Excerpts from analyst reports...

BOCOM: PRC PROPERTY still MARKET PERFORM

Bocom International is reaffirming its MARKET PERFORM call on Mainland China’s Hong Kong-listed property developers thanks to less stringent mandates placed on developers to build budget units.

“The PRC government considered to cut the construction target of public housing by 20% to eight million units in 2012. The original construction schedule, in terms of construction commenced, was to start construction of 10 million units in both 2011 and 2012, and 36 million units in total are built as at the end of Twelfth five-year plan.

“It is widely believed that the tight financial condition of local governments, together with planned reshuffles of political leadership in 2012, contributed to this policy adjustment,” Bocom said.

Insignificant impact to the sector Bocom says it thinks the building target adjustment, and thus the decrease in supply of affordable housing, would not have a significant impact on the mainland property sector.

“This is because most of those developers are actually concentrating on different segments (mid-to-high end residential projects and commercial properties). Instead, the real estate investment growth would be negatively affected for next year, as well as other relevant sectors, such as cement, glass, construction equipment, etc. It would also post some extent of negative effect to the GDP growth forecast for 2012.”

Offshore financing restricted by SAFE PRC media reported that the State Administration of Foreign Exchange (SAFE) restricted the guarantee application by mainland property companies for funds raised by debenture issuances from their subsidiaries.

“In other words, it is a restriction of offshore financing for those mainland developers. It would also help to rein the flow of ‘hot money’ to the mainland property market.”

See also: HK TYCOON LI KA-SHING: Killer 1H, Eyeing Mainland Invasion

BOCOM: Expect slower PRC AUTO SECTOR growth

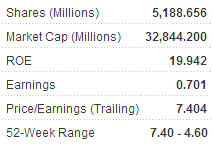

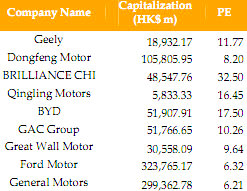

Bocom International said the recent muted performance of PRC auto firms listed in Hong Kong was within expectations.

The auto sector saw slower growth in the low season. China’s auto production reached 1.3061m units in July, up 1.26% YoY or down 6.96% MoM, while sales dropped 11.19% MoM or increased 2.18% YoY to 1.2753m units.

Auto production and sales in the first 7 months of the year were 10.4624m units and 10.6018m units, up 2.33% and 3.22% YoY, respectively.

Bocom ventured that the slower growth was mainly due to seasonal factors.

“July is usually the low season for auto sales and some auto manufacturers suspend production under hot weather or conduct maintenance work during the month."

Passenger cars outperformed commercial vehicles in July. Production and sales of passenger cars in July were 1.0504m units and 1.0118m units, respectively, up 5.82% YoY and 6.74% YoY.

Meanwhile, production and sales of commercial vehicles fell 13.98% YoY and 12.23 YoY to 255,700 units and 263,500 units, respectively.

“Slower investment growth led to the fall in commercial vehicles while sales of passenger cars were supported by strong domestic consumption,” Bocom said.

Smaller cars, smaller share Sales of passenger cars with displacement below 1.6L were 657,200 units in July, down 12.28% MoM or up 6.24% YoY. The sales accounted for 64.95% of the total sales of passenger cars, down 2.59ppts MoM or 0.43ppts YoY.

“The decrease in sales of passenger cars with small displacement was mainly due to the exit of favouring policies. Since most of the small displacement vehicles are under self-owned brands, the market share of self-owned brands fell 4.13ppts MoM or 3.79ppts in July.”

Export performance mixed Exports of domestic auto manufacturers fell 12.73% MoM or increased 57.70% YoY to 73,300 units in July.

The exports retreated slightly from its record high reported in June but the figure stood above 70,000 units in July, showing a relatively strong performance. Cumulative exports soared 57.3% YoY to 454,400 units during Jan-Jul period.

“We expect exports to remain strong in 2H11 on low base effect and rapid development of overseas markets. While we do not see any strong driving force for the sector in 2H11, we do expect sales to recover in its peak season in 4Q11.

“We estimate the sector will grow at around 5% in the second half of the year, and we maintain our MARKET PERFORM rating on the sector.”

See also: MINTH, GREAT WALL MOTORS, BYD Facing PRC Auto Slump: What Analysts Now Say...

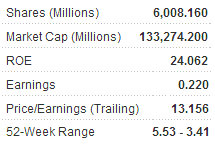

GUOCO: ZIJIN MINING’s ‘cheap valuation’ earns BUY upgrade

Guoco Capital said it is raising Zijin Mining (HK: 2899) to BUY with a six-month target price of 4.80 hkd, implying 13x 2011 P/E.

“We are upgrading Zijin to BUY on its cheap valuation and in-line interim results,” Guoco said.

