UBS: ‘Buy’ Call Maintained for XTEP

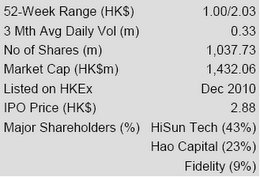

UBS Investment Research said it is maintaining its “Buy” recommendation on fashion sportswear leader Xtep International (HK: 1368) with a target price of 4.00 hkd (recently 3.40 hkd).

“Xtep’s 7.6% yield is still attractive and a sector rerating could continue,” UBS said.

The Street has gradually turned positive on the sportswear sector.

“We recall that investors were generally skeptical about a turnaround of the operations a month ago.

“As more brokers turn constructive on the sector and more positive (or less negative) data points emerge, we believe the sector rerating could continue,” UBS said.

Attractive yield despite strong price performance

UBS recently highlighted Xtep's capacity to pay a higher dividend.

“Despite the strong price performance in recent weeks, an estimated 12 million forward yield at 7.6% is still attractive,” the research house said.

UBS said its channel and store checks suggest Xtep recorded slightly positive same store sales (SSS) growth during the Golden Week holiday last month, indicating sell-through has started to improve.

“We believe the upcoming Q213 trade fair orders will not deteriorate further, but we expect no significant improvement from Q113 at -15% to -20%.”

UBS said it recently turned “bullish” on sportswear.

See also:

XTEP Kicking Things Up A Notch; CHOW SANG SANG Target Hiked

XTEP's Rating Kept At ‘Buy’, Sportswear On Ascent

Bocom: CHINA SPORTSWEAR’S Strong Rally to Continue?

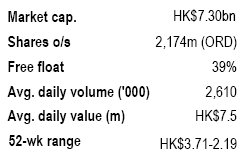

Bocom International said China’s listed sportswear plays have registered a strong share price rally over the last few weeks.

“However, we believe the sector gain is not sustainable as we do not see any sign of improvement, as reaffirmed by our latest management update with the sportswear companies.

“In our view, key negative catalysts will continue to linger into next year, dashing hope for sector recovery,” Bocom said.

Continuing heavy destocking exercises and continued deep retail sales markdowns, higher wholesale discounts and higher distributor rebates would hinder further sector recovery, the research note said.

“Rising store closures are set to continue and exert pressure on the sector, including SSS, orderbooks and margins.

Most sportswear stocks will soon release their 3Q12E business updates and 2Q13E orderbook results next month. We expect little surprise and the negative news flow will persist.”

See also:

XTEP: Overperforming In Overcrowded, Overstocked PRC Sportswear

TWO LEFT FEET: China Sneaker Play Li Ning Sees Dire Year

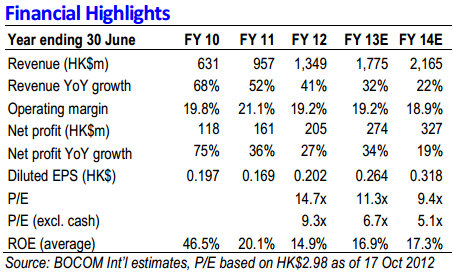

Bocom: Maintains ‘LT-Buy’ call on Magic

Bocom International said it is reiterating its “LT-Buy” recommendation on beauty products play Magic Holdings (HK: 1633) with a target price of 3.50 hkd on 12x CY13 EPS, implying 0.5x 3-year PEG.

Magic was recently trading at 2.92 hkd.

“We hosted a one-day NDR for Magic in Hong Kong recently following our initiation.

"Overall, investors were impressed with Magic’s story of market share win in China’s burgeoning facial mask industry alongside its attractive valuation,” Bocom said.

Bocom said that Magic should benefit from industry consolidation, aided by its clear pricing segmentation, differentiated distribution coverage and comprehensive mask offerings beyond its first-mover advantage.

“Management stated that the company will learn more from its Korean peers and count on product innovation (like snail facial masks) to gain market share.

An increasing number of entrants should help Magic to educate Chinese females on using facial masks as a daily skincare routine.

“Magic is extending its wash-off lines to cleansing mud masks (already launched) and sleeping masks (early 2013), and may also expand to male-oriented facial masks at some point.

“We remain optimistic about the growth prospects of the beauty products and care industry.”

Bocom said that Magic will migrate upward to the mid-cap club as long as it carries on its strong earnings track record.

“We believe this will attract more quality institutional investors. And increasing sell-side coverage should also help boost stock profile and improve liquidity.”

See also:

MAGIC’S Quality Face Time

BEHIND THE MASK: MAGIC’S PRC Market Share A Thing Of Beauty

Haitong: PAX GLOBAL Receives ‘Buy’ Call

Haitong International said it has a "Buy" recommendation on China’s top point-of-sale e-fund transfer play PAX Global (HK: 327) and a target price of 1.8 hkd (recently 1.59 hkd).

“It has been reported in Mainland China that the reduction in credit card payment fees has been approved by the State Council, and has entered the consultation stage.

The reduction in dining and entertainment business may reach 35-40%, while that in other areas may reach 20-30%,” Haitong said.

It added that the change will be effective to ease the operational pressure among the food and beverage companies and will increase their level of profitability over the short term.

On the other hand, the rate reduction also helps to encourage SMEs to install credit card machines to stimulate consumption.

“Such can be regarded as significant and positive news for credit card machine suppliers like PAX Global.

“At present, the domestic electronic payment terminal penetration rate is low, and the policy can unleash market potential,” Haitong said.

With a current P/B of around 0.8 times and a P/E of 7x, the low valuation provides rather high defensiveness, the brokerage concluded.

See also:

Tech Tally: PAX Gets ‘Buy’, EV Play BYD ‘Sell’