PROPERTY DEVELOPERS are facing some uncertainty over the rise of property prices as a result of the past one year of policy curbs, but a strong pipeline of residential projects has been keeping construction players busy.

In 2Q2012, the total supply of uncompleted units from private residential projects in the pipeline was at a record high of 83,251. Of this, 38,175 units were unsold.

While this may not augur well for real estate developers, it does mean ample contracts have been given out to construction players.

In 1Q2012, the pick-up in residential construction activity resulted in Singapore’s construction output expanding a whopping 27.9% compared to 1Q2012.

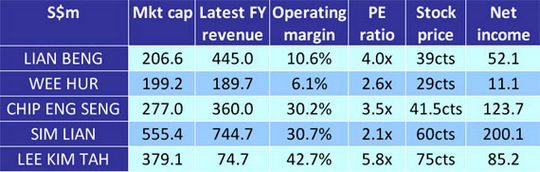

We decided to take a look at how three construction and property players have enjoyed the boomtime.

Wee Hur 1H2012 net profit up 96%

WEE HUR posted a 96% increase in net profit attributable to shareholders to $5.7 million for 1H2012.

1H12 revenue and attributable profit would have been S$251.2 million and S$49.1 million if the previous method of revenue recognition were continued.

It has proposed an interim dividend of 1 cent per share, representing a 123.5% dividend payout.

Wee Hur is currently developing four projects, two of which are industrial projects, namely Harvest@Woodlands and Premier@Kaki Bukit which are 100% and more than 95% sold respectively as at 30 June.

The recognition of the revenue and earnings of the two industrial property projects is deferred until their completion, which means the company’s earnings will be lumpy.

The other two projects are residential developments, Urban Residences (more than 80% sold as at 30 June) and the newly launched Parc Centros.

More than 75% of Parc Centros has been sold since its launch on 21 July 2012.

On top of these four development projects, Wee Hur has a construction order book of S$509.5 million as at 30 June 2012 to be fulfilled through FY2014.

Its construction projects comprise of commercial, residential, industrial and public projects and include public housing projects such as Vista Spring@Yishun and Fernvale Riverbow in Sengkang.

Then there are private residential projects such as Trilight in Newton, and industrial developments such as Premier@Kaki Bukit.

Wee Hur is also into design-and-build projects at Nepal Hill, Fusionopolis at One North and Changi Business Park by Ascendas.

All these translate into a construction order book of about S$204 million a year, versus 1H2012 revenue of S$128 million.

Related story: LIAN BENG, WEE HUR: Winning $100-Million-Plus Contracts

Lian Beng adds capacity to dormitory in Mandai

LIAN BENG Group is adding a third block to its two-block dormitory project at Mandai, which will increase capacity by 32% to 6,290 beds.

The dorm is a 55% joint venture with Centurion Corporation, and construction work on the third block is expected to be completed by 4Q2013 (year-end 31 May).

Lian Beng’s FY2012 revenue fell 12.3% year-on-year to S$445 million, mainly due to a decline in construction activity.

It focused on its construction operations during FY2011, with construction forming 75.2% of total revenue.

Riding on the growth of the overall construction industry in Singapore, its ready-mixed concrete segment grew fastest with revenue contribution increasing from 8.3% in FY2011 to 17.4% in FY2012.

Its net order book stood at S$652 million as at 31 May, to be filled through FY2015, translating into about S$217 million a year.

Lian Beng’s cash and cash equivalents stood at S$186.8 million as at 31 May.

Its projects include HDB projects, condominium developments as well as industrial projects.

Lian Beng has proposed a 2-cent dividend (FY11: 1.6 cent), translating into a payout ratio of 20%.

Related story: LIAN BENG CEO Wins S'pore Corporate Awards 2012 “Best CEO Award”

Heeton net profit up 1.7%, hit by higher cost of development

NICHE PROPERTY developer Heeton posted a 29.0% increase in 1H2012 revenue to S$19.5 million, but profit attributable to shareholders was only up 1.7%, at S$8.4 million.

Revenue increased mainly due to higher recognition of sales from two residential properties, Lincoln Suites and The Lumos.

However, cost of properties sold increased by 112.5% as a result of higher cost of development for Lincoln Suites, resulting in a lower net profit.

Demand for high-end homes has tapered off since the government introduced anti-speculative measures in 2H2011.

Uncertainty in the economy as well as a fear of the government imposing more measures to curb excessive property price hikes have resulted in property players waiting on the sidelines and not launching some development projects.