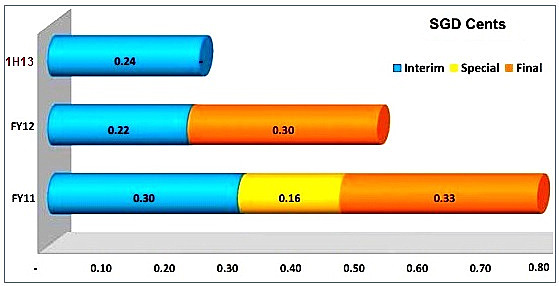

Above: Serial's dividend payouts. FY11 net profit was US$8.8 m while FY12 was US$7.5 m. On annualised basis, FY13 would achieve US$10.6 m

Above: Serial's dividend payouts. FY11 net profit was US$8.8 m while FY12 was US$7.5 m. On annualised basis, FY13 would achieve US$10.6 mSERIAL SYSTEM, once again, has declared a decent dividend payout. For 1H2013, it is 0.24 Singapore cent a share which translates into a yield of 1.9% based on the recent stock price of 12.6 cents.

Going by its track record, Serial can be expected to pay a final dividend and a higher one at that. Last year, the final dividend amounted to 0.30 cent a share.

Serial, which celebrates its 25th anniversary this year, is enjoying a rising business momentum.

In 2Q, net profit rose 55% to US$3.7 million on a 19% rise in revenue to US$206 million. The profit boost was aided partly by a US$0.8 million gain on sale of an investment property in Singapore.

Derek Goh, CEO of Serial System, speaking with analysts. NextInsight file photo.Serial, on the other hand, provided US$1.06 million for inventory obsolescence compared to just US$36,000 in 2Q2012.

Derek Goh, CEO of Serial System, speaking with analysts. NextInsight file photo.Serial, on the other hand, provided US$1.06 million for inventory obsolescence compared to just US$36,000 in 2Q2012.The company continued to face higher office rental cost, resulting in administrative expenses increasing 33% by about US$0.6 million. Higher office rental arose from business expansion and increased rental rates in South Korea and Greater China,

For 1H, Serial's net profit rose 38% to US$5.3 million.

If the 19% rise in revenue in the first-half to US$377.6 million is annualised, one gets US$755.2 million --- which is an all-time high for Serial.

It would also be a good US$100 million higher than the previous record (US$658.1 million) set in FY2012.

In its results announcement on Tuesday, Serial said it expected business to be better in the second half of 2013 "as the Group’s growth strategies continue to benefit from its comprehensive product lines offering wide and diverse product ranges, diversified customer base spanning various industries and consumer segments, extensive distribution network of 50 offices across 11 countries in Asia, strong localized management team and stronger financial position."

Other highlights of 1H

Alex Wui, CFO.

Alex Wui, CFO. NextInsight file photo1. Greater China: At US$200.9 million, the region accounted for 54% of the group revenue in 1H, reflecting the concentration of Serial's customers who do manufacturing in China.

Revenue grew 17% year on year, with the diverse range of electronic components distributed by Serial going into finished products in a dozen key industries, such as consumer/household appliances, automotive, telecommunications and industrial machinery.

2. Profit margins: Gross margin dipped from 9.4% in 1H2012 to 9.2%. Net margin increased from 1.2% to 1.4%.

3. Japan contribution: Serial AMSC Microelectronics, in which Serial has a 70%-stake, made its maiden contribution of US$2.8 million from mid-May to end June. Derek Goh, the CEO of Serial, said at a results briefing on Tuesday that the subsidiary is expected to contribute US$20-30 million a year in sales.

4. Bull Will: After loss-making years 2011 and 2012 and a loss-making 1Q2013, this 43.35%-associate company turned slightly profitable in 2Q2013. CIMB expects Bull Will to be a major contributor in the future.

Recent story: SERIAL SYSTEM: Preparing to enter massive Japanese market