Zijin announced in-line interim earnings of RMB 3.15bn (EPS RMB 0.144), up 25% yoy.

“As the company is undergoing a number of rectification works in its mines to enhance safety and environmental protection standards, its gold and copper output saw a drop of 8% and 5% in 1H11, respectively compared to same period last year. Yet thanks to the robust price of the two products (gold and copper price up 21% and 23% yoy), both revenue and gross profit saw an 18% yoy increase, while gross margin stayed largely stable at 36%.”

Since August, the global gold price has risen 8% to record highs due to the heightening concerns on the US economic outlook and the European debt crisis.

“Yet Zijin’s share price retreated 12% over the same period given the worsening market sentiment and growing concerns on mining life of Zijinshan Mine and Zijin’s gold reserve details. During a recent analyst meeting, Zijin’s management reiterated that as at end-2010, Zijin had a total gold reserves/resources of 750.2 tonnes, including 110 tonnes from Zijinshan.”

Guoco added that Zijin management expects Zijinshan, which accounts for half of the company’s gold output, to have a mining life of six years based on current annual output of 15 tonnes a year.

“Gold segment has accounted for 62% of revenue and 67% of net profit in 1H11. Given that gold price has outpaced other metals in 2H11 so far, we expect the company’s gold segment to have a higher contribution in 2H11. We now estimate the company’s gold segment will record a 18% hoh increase in net profit, and account for 69% of total net profit in 2H11.”

Looking forward, Guoco said it expects Zijin’s gold output to grow by less than 10% in 2012.

“However, the company’s copper production will increase significantly by more than 50% in 2012 following the resumption of work at the Zijinshan copper smelting plant and mine expansion in 2012. With the low interest rate environment in US, high inflationary pressure in emerging countries and also deteriorating ore grade for major mines globally, we remain bullish on gold and copper price. Thus Zijin will be a beneficiary of the strong metal price.”

Guoco said it expects Zijin to record a net profit of RMB 6.74bn (EPS RMB 0.309) and RMB 7.75 (EPS RMB 0.355) for 2011 and 2012, respectively.

“The counter is only trading at 10.0x 2011 and 8.7x 2012 PER that we think is undemanding and should have factored in the negative news flow on the legal proceedings regarding the two pollution accidents last year.”

See also: DIAMONDS IN THE ROUGH: Finance Chief Hawks Hong Kong

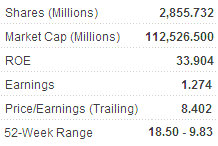

BOCOM: TENCENT kept BUY on strong sales

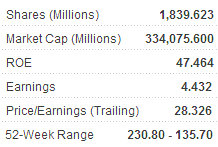

Bocom International said it is maintaining its BUY call on social network portal Tencent Holdings (HK: 700) following strong recent results.

“The second quarter top line beat market expectations but GAAP margins fell 10+bp due to acquisitions and investments,” Guoco said.

Second quarter revenue was RMB6.74bn, up 44% YoY and 6% QoQ, mainly due to a strong advertising season in Q2, while operating profit was RMB2.784bn up 17.4% YoY and down 17.8%QoQ, due to its acquisition activity as well as high spending on marketing/R&D.

Net profit was RMB2.34bn, up 21%YoY and down 19%QoQ while diluted EPS was RMB 1.26 up 22% YoY and down 18%QoQ. Meanwhile, non-GAAP operating profit was RMB3.2bn, up 28% YoY and 2% QoQ, and gross margins flatted at 65%.

“Online games performed strongly even in weak seasonality. Game revenue grew 70% yoy and 2% qoq to RMB3.64bn. Online games contributed 68% to IVAS revenue or 54% of total, the increase was driven by new expansion pack of DNF as well as in-game promotion for qq speed/qq dance/mini casual games,” Bocom said.

It added that school exam season is the main factor leading to revenue growth slowdown compared to preceding quarters.

“However, due to the strong performances of the games, PCU of DNF/combined ACG/MMOG hit record high of 2.6mn/7.5mn/4mn, respectively. Both QQ XianXiaZhuan/C9 are on the right track with pipeline in 2H11, while Legend of Yulong has been delayed to 2012.

“Online game revenue is expected to increase 13% to RMB4.13bn in 3Q11, with strong promotion during school holidays.”

Bocom said revenue will continue to increase with solid growth of both games and social networking services.

“Tencent is trading at 28/22x 2011/2012 PE. We cut 9%/2% of 11/12 EPS to HKD6.7/8.6, and cut the target price to HKD231 (from HKD262) on 1.1X PEG.”

See also: FOCUS MEDIA: Gen2 Fund Boosts Stake In HK/Singapore Ad Firm