Koh Seng Geok, CFO and executive director.

Koh Seng Geok, CFO and executive director. NextInsight file photoROXY-PACIFIC HOLDINGS not only delivered strong growth in earnings in 1Q but its CFO, Koh Seng Geok, followed up with a 50,000 share purchase on the first trading day after the release of the results.

His purchase price was 60 cents, and he raised his direct and deemed shareholding to 6,738,000. The stock closed recently at 62 cents.

The CFO has regularly increased his stake, and his latest purchase dovetails with a positive outlook for the company.

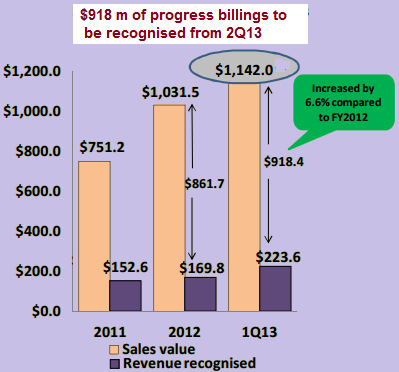

In Roxy-Pacific's 1Q results announcement, it was revealed that it had chalked up S$918.4 million of sales of property units ("progress billings") which it would recognize from 2Q 2013 till 2017.

In Roxy-Pacific's 1Q results announcement, it was revealed that it had chalked up S$918.4 million of sales of property units ("progress billings") which it would recognize from 2Q 2013 till 2017.

To put the S$918.4 million in perspective, it is equivalent to 6.6X the $138.7 million revenue achieved by Roxy's property development business in 2012.

SIAS Research analyst Liu Jinshu, in his May 7 report, gave the following take on the results and estimated the intrinsic value of the stock to be 71 cents:

ROXY-PACIFIC HOLDINGS Limited (Roxy) maintained its positive momentum in 1Q FY13 with net profit of S$11.8m (+31% YoY) on revenue of S$53.7m (+41% YoY).

The results were largely within our forecasts – S$78.3m of revenue from WiS@Changi will only be recognized at completion by the end of this year.

The results were largely within our forecasts – S$78.3m of revenue from WiS@Changi will only be recognized at completion by the end of this year. Pre-sales remained robust, reaching S$110.5m since Feb-Apr 2013 (78 days) versus S$75.2m

during the preceding period Oct 2012-Feb 2013 (99 days).

We continue to like Roxy’s strong sales record, demonstrating its resilience in light of prevailing property market cooling measures. Maintain Invest.

Recent story: ROXY-PACIFIC: What property strategy post-cooling measures?

Strong Pre-Sales: The strong growth in pre-sales was due to the launch of Jade Residences (former Jade Towers) in Apr, which accounted for S$87.4m of pre-sales.

The remaining S$23.1m was from Eon Shenton and WiS@Changi. As at 24 Apr 2013, Roxy has about 20 units unsold among the 1,700 uncompleted units launched prior to 2013.

The remaining S$23.1m was from Eon Shenton and WiS@Changi. As at 24 Apr 2013, Roxy has about 20 units unsold among the 1,700 uncompleted units launched prior to 2013.

“Right-Pricing” at Jade Residences: The Jade Residences is already about 50% sold within a one-month period (+6% points since 24 Apr), at maximum prices in excess of S$1,600 psf. This property was initially acquired at about S$734 psf. We reckon that the Jade Residences

has an estimated gross margin of about 20%.

Outlook: Given Roxy’s high level of progress billings, we expect the company to deliver strong growth up to at least 2015. As such, we reckon that there is relatively little pressure on Roxy to enlarge its land bank and that it can afford to look for projects that are highly attractive.

We gathered that Roxy is, in the interim, evaluating potential projects both within and outside of Singapore. It is also not limiting itself to residential projects, but also considering hotel and investment opportunities to boost income in other segments. The S$200m medium term note programme presents a ready source of funding for the company to embark on any such new projects.

Recent story: ROXY-PACIFIC: What property strategy post-cooling measures?