Teo Hong Lim, CEO of Roxy-Pacific Holdings, directly holds 86.6 million shares of the company and has a deemed interest in 467.4 million shares held under a family vehicle. NextInsight file photoDESPITE THE market downturn this month (June), shares of Roxy-Pacific Holdings have held firm. They closed at 60.5 cents this week.

Teo Hong Lim, CEO of Roxy-Pacific Holdings, directly holds 86.6 million shares of the company and has a deemed interest in 467.4 million shares held under a family vehicle. NextInsight file photoDESPITE THE market downturn this month (June), shares of Roxy-Pacific Holdings have held firm. They closed at 60.5 cents this week. When the stock briefly dipped on 25 June, executive chairman and CEO Teo Hong Lim bought 200,000 shares at 58 cents.

Independent director Tay Kah Poh also picked up 50,000 shares at 58 cents apiece, raising his total holding to 1,428,000 shares.

Mr Tay is a real estate expert: He is Exective Director of Reyfern Real Estate Consultancy, and an Adjunct Associate Professor at the National University of Singapore's Department of Real Estate.

There is increased optimism around Roxy-Pacific as it launched, over the past three months, three property projects – LIV on Sophia, WhiteHaven and Jade Residences.

The sales performance has been positive – ie, 100%, 71% and 50% units have been sold to-date, respectively, according to an OCBC Investment Research report yesterday.

OCBC analysts Eli Lee and Kevin Tan wrote: "Overall, we judge this pace of sales to be fairly strong with selling prices above expectations."

They also highlighted that the property developer now sits on a whopping S$1,118m of unrecognized progress billings from sold units for a range of projects (up 30% from end FY12).

This is 8.1 times the total FY12 property development revenues, and would underpin earnings growth over FY13-16.

Based on a simple average, each year in the FY13-16 period would see Roxy-Pacific recognising $280 million of revenue from property development, or about 100% higher than the $138.7 million recognised in FY2012.

As a proportion of the Group's total revenue, property development accounted for 73% last year. The remaining 26% came from the operations of Grand Mercure Roxy Hotel and 1% from rental income of its property investments.

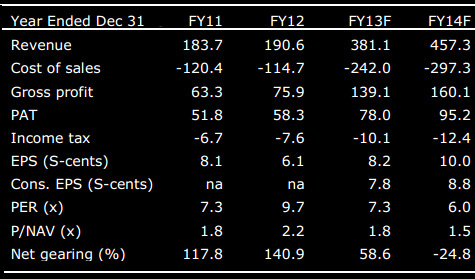

For OCBC's estimate of the total revenue and earnings over FY13 and FY14, see the table below.

The following are excerpts from the analysts' report:

The following are excerpts from the analysts' report:In addition, the sold-out launch at LIV on Sophia, located in the same vicinity as ROXY’s final land-bank site (Wilkie Terrace), likely points to positive demand when it is launched ahead.

Successful harvest is a milestone. We see these successful launches to be a key milestone for ROXY given their significant combined size – S$423m and S$95m in estimated total sales and net profits – relative to the group’s project portfolio.

Record of sharp execution. Management continues to acquire and launch niche sites expediently with high sell-through rates, while deftly navigating the property cycle. We understand ROXY is now prudently sourcing for more landbank; already it has entered into agreements to acquire Sunnyvale Apts for S$25m and Yi Mei Gardens for S$136m.

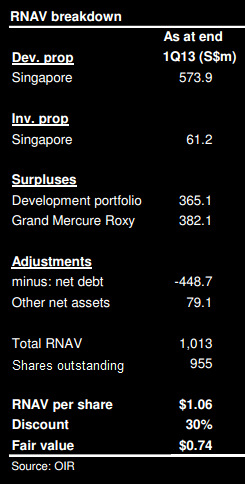

By our calculations, these two acquisitions would accrete 3.5 S-cents to RNAV.

By our calculations, these two acquisitions would accrete 3.5 S-cents to RNAV.

Upgrade to BUY with increased S$0.74 FV. We update our model with latest datapoints and our fair value increases to S$0.74 (30% RNAV disc.) versus S$0.61 (25% discount) previously. Note that our RNAV discount is raised given increased

residential uncertainties from rising mortgage rates.

We deem this to reflect a sturdy margin for safety, particularly since a large portion of ROXY’s value comprises Grand Roxy Mercure Hotel (worth S$0.47 per share) and that only 10% of ROXY’s total launched GDV is now left unsold.

Upgrade to BUY with a FV of S$0.74 (30% RNAV disc.).

Source: OCBC Investment Research

Source: OCBC Investment Research

Recent story: ROXY-PACIFIC: $918 m sales to be recognised from 2Q

We deem this to reflect a sturdy margin for safety, particularly since a large portion of ROXY’s value comprises Grand Roxy Mercure Hotel (worth S$0.47 per share) and that only 10% of ROXY’s total launched GDV is now left unsold.

Upgrade to BUY with a FV of S$0.74 (30% RNAV disc.).

Source: OCBC Investment Research

Source: OCBC Investment ResearchRecent story: ROXY-PACIFIC: $918 m sales to be recognised from 2Q