• Wee Hur Holdings has two core business: construction and dormitory operation. These are high growth areas currently and will continue to be the case for the next few years.

|

Excerpts from DBS Research report

Analysts: Geraldine WONG & Derek TAN

WEE HUR HOLDINGS: Locked and loaded

| • Backed by a strong investment war chest following the divestment of the PBSA portfolio at a substantial gain

• Growth will be driven by completion of a new 10,500-bed dormitory in Singapore, representing a 67% increase in bed count, and a robust construction outlook • Core business revenues to deliver c.20% CAGR in the coming years • Fair value estimated at SGD 0.80, based on our SOTP valuation of SGD 0.89. |

||||

| The Business |

Diversifying from its roots in construction. Wee Hur began as a construction company in 1980 and has since transformed into an investment holding company with diversified operations in construction, property development, workers’ accommodation and purpose-built student accommodation (PBSA).

The Group operates a massive portfolio of 6,071 student housing beds under the Y-Suites brand across 5 key locations in Australia, and 25,000+ beds in 2 large scale workers’ dormitories in Singapore.

Construction remains a major revenue driver, and Wee Hur has been awarded major contracts by the HDB in Singapore.

Wee Hur’s property development arm focuses on residential, industrial, and mixed-use projects in both Singapore and Australia.

The Group also earns revenue from fund management services and PBSA operations such as sales, marketing and student dormitory management.

| The Stock |

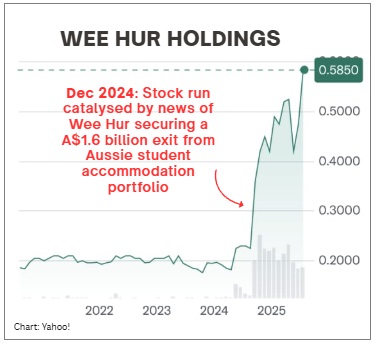

Value unlocked from a decade of strong growth in PBSA Australia. The recent disposal of a 5,662 bed, 7 property PBSA portfolio for ~SGD319 mn in cash unlocked SGD0.35/share in value for Wee Hur, accounting for 60% of the current share price.

| Poised for growth from 2026 |

| "With the new Pioneer Lodge, Wee Hur hopes to maintain high levels of occupancy and competitive rental rates close to SGD500 per bed. The new property will increase the number of beds under Wee Hur by 70% to 26,244 by end of 2025. Thus, this business segment is set to be a major revenue driver for the Group, which we estimate could be by up to c.70% based on full year contribution from FY26 onwards." -- DBS Research |

The disposal allows Wee Hur to focus and grow its workers’ dormitory business, while expanding other business segments.

We value the dormitory business using a conservative 4x P/E multiple and the construction business at 8x P/E.

With the upcoming 10,500-bed workers’ dormitory in Pioneer and favorable growth prospects for its construction segment, we estimate Wee Hur’s fair value at SGD 0.80/share, pegged to a 10% discount to our SOTP valuation of SGD 0.89/share.

SOTP valuation at c.SGD0.80/share for Wee Hur Holdings. We estimate the value of property development segment using the gross development value (GDV) and value the remaining PBSA segment based on SGD200,000 per bed. A lower price-to-earnings (P/E) multiple of 4x is applied to the worker dormitory business factoring in the short remaining lease duration at Tuas View (ending October 2026) and Pioneer Lodge (ending December 2029). The construction segment is valued at a conservative 8x P/E multiple, at a discount to peers due to its smaller scale. We further apply a 10% hold-co discount to derive a fair value of SGD 0.80. |

|

Sum of parts valuation of Wee Hur indicates a fair value of SGD0.80 / share |

|||||

|

Business Segments |

Profit After Tax |

P/E |

Valn (SGD mn) |

Valn (per share) |

Remarks |

|

Property Dev't |

550.0 |

550.0 |

0.60 |

GDV of SG/AU developments |

|

|

PBSA |

218.4 |

0.24 |

Based on SGD 200,000/room valuation |

||

|

Worker’s Dormitory |

47.0 |

4x |

189.0 |

0.21 |

4x P/E on profit, lower due to shorter tenure |

|

Construction |

32.8 |

8x |

262.4 |

0.45 |

8x P/E on est. profit from order book |

|

Total |

1,219.8 |

1.49 |

|||

|

Less: |

|||||

|

Net Debt |

(113.8) |

(0.12) |

|||

|

Value extracted from disposal |

319.0 |

0.35 |

|||

|

Capex |

(592) |

||||

|

Minority Interest |

(14.5) |

(0.02) |

|||

|

Total Value |

817.6 |

0.89 |

|||

|

Shares Outstanding |

919 |

||||

|

Hold-co discount |

10% |

||||

|

Fair Value |

SGD 0.80 |

||||

Source: DBS Research

Full report here.