Main reference: Story in Securities Times

For what seems like forever, Chinese shares have enjoyed much higher share prices and P/Es than their co-listed brethren in Hong Kong.

Not anymore...

Things have switched places with many constituents of a half-decade old comparative sub-index having pricier Hong Kong shares than A-share counterparts.

If shareholders have lost money in Hong Kong – or especially in China – over the past few years, they can point their fingers to a lot of causes, both unfair and otherwise, for their misfortunes.

But one place undeserving of scorn is the index situation, as both markets boast a plethora of indices tailor made for all variety of investors.

One such is the Hang Seng China AH Premium Index.

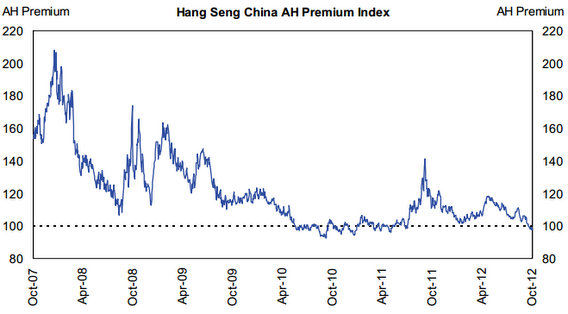

Launched in 2007, the cross-border comparative index is a member of the Hang Seng China AH Index Series, and gauges absolute price premiums of Mainland China-listed A shares over Hong Kong-listed H shares for AH dual-listed companies.

If the AH Premium Index tops 100, then A shares are trading at a premium to H shares.

And when the index ventures into sub-100 territory, that means A shares are trading at a discount to H shares.

The useful investor tool is a virtual daily “must check” index for holders of shares on either side of the de facto border separating the former British colony of Hong Kong from its giant neighbor to the north, and is specifically created to determine the price performances of the constituent listcos in the A-share and H-share markets, respectively.

To put things in perspective, the AH Premium Index is currently at a historical low of just 96.22 points, which translates into A shares now trading at a 3.78% discount to H shares.

Of the 80 shares that make up the AH Premium Index, 56 A-share firms are currently trading higher than their dual listed H-share twins in Hong Kong.

And among this sampling, the biggest gap in share price is a 7.2 times price premium for one A share over its H-share version.

On the surface, it would appear from this slice of date that A shares still continue to sell for higher prices than their H shares.

However, the interesting thing is that if market value is taken into consideration as a weighting factor, then A shares currently look like quite the bargain versus their Hong Kong replicas.

Two examples of constituents on the AH Premium Index are hybrid vehicle and battery maker BYD Co (SZA: 002594; HK: 1211) and Tsingtao Brewery (SHA: 600600; HK: 168).

These two counters are not only highly recognizable consumer names to most investors, but also well represent the chaos in premiums at play in the market.

The current price for BYD’s Shenzhen-listed A shares is 15.04 yuan, while the carmaker’s Hong Kong-listed shares are now selling at around 20 hkd (around 16 yuan).

Meanwhile, Tsingtao’s Shanghai-listed A shares are at 29.29 yuan and its H-shares are at 42.55 hkd.

That all means that BYD’s PRC-listed A shares are currently trading at a slight discount to its H shares, while Tsingtao’s PRC-listed A shares are now at a 14.4% discount to its Hong Kong-listed brethren.

In short, there is disarray in the old order.

During trading on Tuesday, the 96.22 level for the comparative index was reached, marking a historic low, or a watermark not seen in five-and-a-half years.

So how did A shares suddenly change from overpriced to underdogs?

The AH Premium Index is the go-to guide to determining where the relative bargains are in either market.

Another interesting thing about this Index is not only are market caps taken into consideration, but so are daily trading turnover figures.

Therefore, actively traded counters have a bigger influence on their standings in the AH Premium Index, which also explains why the more vibrant Hong Kong market and its shares have been doing better of late on the Index.

By definition, small-cap firms on either side of the de facto border tend to have limited daily turnover and therefore less impact on the Index.

Not only have investors in Mainland China been spooked by the sluggish performance of A-shares this year, but the stronger activity in Hong Kong had made many a PRC investors a “born again” believer in H-shares.

In addition, the highly transparent and open-to-all nature of the Hong Kong Stock Exchange means that the free flow of funds in and out of the Special Administrative Region’s market is all the more guaranteed.

By contrast, non-PRC investors still remain largely confined to Qualified Foreign Institutional Investor (QFII) funds and their fickle but rising quotas to gain access to A shares.

With the rise of the Hong Kong market vis-à-vis the comparatively sluggish Shenzhen and Shanghai bourses – all easily seen when the AH Premium Index slips under the 100 point level -- it is even more incumbent upon China’s securities watchdog to find ways to light a fire under A shares once again.

See also:

Gold Or Homes? JIM ROGERS Tips On China

Main China Investment Themes For 2013

BLAME GAME: Finger Pointing Futile Amid China Slump

Mainland Money Flooding HK Market