Toread spokesperson and rocker Wang Feng sings the praises of the adventure equipment firm. Photo: Beijing ToreadUBS: BEIJING TOREAD a ‘Buy’

Toread spokesperson and rocker Wang Feng sings the praises of the adventure equipment firm. Photo: Beijing ToreadUBS: BEIJING TOREAD a ‘Buy’

UBS Investment Research reiterated its "Buy" recommendation on Beijing Toread Outdoor Products (SZA: 300005) with a target price of 18.2 yuan (recent share price 14.4).

Toread’s 2012 revenue and net profit were up 47% and 57%, respectively, in line with the research house's expectations.

“We believe Toread’s better-than-sector average (35%) revenue growth was due to its successful brand building, continued product improvement, and supply chain integration.

"Inventory fell 8%, inventory turnover days declined by eight days, and net operating cash inflow increased by 74%, indicating steady growth,” UBS said.

Meanwhile, Toread’s Q1 2013 revenue/operating profit/net profit were up 36%/39%/45% year-on-year, below UBS’s estimates.

Toread listed on the ChiNext in 2009. Photo: ToreadWe believe continued sluggish end-market demand was the main reason for the lower-than-expected earnings.”

Toread listed on the ChiNext in 2009. Photo: ToreadWe believe continued sluggish end-market demand was the main reason for the lower-than-expected earnings.”

UBS said it believes Toread’s sold-out rate in 2012 was essentially flat year-on-year, remaining at the best level among the various apparel and home textile sub-sectors.

“As of end-March, the 2013 spring-summer order execution rate was 57%, also a good level.

“We maintain our 'Buy' rating as Toread’s valuation may be being dragged down by the downward shift of the sector average valuation.”

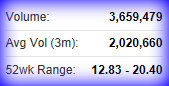

Toread recently 14.4 hkdBeijing Toread Outdoor Products specializes in the development and sale of outdoor products including tents, hiking boots, all-weather jackets and protective gear. Its business model is based on a combination of outsourced manufacturing, franchising, and directly managed distribution. The company has a self-owned brand: 'Toread'. At end-2012, it operated 1,395 stores, including 159 directly managed stores and 1,236 franchised stores.

Toread recently 14.4 hkdBeijing Toread Outdoor Products specializes in the development and sale of outdoor products including tents, hiking boots, all-weather jackets and protective gear. Its business model is based on a combination of outsourced manufacturing, franchising, and directly managed distribution. The company has a self-owned brand: 'Toread'. At end-2012, it operated 1,395 stores, including 159 directly managed stores and 1,236 franchised stores.

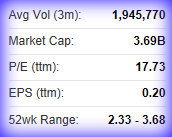

Magic recently 3.66 hkdGuoco: MAGIC Still ‘Buy’ at 52-wk High

Magic recently 3.66 hkdGuoco: MAGIC Still ‘Buy’ at 52-wk High

Guoco Research said it is maintaining its “Buy” call on cosmetic facial mask maker Magic Holdings (HK: 1633) with a target price of 4.05 hkd (recent share price 3.66).

“The share price recently surpassed a previous high at 3.55 hkd and closed at its 52-week high with exceptional turnover,” Guoco said.

The research house added that Magic’s 9-day RSI standing above 80 signaled a pullback in the near term for accumulation.

Guoco’s cut loss for Magic Holdings is 3.33 hkd with a consensus 2013 P/E of 14.7 times.

See also:

TOREAD: Outdoor Products Hiking Up Sales Amid Urbanization

MAGIC Shines