SERIAL SYSTEM's 4Q of 2013 was a zip to the finishing line, crossing the S$1 billion annual sales mark for the first time in its 25-year history.

Derek Goh, executive chairman & CEO of Serial System at the FY2013 results briefing. Seated is CFO Alex Wui. Today, Derek bought 2.095 m shares of Serial for a total of $278,593, or an average of 13.3 cents a share. The stock ended the day at 13.7 cents.

Derek Goh, executive chairman & CEO of Serial System at the FY2013 results briefing. Seated is CFO Alex Wui. Today, Derek bought 2.095 m shares of Serial for a total of $278,593, or an average of 13.3 cents a share. The stock ended the day at 13.7 cents. Photo by Janine YongIts 4Q performance was all the more notable because the net margin was higher (1.4% vs 1.16% a year earlier).

With revenue up (34% y-o-y) on higher margins, the net profit attributable to shareholders for 4Q soared 63% higher y-o-y at US$3.1 million.

That gave a major push to the full-year figure to US$11.2 million (up 41% y-o-y), enabling Serial to propose a final dividend of 0.30 Singapore cent a share.

(Already paid were the interim dividend and 25th anniversary special dividend of 0.24 and 0.25 cent a share, respectively)

Prospects for this year look alluring.

Serial, in its latest financial statements, once again said it is targeting US$1 billion in sales, which is 25% or so higher than the S$1.02 billion achieved last year.

"It's challenging but it doesn't mean we cannot achieve," said Serial chairman and CEO Derek Goh at a results' briefing yesterday.

And Serial said it is "working resolutely to improve" its 2013 net margin of 1.4%.

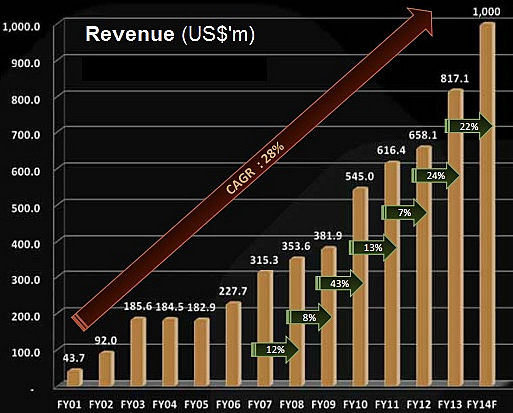

Chart shows revenue growth of Serial since 2001 when Derek Goh, took over as CEO (in addition to being executive chairman).

Chart shows revenue growth of Serial since 2001 when Derek Goh, took over as CEO (in addition to being executive chairman).If the target sales growth is achieved and, conservatively, if the net margin is unchanged at 1.4%, then Serial would be booking about US$14 million (S$17.5 million) net profit this year.

That would be record profits, exceeding the previous peak of US$12.0 million in 2010.

In turn, the PE would be 6.7X based on the recent stock price of 13.2 cents and forecast earnings per share of 1.95 Singapore cents.

What underpins the confidence of the company is a 3-pronged strategy it announced on 27 January 2014.

It said it was "striving to increase contributions from existing product lines, including selling more value-added modules instead of standalone components, expanding its customer base and mining internal data vigorously to improve inventory management and bulk purchasing."

(See: SERIAL SYSTEM: US$1 B Sales Target, Higher Margins With Enhanced Biz Strategy)

The strategy, which started to take root in 2H2013, has borne early fruits.

Aside from a higher net margin and a surge in sales in 4Q2013, Serial's inventory turnover days have fallen sharply from 41 days in 2012 to 30 days in 2013, due to a newly-developed internal forecasting system which analyses customers’ demand and places the optimal level of supply requests to suppliers.

Here are some questions and answers from yesterday's results briefing (picture above, by Janine Yong): |

Recent story: Strong insider buying @ SERIAL SYSTEM, LEY CHOON GROUP