Excerpts from recent analyst reports

OSK-DMG initiates coverage of Food Empire with 72-cent target

Analysts: Melissa Yeap & Terence Wong, CFA

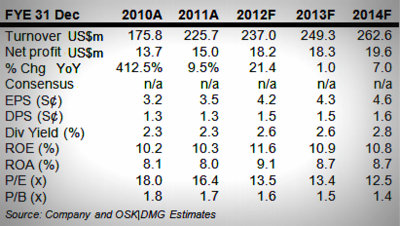

We initiate coverage on Food Empire with a BUY and TP of S$0.72, derived from 17x FY12F earnings, in-line with the industry average.

We expect 2012-14F earnings growth to be driven by:

1) Steady growth in existing markets,

2) Expanding gross margins from lower raw material prices namely coffee and sugar as well as

3) Operational efficiencies from higher volumes.

We also highlight that the Group intends to expand its reach into Asia via the acquisition of an existing

player giving it an instant platform into the market. As at 30 Sep 2012, the Group is sitting on net

cash of US$29.8m.

While we have not included the potential of this inorganic growth into our estimates, we expect any news on this front to provide some positive boost to the stock price.

Margins set to expand. We note that the Group has the highest gross margins among peers at 43.8% vs Super at 34.1% and VizBrandz at 32.2%.

However in terms of net margins, it lags behind at 6.6% vs a high of 14.0% for Super.

Margins are expected to expand as the Group engages in backward integration. It is in the midst of building a non-dairy creamer plant in Malaysia and an ingredients plant in India. Capex for this is estimated to be US$20-30m over a two to three year period.

Click on the 38-second video below for the where and who of NextInsight's recent visit to Food Empire's HQ in Harrison Road in the MacPherson area.

Recent stories:

FOOD EMPIRE opens its first manufacturing plant in Ukraine

FOOD EMPIRE: 3Q net profit surged 91% to USD8.1 m

Nam Cheong launches Malaysia's first diesel-electric multi-purpose platform supply vessel

OSK-DMG analyst: Lee Yue Jer

Photo: Lee Yue Jer

We visited Nam Cheong’s Miri Yard over the weekend for the launch of Malaysia’s first diesel-electric Multi-Purpose Platform Supply Vessel (MPSV), built by Nam Cheong for Bumi Armada Bhd.

Fuel-saving MPSV. The NC800 MPSV, designed by Finnish ship designer Wärtsilä, is the largest vessel built by Nam Cheong in Malaysia and is the first vessel to run on diesel electric propulsion. We understand that this design offers fuel-cost savings of about 20%.

Good equipment, ample space. Commissioned by Bumi Armada for its clients Sarawak Shell Berhad and Sabah Shell Petroleum Company, the vessel is equipped with a Remote Operated Vehicle (ROV) mezzanine deck, crane, and a large 800-square-metre deck area.

Recent stock price: 24 cents.

Target price: 30 cents.

Recent story: NAM CHEONG, SHENG SIONG: What analysts now say....