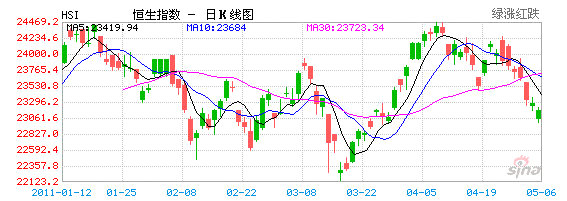

HONG KONG'S benchmark Hang Seng Index fell 2.4% this week and 0.44% on Friday to finish at 23,159.14 on a raft of uninspiring news out of the US and softening global commodity prices.

The eight-day losing streak for Hong Kong shares marks the longest such downturn since 2003, when SARS and Gulf War II were weighing heavily on sentiment.

A Chinese language piece in Sinafinance said a major drag on the Hang Seng today and for much of the week has been the declining fortunes of energy-based firms, as well as just-released worse-than-expected unemployment data from the US.

Crude oil futures on the Nymex fell by nearly 9% on Thursday, breaking through the psychologically-important 100 usd per barrel threshold.

This dragged major upstream oil explorer CNOOC Ltd (HK: 883) down 2.28% today to close at 17.98 hkd.

Crude oil peer Petrochina Company Ltd (HK: 857) gave up 0.76% to finish at 10.48 hkd.

Lower commodity prices across the board also helped China Shenhua Energy Company Ltd (HK: 1088) lose 1.43% to close at 34.55 hkd, while China Coal Energy Co Ltd (HK: 1898) dropped 0.38% to 10.44.

However, cheaper energy -- especially crude oil -- was of course not all bad news for Hong Kong-listed enterprises, with transportation-related firms some of the biggest beneficiaries.

Airlines, whose overall costs are heavily impacted by fuel prices, were led by Air China Ltd (HK: 753) which leapt 5.8% today to close at 8.39 hkd.

For similar reasons, Hong Kong-based carrier Cathay Pacific (HK: 293) rose 3.2% to 19.9 hkd,

Meanwhile, Shanghai-based China Shipping Development Co Ltd (HK: 1138) jumped 6.8% to 8.30 hkd on expectations of cheaper petrol prices going forward.

Mainland China still relies on coal for around 80% of its electricity generating feedstock, so lower prices for the commodity mean cheaper operating costs for power producers.

China Resources Power Holdings Company Ltd (HK: 836) added 1.0% on the day to finish at 15.82 hkd.

Analysts expect a cautious wait-and-see approach next week as markets await a new raft of economic information to be released by Beijing.

They also say that eyes will be focused on Europe as well, awaiting data on debt financing, payrolls and inflation.

Sinafinance cited Mark To, Head of Research at Wing Fung Financial Group Ltd, as saying commodities will continue to be a major driver – one way or the other.

“Recently, global commodity prices have come down to earth in a hurry, and have impacted several different sector plays in all markets. But Hong Kong already rose somewhat disproportionately on energy-based plays in mid-April, so today’s energy selloff is natural.

“The index is quite likely to show an upward trend from mid-May on, at which time a series of new companies will be listed on the main board,” Mr. To said.

See also:

HK WEEKLY WRAP: Index Slides 1.7% On Week On Rate Worries

HANG SENG LOSING STEAM: 23,500 New Support Level?