Excerpts from latest analyst reports

CIMB says new shareholder could mark shift in China Minzhong's strategy

Analysts: Kenneth Ng CFA & Lee Mou Hua

Indofood Sukses Makmur is now a major shareholder after its proposed subscription of 98m new shares at S$0.915 each.

We think this could mark the start of a shift in Minzhong’s strategy and also alleviate corporate-governance concerns.

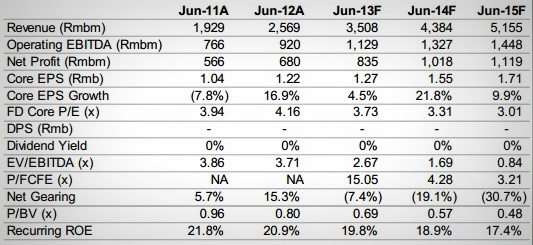

The new shares will dilute our FY13 EPS by 15%. We are cutting our FY13-14 EPS by 8-15% to factor in the dilution.

Our target price (4x CY14 P/E, sector average) dips accordingly.

Benefits could accrue, earliest in FY14. The S$89m raised will strengthen Minzhong’s ability to pay dividends this year. We keep our Outperform on the back of this possibility.

Recent story: KING WAN, ASL MARINE, CHINA MINZHONG: What analysts now say

NRA Capital raises Serial System's fair value to 17 cents

Analyst: Jacky Lee

S$5.4m positive free cash flow generated in 4Q12 due mainly to improved inventory turnover.

As a result, net gearing improved from 58% as at end-Sep quarter to 54%.

As expected, the board declared a lower 0.3 cts final dividend but this is still a decent 3.9% yield (including the 0.22 cts interim dividend already paid out).

We maintain our FY13-14 net profit forecast and introduce our FY15 forecast.

Nevertheless, our fair value has lifted by 3 cts to S$0.17 as we roll forward our base from 8x FY13 PER to FY14.

Given Serial is still gaining market share from its competitors with decent dividend payout, we maintain Overweight.

Click here for the NRA report.

Recent story: SERIAL SYSTEM: Once again, a decent dividend payout