Excerpts from analyst reports...

Yuanta ‘BUY’ on MINTH Due To Auto Parts Prospects

Yuanta Research said Minth Group (HK: 425) is its “top pick” in China’s auto sector thanks to opportunities for the firm to supply parts to the world’s biggest carmaker.

“Minth is set to benefit from Toyota’s penetration into the lower-end market, which in our view will provide Minth with an opportunity to break into Toyota’s enclosed supplier system; its upcoming new aftermarket parts business should also improve its margins.”

Yuanta added that it is transferring coverage of Minth with a BUY rating and a target price of 14.8 hkd, implying 37% upside.

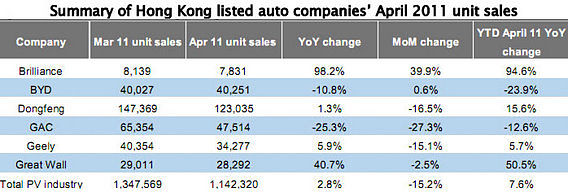

As for the state of the PRC’s auto industry overall, Yuanta is urging investors to “proceed with caution.”

“We lower our 2011 China passenger vehicle (PV) demand growth estimate from 6.5% to 2.5% YoY on a revised M2 supply assumption of 16.5% (17% previously). We believe industry concerns will shift from supply bottlenecks to demand slowdown in 2H11.”

The brokerage added that competition will likely increase in the lower-end market and result in operating margins shrinking.

“We are turning more cautious on the China auto industry, and we anticipate the focus in 2H11 will shift away from supply shortages towards weakening demand.

"Our 2.5% YoY PV demand growth forecast for 2011 is significantly below the consensus estimate of low double-digit YoY growth.”

Yuanta added that it prefers upstream companies over downstream names in this low-growth environment, with Minth Group its top sector pick.

See also: HK-LISTED INSURERS, RETAILERS, AUTOS: What Analysts Now Say...

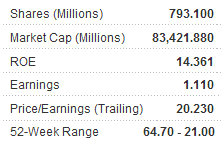

Yuanta cuts Great Wall Motors to SELL on SUV competition

Yuanta says it is downgrading its call on Great Wall Motors (HK: 2333) to SELL.

It is also cutting the target price to 10.20 hkd, representing a 16% downside.

“We expect the company will continue to lose SUV market share in 2011 as a result of increasing competition in the mid- to low-end SUV market,” the brokerage said.

Yuanta added that several JVs have started making lower-end cars, and as a result competition should intensify in this market.

“While we do not expect a full-blown price war at this point, we anticipate promotional fees will grow, pressurizing operating margins.”

See also: XTEP, CHINA AUTOS: What Analysts Now Say...

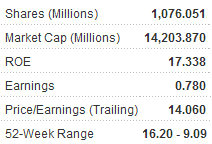

Yuanta SELL on BYD on declining market share

Yuanta says it is transferring coverage with a SELL rating on BYD Co (HK: 1211) and lowering its target price to 18.80 hkd (26% downside).

“We anticipate the company will continue to lose market share in 2011, based on our forecast of a 23% drop in dealership numbers and increasing competition in the lower-end market.

See also: BYD: HK-Listed Automaker To Work With Intel, Buffett Staying Put