OSK-DMG higlights Yangzijiang's near-term re-rating catalysts

Analysts: Lee Yue Jer & Jason Saw

Vessel prices have risen 15-20% y-o-y while steel prices have been on a downtrend. Photo: CompanyBack to lower taxes. YZJ has been accredited a “High/New Technology Enterprise” (HNTE), which will reduce its tax rate from the prevailing 25% corporate rate to a preferential rate of 15%.

Vessel prices have risen 15-20% y-o-y while steel prices have been on a downtrend. Photo: CompanyBack to lower taxes. YZJ has been accredited a “High/New Technology Enterprise” (HNTE), which will reduce its tax rate from the prevailing 25% corporate rate to a preferential rate of 15%. We had earlier flagged this as a likely development given YZJ’s market-leading position in building 10,000- TEU vessels, offshore assets, and eco-friendly vessels, on top of its vessel design capabilities.

Stock again oversold on margin fears and chairman’s potential retirement in 3 years. YZJ’s stock was sold down after its 4Q13 results owing to:

i) the high tax rates in 4Q13;

ii) high-margin vessels having been delivered; and

OSK-DMG says there were "indications from Ren Yuanlin" (above) that he would retire in 3 years. NextInsight file photoiii) indications from chairman Ren Yuanlin that he will retire in three years.

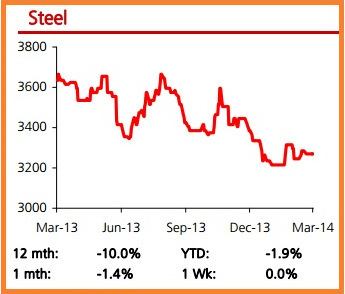

OSK-DMG says there were "indications from Ren Yuanlin" (above) that he would retire in 3 years. NextInsight file photoiii) indications from chairman Ren Yuanlin that he will retire in three years. We note that YZJ’s margins have consistently outperformed street expectations, and that the currently full utilization at its yards will enhance margins. Meanwhile, vessel prices have risen 15-20% y-o-y while steel prices have been on a downtrend.

HTM collateral 3.2x covered in land. Investors were also concerned about the default risks in Chinese property companies, to which YZJ lends 44% of its held-to-maturity (HTM) portfolio. We see two risk mitigation factors:

i) 64% of its overall collateral is in land and only 9% in shares (which may not be shares in property developers), and

ii) the coverage ratio for land is 3.2x.

Weakening steel prices benefit Yangzijiang's shipbuilding business. Chart: DatastreamWe believe that the company can easily recover its principal plus interest via sale of the land at a >50% discount.

Weakening steel prices benefit Yangzijiang's shipbuilding business. Chart: DatastreamWe believe that the company can easily recover its principal plus interest via sale of the land at a >50% discount. Maintain BUY, with higher SGD1.58 TP. We continue to like YZJ for being the strongest shipbuilder in China in a recovering industry. Other near-term catalysts are: i) exercising options for 10,000-TEU containerships, which will boost utilization and support margins;

ii) receipt of deposits for two semi-submersible rigs, making the contracts effective.

Maintain BUY, with higher SGD1.58 TP (from SGD1.55), raising the shipbuilding multiple to 9.5x vs 9x in our SOP valuation.

Recent story: YANGZIJIANG: FY2013 gross margins widened in shipbuilding slump