Beijing Toread Outdoor Sports, which is listed in Shenzhen, is a substantial shareholder of Singapore-listed Asiatravel.com. Read: ASIATRAVEL.COM: New strategic partner to help bring about profit recovery

Excerpts from analysts' reports

UBS has 'buy'' call and RMB 23.00 target for Beijing Toread Outdoors

Analyst: Yunyun Hu

Excerpts from analysts' reports

UBS has 'buy'' call and RMB 23.00 target for Beijing Toread Outdoors

Analyst: Yunyun Hu

Beijing Toread Outdoors reported sales of RMB1.45 billion in 2013. It has self-owned and franchised stores, as well as an online sales platform. Photo: Internet.

Beijing Toread Outdoors reported sales of RMB1.45 billion in 2013. It has self-owned and franchised stores, as well as an online sales platform. Photo: Internet.

2013 net profit up sharply YoY, brand marketing expenditure higher

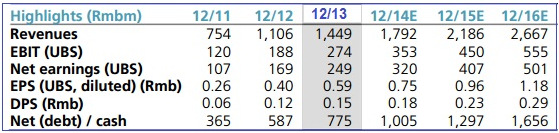

Toread posted 2013 revenue of Rmb1.45bn (up 31% YoY) and net profit of Rmb250m (up 47% YoY).

The profit margin expanded mainly due to lower expense ratios from the scale effect, with the selling expense ratio down 1ppt YoY to 17.5% and the administrative expense ratio down 1.4ppt YoY to 10.8%. But the brand marketing expenditure (advertising and promotional expenses) increased 50% YoY, which should improve long-term competitiveness, in our view.

Toread advertising is seen on the side of this helicopter at Everest base camp. Photo by David Tan Kim SengQ114 net profit up 32% YoY

Toread advertising is seen on the side of this helicopter at Everest base camp. Photo by David Tan Kim SengQ114 net profit up 32% YoY Q114 revenue was Rmb320m (up 16% YoY) and net profit came to Rmb77.7m (up 32% YoY). Amid a weak retail environment overall, we believe Toread will actively optimize channels and upgrade stores by enhancing shopping experience and improving interactive services etc. Backed up by online sales, its revenue growth may pick up gradually.

New platform to be launched, service + product synergies expected

On 18 April, Toread will officially launch “lvye.com” as its comprehensive service platform for its high-end global outdoor travel business.

There will be over 150 online suppliers providing more than 300 tourist lines initially. The company, together with its

There will be over 150 online suppliers providing more than 300 tourist lines initially. The company, together with its

affiliated ivye.cn, will also roll out the TOP tour guide scheme, which aims to recruit tour guides as its C-store owners.

As we stressed in our report dated 10 April, we think Toread’s online tourism service and outdoor product sales could produce synergistic effect more rapidly, thanks to the social nature of outdoor activities.

As we stressed in our report dated 10 April, we think Toread’s online tourism service and outdoor product sales could produce synergistic effect more rapidly, thanks to the social nature of outdoor activities.

Valuation: Maintain Buy rating and Rmb23 PT

We derive our price target of Rmb23 using UBS’s DCF-based VCAM tool (7.5% WACC).

We derive our price target of Rmb23 using UBS’s DCF-based VCAM tool (7.5% WACC).