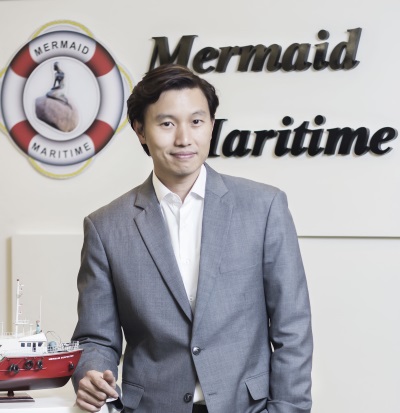

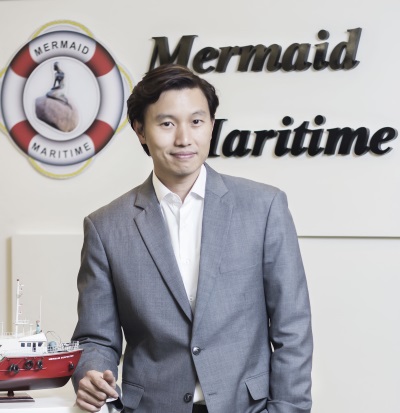

CEO Chalermchai Mahagitsiri's total interest in Mermaid has increased to 68.3%. He has a deemed interest in Mermaid via Thoresen Thai Agencies' stake of 57.7% and he holds a direct interest of 10.6%.AFTER FALLING by close to 50% over the past half year, Mermaid Maritime’s stock price has recovered by some 12% in just a couple of days to 32 cents yesterday (Tuesday), spurred by insider purchases of 2.35 million shares.

CEO Chalermchai Mahagitsiri's total interest in Mermaid has increased to 68.3%. He has a deemed interest in Mermaid via Thoresen Thai Agencies' stake of 57.7% and he holds a direct interest of 10.6%.AFTER FALLING by close to 50% over the past half year, Mermaid Maritime’s stock price has recovered by some 12% in just a couple of days to 32 cents yesterday (Tuesday), spurred by insider purchases of 2.35 million shares.

Its parent company, Thoresen Thai Agencies, purchased Mermaid shares on three consecutive trading days. Details:

♦ Bought 700,000 Mermaid shares on 16 October from the open market when its stock price reached a year-low of 28.5 cents.

♦ Purchased another 1.54 million shares the following day (17 October).

♦ Bought another 110,000 shares on the next trading day (Oct 20).

Mermaid Maritime CEO Chalermchai Mahagitsiri is deemed interested in these purchases, which were transacted through Thoresen Thai Agencies’ wholly-owned subsidiary, Soleado Holdings.

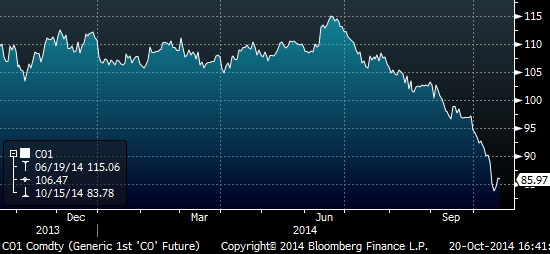

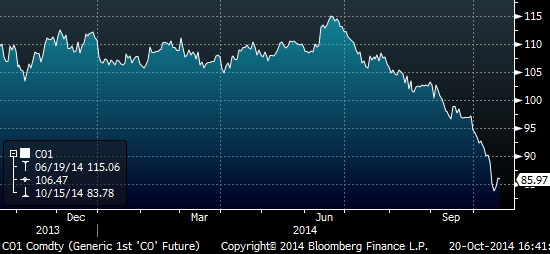

Mermaid Maritime’s stock price had fallen in tandem with weak crude oil prices, which were down some 25% since June to about US$85 per barrel.

The stock has a trailing PE of 6X and dividend yield of 1.99%, according to Bloomberg.

Over 6 months, Mermaid Maritime's stock price fell from 54 cents to 28.5 cents last Thursday. Purchases by Thoresen helped lift the stock to 32 cents on Tuesday.

