HSBC: XTEP Upgraded to ‘Neutral’

HSBC Research has upgraded its recommendation on fashion sportswear leader Xtep International (HK: 1368) to “Neutral” from “Underweight” while hiking the Hong Kong-listed firm’s target price to 3.2 hkd from 2.2 (recent share price 3.24).

HSBC said Xtep is not immune to the difficulties faced by the sportswear sector but believes it manages industry challenges better than its rivals.

The research house said that sportswear brands including Anta and Li Ning are more focused on technology and functionality, whereas Xtep is more fashion-oriented, which gives it a more stable, dedicated target market.

HSBC lowered its 2012-14 earnings estimates for Xtep by 0-11%.

It also raised its long-term sales growth assumption to 6% (from 2%) for 2015-19.

See also:

China Retail Rundown; XTEP ‘Buy’; ANTA Mixed

XTEP ‘Buy’; Bocom Downbeat; MAGIC Shines; PAX Impresses

XTEP Kicking Things Up A Notch; CHOW SANG SANG Target Hiked

Photo: UPC

Bocom: UNI-PRESIDENT Initiated with ‘LT-Buy’

Bocom International said it is initiating coverage of food and beverage giant Uni-President China (HK: 220) with an “LT-Buy” recommendation and a target price of 10.50 hkd (recent share price 9.44).

“Uni-President stands out on product innovation. UPC has built an impressive track record of unveiling innovative F&B products to attract consumers,” said Bocom.

The research house said UPC’s strong-selling portfolio helped its business turn around, and the consumer market has embraced Laotan-branded spicy-and-sour beef noodles, Assam milk tea and Chinese traditional pear juice.

“Apart from these, we are more excited about its lineup of future star products which include high-end Bama water, fresh ice cream and 100% fruit juice.

“Given the growing importance of product novelty in China’s F&B industry with a shorter product lifecycle, UPC’s differentiation efforts should increasingly bear fruit ahead.”

Earnings risk skewed to the upside

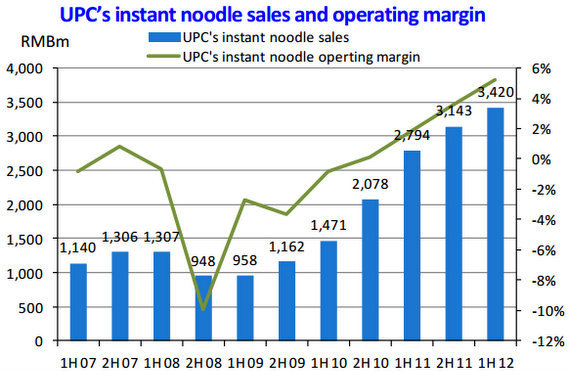

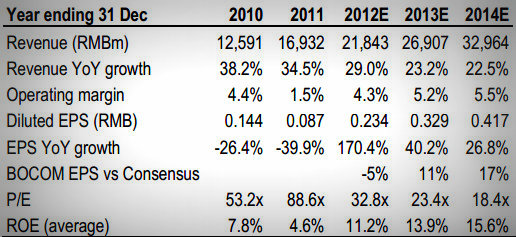

Bocom anticipates UPC will achieve a net profit CAGR of 33% in 2012-14E, driven by a 23% revenue CAGR and operating margin expansion owing to its focus on differentiated SKUs, geographic penetration and proven experience in Taiwan.

“The better-than-expected execution in selling its high-margin signature products (esp. in underpenetrated cities) should bring in more revenue and operating leverage, thus offering upside risk to our earnings forecasts.”

Bocom’s target 2013 P/E of 26x is on par with rival Tingyi’s long-term average P/E.

“This is to recognize UPC’s capability in product innovation, which should prevail over distribution as the utmost feature in China’s ever-changing F&B industry, in our view,” the research house added.

Bocom said a blue sky scenario would result in rival Tingyi’s stronger position in product offerings and operating scale following the alliance with PepsiCo possibly prompting UPC management to consider attracting strategic F&B partners at some point.

“Given that strategic investors normally pay a premium, we think this offers long-term upside to UPC’s share prices.

“We advise long-term investors to buy in Uni-President, a key beneficiary of the structural growth in staples consumption supported by China’s ongoing urbanization, which is among the top agenda items of China’s new premier.”

See also:

XTEP's Rating Kept At ‘Buy’, Sportswear On Ascent

XTEP: Overperforming In Overcrowded, Overstocked PRC Sportswear

GOLDEN OPPORTUNITIES? CHOW SANG SANG Jewelry ‘Outperform’; RETAIL Upbeat