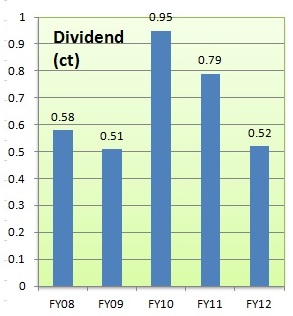

THE FIRST THING to note about Serial System's full-year results is that there is a dividend payout, once again.

The electronic components distributor is a consistent payer of dividends. And the yield typically beats fixed desposit rates by a wide margin.

Serial has proposed that the final dividend for FY12 be 0.3 cent a share. Add that to the 0.22 cent interim dividend already paid out, and the total is 0.52 cent.

On a share price of 11.1 cent a share, which is the midpoint of its 52-week trading range, the dividend yield is 4.68%.

Serial typically pays 45-50% of its earnings as dividend.

FY12's dividend of 0.52 cent a share is 50.9% of its FY12 earnings per share of 1.02 cent.

Highlights of FY12 results

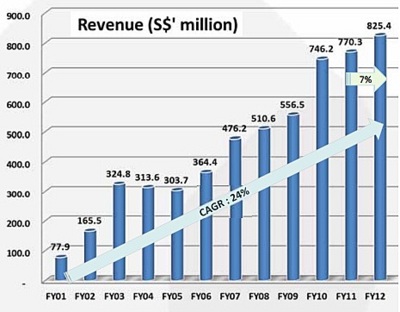

1. Revenue rose 7% to S$825.4 million, making Serial one of a small percentage of SGX-listcos with sales of that order. See chart on the right.

Its growth has outpaced the Asia-Pacific semiconductor market which shrank 1% in sales last year.

2. Serial's net profit fell 29% to S$9.2 million on higher expenses.

Serial CEO Derek Goh told analysts at a briefing last Thursday: "Most operating expenses have gone up -- labour costs, rental costs. Every year, rental in China has risen by 10-15% easily. That has forced us to buy our own property."

NextInsight file photo

Serial also faced increased freight and transportation costs due to higher fuel and petrol costs.

There were also higher staff costs as a result of the company growing newer product lines and expanding its customer base.

3. Net gearing went down to 54% from 71%. This might be a positive development but the nature of the business is such that if sales go up, Serial's bank borrowings are likely to follow suit. Serial's cash conversion cycle was 68 days in FY12.

4. Net profit margin was 1.1% while gross profit margin was 9.5% -- which was significantly higher than the 5-6.25% range achieved by its Taiwan peers.

"But their revenue is much larger. One customer can give them $300-500 million in business," said Derek. "We can't take this kind of volume because Singapore banks won't be as ready to give the financing as Taiwanese banks to Taiwanese distributors. Taiwan banks can give 90% financing and charge interest of around 1% p.a. only."

In its results announcement, Serial said it was "cautiously optimistic of a better performance in FY2013 as the major economies, especially China and the United States of America show signs of a more stable and sustainable growth recovery and the Eurozone debt crisis risk subsides."

However, it also noted that the business environment for the electronics industry continues to remain highly competitive and challenging.

CIMB analyst Renfred Tay, in a report today, wrote: "We increased our revenue estimate in FY13-14 by 6-9% to factor in the expected increase in revenue from Japan. Our gross margin estimate is left unchanged at 9.3%. We also increased our estimates for opex in FY13 in anticipation of the added costs from Japan. Our net profit estimate for FY13-14 goes up by 5-23% as a result. In addition, we also introduce FY15 numbers to our forecast.

"Along with the increase in our forecasts, our price target rises to S$0.142, based on 8x CY14 P/E (about its 5-year historical average). Despite its recent run up in price, dividend yield for FY13 still remains attractive at 5.2%. Upgrade to BUY."

For the Powerpoint material from the analyst briefing, click here.

Recent stories:

Popiah King Sam Goi builds up stake in SERIAL SYSTEM

Insider buying @ SERIAL SYSTEM, STRACO CORP