRANDNESS (The story up to now): On verge of filing for beverage subsidiary's IPO). |

You may recall that the portfolio is a construct of the best ideas of six investors who, after a hearty meal of nasi lemak and mee rebus somewhere in MacPherson, responded to a spontaneous question by one of them: "What is your best stock idea(s) currently?"

A seventh investor was later invited to contribute his stock picks. (For our past stories on how this nasi lemak portfolio evolved, see the links at the bottom).

There are two changes to the portfolio going forward. The investor who picked Cheung Woh Technologies is dropping it because the stock is illiquid, and the company's business story is not easy to keep abreast of.

In its place is high-growth property developer Oxley Holdings (43 cents) which looks set to report high profitability over the next few years (for more, see: OXLEY: Has garnered unbilled sales of $3.2 billion!).

Another property business joins the portfolio as the investor who picked Micro Mechanics is replacing it with Bund Centre (81 cents).

No, we are not selling any of the super trio (Best World, HTL and Sino Grandness) as yet.

We will update the performance of the portfolio at year-end.

Cautionary note: The portfolio reflects the diverse investment interests and perspectives of 7 investors, each of whom has other stock picks not accounted for in this nasi lemak portfolio. Thus, their risk profiles and investment objectives are not fully known and may differ -- in fact, you can assume they are likely to differ -- from yours.

7 June update: Stock picker is taking out Singapore Shipping at 27 cents from the porfolio with a realised loss of 11.5%.