L-R: Independent director Robson Lee, executive director Peter Ho, executive chairman Derek Goh, CFO Alex Wui, independent director Paul Tan and independent director R. Ravindran.

L-R: Independent director Robson Lee, executive director Peter Ho, executive chairman Derek Goh, CFO Alex Wui, independent director Paul Tan and independent director R. Ravindran.

Time & date: 10 am, 27 April 2013.

Venue: Serial System Building, 8, Ubi View.

Photos by Cheng Siew Hooi

THERE WERE 3 interesting takeaways from Serial System's AGM and an announcement over the weekend:

a. The announcement: A son of Sam Goi, the No.2 largest shareholder, has joined the board of directors of Serial System.

b. Serial System's chairman and CEO, Derek Goh, elaborated on the company's impending entry into the Japanese market.

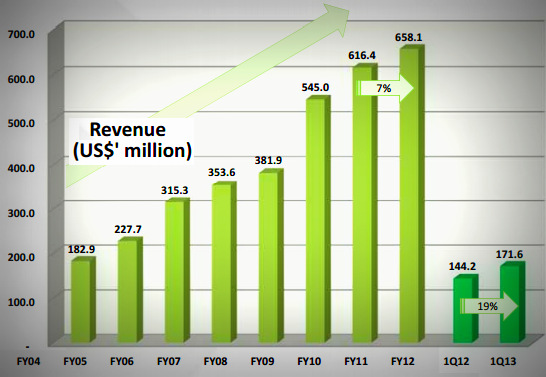

c. Serial System reported a 10% rise in net profit and 19% rise in revenue for 1Q2013.

First, Goi Kok Neng, 36, has joined the board as a non-executive director.

His father, Sam Goi, a well-known F&B entrepreneur as well as a key investor in several listed companies, owns 111.8 million shares of Serial, which is a 12.5% stake in the company.

The senior Goi has been a shareholder of Serial for more than 10 years, and has been raising his stake in Serial in recent years, though he is best known for investing in listed F&B-related companies.

Derek Goh, executive chairman & CEO of Serial System.Secondly, at Serial's 1Q results briefing for AGM attendees, Derek Goh said that a 60-40 joint venture between Serial System and a Japan-listed company, AMSC, will start operations in June this year.

Derek Goh, executive chairman & CEO of Serial System.Secondly, at Serial's 1Q results briefing for AGM attendees, Derek Goh said that a 60-40 joint venture between Serial System and a Japan-listed company, AMSC, will start operations in June this year.The JV will sell and distribute semiconductors and other electronic products in Japan. (The formation of the JV was first announced in February 2013).

Japan is a promising market given its size being more than US$40 billion a year.

Japan is the latest market that Serial is entering, having gained a foothold through the years in markets such as Taiwan, South Korea, China, and India.

The Serial-AMSC joint venture will buy over the assets of AMSC which will be then de-listed from the Osaka Securities Exchange.

Through the JV, Derek Goh said, Serial System will be the only Asian distributor in Japan. The JV will seek to work with Japanese suppliers to extend their business out of Japan.

At the same time, the JV will extend Serial's franchise with existing suppliers into Japan.

Asked about the revenue of AMSC, Derek said it recently was around US$50 million a year but was much higher at around US$400 million until AMSC lost two key distributorships.

Serial System's revenue growth has been consistently on an uptrend but rising operating expenses have dampened the profit growth rate.

Serial System's revenue growth has been consistently on an uptrend but rising operating expenses have dampened the profit growth rate.Third, more info on the 1Q2013 performance of Serial:

> Revenue from Greater China grew 11% to US$88.6 million while Taiwan grew 20% to US$13.0 million.

> Revenue from India leapt 144% to US$4.4 million.

Despite a 19% rise in Group total revenue, gross profit grew at a slow pace of 15%, as a result of higher operating costs. Wage costs and office rentals in China, in particular, have risen by double digits annually.

Serial's net profit grew at 10%, and the net margin was 0.9%.

Derek Goh reiterated that Serial has been paying 40-55% of its net profit as dividends. For FY12, the final dividend will be 0.3 cent a share while the interim dividend already paid was 0.22 cent.

This year, by the way, marks Serial's 25th anniversary.

This morning (Apr 30), CIMB put out a 'buy' recommendation on Serial, saying "We rate Serial a BUY with a target price of S$0.15, based on 8x CY14 earnings (5-year historical average forward P/E). FY13 dividend yield remains attractive at 5.3% and compensates for poor liquidity."

The Powerpoint materials can be accessed at the SGX website.

The invite to the AGM was: SERIAL SYSTEM invites you to its AGM - &1Q results briefing & lunch - this Sat