Excerpts from analyst reports.. Source: SIAS Research

Source: SIAS Research

SIAS Research pegs Roxy-Pacific's intrinsic value at 71 cents

Analyst: Liu Jinshiu

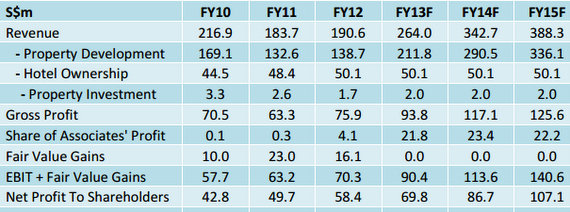

More Blockbuster Years to Come: The strong sales accumulated have led to record progress

billings of S$861.7m largely to be recognized from 2013 to 2015.

Without expecting further revaluation gains, we forecast Roxy to report net profit of close to S$70m in 2013 and S$80m to S$90m in 2014.

These earnings will form the foundation for Roxy to enlarge its property development portfolio for consistent growth. WiS@Changi is expected to be completed in 2013. Being a commercial project, the full lump sum revenue of S$70.8m will be recognized in FY13.

Moreover, Roxy also revealed at the results briefing that it has started looking at potential projects

in Malaysia, as some of its existing JV partners are already in the Malaysian market and can

provide some local knowledge.

Neutral on Hotel Ownership Performance: The Grand Mercure Roxy Singapore hotel reported lower occupancy rate for 4Q 2012, partly due to certain floors being closed for renovation. Works are expected to be completed in May 2013. We are neutral about this segment and project flat revenue growth and gross margin for the hotel ownership segment across our forecast horizon.

Click on above video of the recent analyst briefing, and our story: ROXY-PACIFIC: $862 M In Property Revenue To Be Recognised Over 4 Years

DBS Vickers ups CapitaLand target price to $4.42

Analyst: Lock Mun Yee

Residential and mall business to drive outlook. Looking ahead, outlook would remain driven by activities in the development and mall rental income businesses. In Spore, it would continue to sell units at D'Leedon and The Interlace.

In China, plans are on track to launch 4,000 units from 3 new residential projects namely Vermont Hills, Summit Residences and The Lakeside as well as from ongoing developments.

Raffles City Chengdu is also expected to market its exclusive strata-titled apartments in 1H13.

From CMA's perspective, the group would continue to experience earnings growth as its malls stabilise.

Capitaland's balance sheet remains healthy with a gearing of 0.45x as at Dec 2012 and this would enable the group to continue to landbank in Singapore and China as well as tap other opportunities such as a 51% stake in the JV to develop A2 island as Danga Bay in Msia.

Maintain Buy. We are retaining our Buy call with TP revised higher to S $4.42. This is pegged at a 25% discount to our revised RNAV of S$5.89 as we update for the latest balance sheet and adjust for the latest TPs of listed subs/reits. We believe share price catalyst will appear as management continues to drive ROE improvements.