The following content was published recently in Propwise's blog, www.propwise.sg, and is reproduced with permission. Propwise, who holds the Chartered Financial Analyst qualification, is the author of several books on the property market.

IN A PREVIOUS article Worrying Trends in the Singapore Property Market, I highlighted four disturbing trends in the Singapore market:

- HDB prices are rising faster than private property prices

- Private home buyers are in a cautious mood, especially in the high end segment

- Developers are turning cautious too

- Investors are going into industrial and commercial properties

I think these trends are signalling that we are near a turning point in the property bull market. The insiders are turning cautious while the “man on the street” average investors are still rushing in.

Middle income families are rushing to buy high-priced HDB flats and mass market residential properties and small-time investors are snapping up “shoebox” industrial units with a fairly ambiguous rental market.

At the same time the wealthy and developers (the “insiders”) are turning cautious on the market, and the weakening global economic situation means that the yields of the industrial and commercial properties could be at risk. Which group do you think has a better grasp of what is going on in the market?

Property market turning point likely in 2012

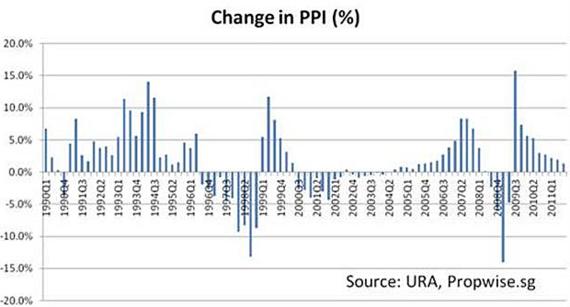

The argument that we are reaching a turning point in the market is also backed up by the eight straight quarters of decelerating growth in the URA’s Property Price Index till 3Q11, which is likely due to concern over the slowing economy, worrying global economic situation especially with the troubles in Europe and weak growth in the US, combined with the dampening effect of the government measures.

We had previously seen this decelerating price growth trend preceding the property bear markets that began in 3Q2000 and 3Q2008 (but not the one in 3Q1996).

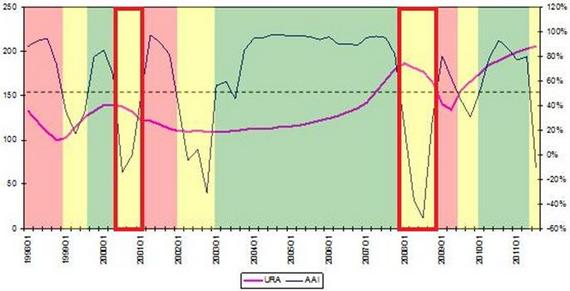

Property consultant and developer Getty Goh is also calling for a property bear market based on his proprietary Ascendant Assets Indicator.

To recap, the basic premises of the AAI are (1) there is a lead-lag relationship between the stock and property market and (2) we are able to tell how the property market is performing by analysing the correlation between the stock and property market. Based on the URA’s 3Q11 numbers the AAI has dropped, indicating a change in market sentiments.

Simplistically speaking, we can observe that the URA PPPI index in the yellow zone after each green zone has contracted during the last two cycles (red boxes), and it is probable that it will do so going forward.

And I believe that the Government’s recent announcement of the Additional Buyer’s Stamp Duty (ABSD) will be the straw that breaks the camel’s back. The impact of the ABSD is that the transaction cost for investors will increase substantially, killing investment demand. Thus transaction volumes will fall and prices are likely to be impacted. Foreigners will shrink as a percentage of all buyers, with the impact on the high-end market larger than for the other segments.

How much will prices fall?

Beyond just the price movement, we have to worry about things like the large upcoming supply of completed private and public housing that may “flood” the market and global economic uncertainty due to the troubles in the U.S. and Europe.

So while I’m pretty confident that property prices will not increase significantly (if at all) in 2012, it is much harder to predict the amount of downside in the market. There are also supportive forces in the market, including the current low interest rate environment, and foreign investor perception of Singapore as a “safe haven” to park their money in.

Thus while we can know with some certainty what the medium term supply is going to look like, the big unknown is demand. Demand is influenced by many factors – market sentiment, unemployment levels, immigration policy of the government etc. In fact, some analysts have argued that the upcoming surge in supply will not cause property prices to fall.

So if you’re expecting prices to fall significantly, don’t hold your breath as it may not happen.

Getty Goh thinks that the best-case scenario is that private property prices remain stable while non-residential property prices could still increase, but it is possible in the worst-case scenario for Singapore property prices for all sectors to tank.

As I have been doing for a while, I caution all investors to study the market carefully before and do your sums before committing your hard earned cash and credit to a property investment. The outlook for 2012 may seem especially uncertain, but for the well-prepared investor, it may be a year of great bargains as well!

Recent story: Singapore's latest property measure: What analysts say about it....

i.e. U-SHAPE