Over 6 months, Mermaid Maritime's stock price fell from 54 cents to 28.5 cents last Thursday. Purchases by Thoresen helped lift the stock to 32 cents on Tuesday.

Bloomberg data

Brent crude oil price

Brent crude oil price

What some investors do not realize is that unlike oil & gas players that focus on oil exploration, there is relatively low correlation between Mermaid Maritime’s earnings with short-term fluctuations in oil prices.

In a scenario of falling oil prices, exploration activities are the first to be cut, followed by existing exploration works, while the last segment to be hit is oil production.

When depressed oil prices make oil exploration less profitable, oil and gas majors prefer to maintain production and take greater care of existing fields rather than invest in new ones.

As Mermaid Maritime owns and operates subsea vessels and drilling rigs that support offshore production (instead of exploration), it has strong earnings visibility.

Its fleet comprises of dive support vessels, ROV support vessels, construction barges and offshore utility vessels, tender rigs and high-spec jack-up oilrigs.

Its services range from subsea inspection, repair and maintenance, infrastructure installation support, emergency callout and salvage, cable laying to accommodation rig services and offshore drilling.

Mermaid Asiana is one of Mermaid Maritime's dive support vessels. The company is a leading provider of subsea and drilling services for the offshore oil & gas industry.

Mermaid Asiana is one of Mermaid Maritime's dive support vessels. The company is a leading provider of subsea and drilling services for the offshore oil & gas industry.

Its biggest customer is state-owned Saudi Aramco followed by other national oil and gas companies that are less sensitive to oil price changes than international oil and gas companies.

“The breakeven price for oil production is quite low for most of our clients and the current oil prices are far from those levels,” said the CEO.

“In fact, we are in the bidding season for next year’s jobs and the pipeline of contracts look very promising,” he said.

Mermaid Maritime had a strong order book of US$470 million as at September 2014.

"Our business fundamentals are very strong and we are on track to deliver our highest yearly earnings for the upcoming full year results,” he added.

The company, whose recent FY ended in Sept 2014, had posted 3QFY2014 revenue of US$225.2 million, up 25% year-on-year while net profit was US$31.5 million, up 543%.

Subsea services contributed 73.3% to 3QFY2014 revenue, while survey services contributed 16.3% and drilling services contributed 10.4%.

Recent story: ASL MARINE, MERMAID MARITIME: What Analysts Now Say

CEO Chalermchai Mahagitsiri's total interest in Mermaid has increased to 68.3%. He has a deemed interest in Mermaid via Thoresen Thai Agencies' stake of 57.7% and he holds a direct interest of 10.6%.AFTER FALLING by close to 50% over the past half year, Mermaid Maritime’s stock price has recovered by some 12% in just a couple of days to 32 cents yesterday (Tuesday), spurred by insider purchases of 2.35 million shares.

CEO Chalermchai Mahagitsiri's total interest in Mermaid has increased to 68.3%. He has a deemed interest in Mermaid via Thoresen Thai Agencies' stake of 57.7% and he holds a direct interest of 10.6%.AFTER FALLING by close to 50% over the past half year, Mermaid Maritime’s stock price has recovered by some 12% in just a couple of days to 32 cents yesterday (Tuesday), spurred by insider purchases of 2.35 million shares. Over 6 months, Mermaid Maritime's stock price fell from 54 cents to 28.5 cents last Thursday. Purchases by Thoresen helped lift the stock to 32 cents on Tuesday.

Over 6 months, Mermaid Maritime's stock price fell from 54 cents to 28.5 cents last Thursday. Purchases by Thoresen helped lift the stock to 32 cents on Tuesday.  Brent crude oil price

Brent crude oil price Mermaid Asiana is one of Mermaid Maritime's dive support vessels. The company is a leading provider of subsea and drilling services for the offshore oil & gas industry.

Mermaid Asiana is one of Mermaid Maritime's dive support vessels. The company is a leading provider of subsea and drilling services for the offshore oil & gas industry. NextInsight

a hub for serious investors

NextInsight

a hub for serious investors