Top management was out in full force to brief analysts and media at Tower Club on Monday (L-R): Executive chairman/CEO Derek Goh, CFO Alex Wui, Senior VP (regional marketing, corporate planning & development) Sean Goh, and COO Adrian Chu. Photo by Janine Yong

Top management was out in full force to brief analysts and media at Tower Club on Monday (L-R): Executive chairman/CEO Derek Goh, CFO Alex Wui, Senior VP (regional marketing, corporate planning & development) Sean Goh, and COO Adrian Chu. Photo by Janine Yong

THE SHARE price of Serial System has turned north by as much as 1.2 cents, or 10%, to 13.7 cents since it announced on Monday morning (Jan 27) an enhanced corporate strategy that will place it on the road to achieving US$1 billion in sales this year, as well as stronger profit margins going forward.

Sales of US$1 billion, if achieved, represents a sharp 25% jump or so from the 2013 sales of S$1 billion that management is confident it has achieved, or even exceeded.

The S$1 billion sales mark for 2013 is in itself notable, as it translates into a 21% rise in revenue from the year before (S$825.4 m).

Finalised FY2013 results will be announced on Feb 18.

It looks set to be a tale of a Singapore company overcoming strong international competition in an industry where margins of distributors of electronic components have constantly been under pressure. Mainly, operating costs -- labour, rental, etc -- have risen unabatedly, especially in China. It's chow time @ Tower Club for analysts and media before the discussion begins. Photo by Janine YongIn a lunch meeting with analysts and the media on Monday (Jan 27), executive chairman and CEO Derek Goh had more good news: He said the FY2013 net margin is expected to have improved from the 1.2% recorded in 2012.

It's chow time @ Tower Club for analysts and media before the discussion begins. Photo by Janine YongIn a lunch meeting with analysts and the media on Monday (Jan 27), executive chairman and CEO Derek Goh had more good news: He said the FY2013 net margin is expected to have improved from the 1.2% recorded in 2012.

Better still, the net margin is expected to continue to improve in 2014, he said.

Underlying the optimism is the enhanced corporate strategy.

It's not entirely a freshly dreamed-up strategy -- in fact, parts of it have been executed in Serial recently and positive results have been achieved, which helps explain why 2013 revenue is expected to hit S$1 billion on higher net margins.

Two specific outcomes from two different areas of business: Serial achieved US$70 million of sales in 2013 of component modules (more on this later) and it reduced its inventory turnover days from 41 in 2012 to about 30 in 2013.

3-pronged strategy

Broadly, Serial said the enhanced corporate strategy involves:

a. Expanding Serial's product portfolio and increasing the proportion of higher-value components -- ie, what Serial sells.

b. Improve internal efficiencies with emphasis on financial management, supply chain management and business intelligence -- ie, how Serial will do certain things.

c. Deepen penetration in existing markets and widen geographical expansion -- ie, where Serial will go.

Serial's 4-page corporate update and 18-page Powerpoint presentation have lots of information, so evidently this is not your normal annual corporate review.

Instead, it is the blueprint for greater success in a new chapter of Serial's corporate history. It has now been revealed, not coincidentally, just after its 25th anniversary celebration last year. (See: SERIAL SYSTEM celebrates 25th anniversary with big charity donations)

Investors are encouraged to read the documents but if there is one thing we wish to highlight, it is the component modules that Serial are developing and selling -- which will be a mainstay of its growth in revenue and profit margins.

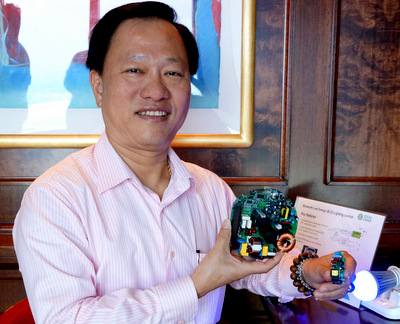

Executive chairman Derek Goh with component modules developed by Serial's joint ventures. Photo by Janine YongBasically, instead of selling individual components to its customers (who are mainly manufacturers of devices), Serial will develop the software and put together the components as a packaged solution.

Executive chairman Derek Goh with component modules developed by Serial's joint ventures. Photo by Janine YongBasically, instead of selling individual components to its customers (who are mainly manufacturers of devices), Serial will develop the software and put together the components as a packaged solution.This is done through joint ventures, started in May 2013, with two design houses in China specialising in "low-power application" segment and "industrial" segment, respectively.

Serial is currently negotiating to start a third JV with another design house which specialises in automotive applications and a fourth JV specialising in the surveillance and security segments.

To customers, these solutions mean greater efficiency and faster time to market.

It follows that they would pay a premium for the modules and Serial gets to sell more components.

Automotive and Mobile & Cloud

While the component modules represent value-add and they differentiate Serial from other distributors, Serial will continue to derive a significant of its revenue from selling individual components.

To sell more of individual components as well as through packaging them into component modules, Serial is targeting two fast-growing segments -- the automotive segment and the mobile devices and enterprises cloud solutions segment.

Serial aims to increase the contribution of auto-related solutions from 8% of group semiconductor revenue currently to 20% in the next two years.

And from 15% of group semiconductor revenue, components for mobile devices is targeted to rise to 20%. From virtually nothing now, the enterprise solutions solutions segment will leapfrog to 10% -- all within the next 2-3 years.

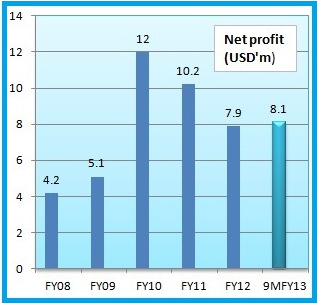

The strong 9M13 profit of US$8.1 m bodes well for the full-year 2013 results. Does this signal a positive upturn of Serial's profit trend and margin for 2014 and beyond?Overall, Serial is seeking to increase its hardware contribution in end-products (technical term: Bill of Materials) from 60% currently to 90% in 2-3 years.

The strong 9M13 profit of US$8.1 m bodes well for the full-year 2013 results. Does this signal a positive upturn of Serial's profit trend and margin for 2014 and beyond?Overall, Serial is seeking to increase its hardware contribution in end-products (technical term: Bill of Materials) from 60% currently to 90% in 2-3 years.The finished products of Serial's customers span a dozen key industries, from consumer/household appliances to automobiles to telecommunications gadgets and to industrial machinery.

While they bear the stamp of the manufacturers or the brand owners, Serial can certainly derive satisfaction from knowing that, in its own way, it plays a vital role in making all these products possible.

More importantly, for Serial shareholders, such a contribution would spell higher profits and margins -- and reverse a downtrend that has taken place since 2010 (see chart).