Translated by Andrew Vanburen from: 兩大法則防股市輸身家:分散注碼 慎選工具 (中文翻譯, 請閱讀下面)

I recently talked about how Warren Buffett’s right hand man – Charlie Munger – says investors should mimic pilots before laying down their money by first composing and consulting checklists.

No pilot who values his life would take flight without doing so first, so why should an investor who values his money invest without a checklist?

This time I want to discuss two guaranteed ways NOT to lose money in the market... or at least try your darndest not to, by making a mental checklist before each move focusing on diversification and discipline.

Here is a strategy that is definitely worthy of emulation.

Keep your portfolio sufficiently diversified, as one single basket is a risky place to put all the eggs.

Also, be disciplined in your selections, and always go the extra yard to learn exactly why a share price is where it is... and where it might be headed.

For example, you might have speculative positions in select counters that employ three separate assurances: technical analysis, front-runner wagering, or diversifying your holdings so as to attain optimal hedging.

Technical analysis is purely predicated on value and affordability, and is limited by price fluctuation, as I have described earlier.

Oftentimes, as soon as chatter hits the floor on a certain stock, by the time it is fully audible – let alone verifiable – it is often past the “buy” stage and well into “hold” territory.

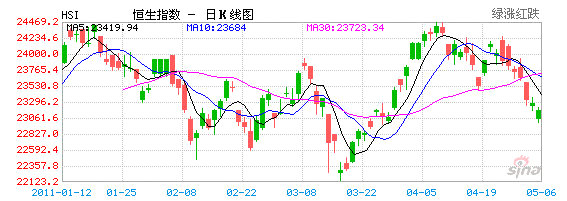

As for the state of the Hang Seng these days, external factors have been the main drags of late and the holders are sitting forward on their haunches waiting for the slightest glimmer of upbeat information to either expand their stake, or venture off in another direction.

But although it doesn’t look like there is much room at the top these days, the Index is also unlikely to plummet through 23,000 amid another downturn. Over the next few sessions, I expect investors will yell “fire!” at the first visible spark, but the market should be able to hold its current level with relative ease.

That being said, an escape plan would not be a bad idea... just as a contingency measure. But right now there is no smell of smoke, so the likelihood of a fire on the horizon is equally remote.

Other than technical analysis, there is always the front-runner strategy, one which usually either results in a short-term win or loss. Determinants for these counters include being: elite, highly-profiled, cyclical or rapid risers.

But human nature dictates that this is somewhat out of synch with reality, and investors are more likely to buy when a stock is falling than when it is rising.

Therefore, portfolio diversification and a disciplined approach to pondering new additions to said portfolio constitute the safest gamble of all, hands down.

See also: HK market: Where to find diamonds in the rough?

兩大法則防股市輸身家:分散注碼 慎選工具

(文: 黃國英, 豐盛融資資產管理部董事)

上周談到,股神拍擋蒙格,建議投資者學習飛行員,使用「檢查清單」,時常核對,以保平安。

自己見賢思齊,列出炒賣倉位三大保命法:技術分析、注碼及工具。TA保命,以價止蝕,前文已述。話音剛落,一周之內,已可應用:外圍強,港股未動,以期指搏突破。上望空間不少,當時看法,是長驅直進。訂定止蝕,置於不該跌回的水平:23900。即日失守,等於機身着火,對策自是彈射逃生。至於脫險歸來,是否「唔升就要跌」,轉身造淡,乃是後話。

高注大注五毒之首

TA以外,注碼定輸贏,理至易明。之前寫過,旺市輸身家,關鍵有五:高位、大注、周期股、流嘢增長股及溝招。高位與大注,實是五毒之首。人的習性,多是低位唔搏,反而越升越信,越買越大。市淡明哲保身,市旺奮不顧身,對個人財富,殺傷力整大。戒除高位手鬆大注,為一要點。

注碼保命第二點,在於分散。投資乃持久戰,對價格波動較為寬容,可花較多時間研究。度清度楚,費盡心神,自然要買大 啲先抵。人所共知,股神巴菲特的集中投資法,其理在此。但炒賣則剛剛相反:投資要精;投機求快,一如西部牛仔決鬥,務必盡快擊倒對手,不可能講究:「瞄 頭?瞄心口?定射腳算數?」兵貴神速,值搏就郁。問題是,研究深度受限,就不可次次重注。分散注碼入市,可減低一網成擒的風險。一隻二、三線股,最多以組 合3-5%下注,就算公司出事,股價腰斬,組合都只是損失1-2%,尚有餘力再戰。早前曾有讀者,謂以本金兩倍槓桿,炒一隻二線股,得手固然高興,但需防一朝事變,任何數乘零,仍舊變零。謹記:大業百戰方成,敗亡一役足矣。

檢查清單第三項,是以工具保命。慎選工具,重點有二,一為流通性,以便及時出脫;二為控制損失金額,減輕中伏時的傷 勢。很多人習慣升市之初炒大股,得手就轉入二、三線,之後再接再勵,衝入更細的細股。反彈以大股為先,再戰二、三線,是標準操作,不會反對。但越升越走偏 鋒,不知適可宜止,則恕難苟同。升市後期,升幅固然以細股最勁,但一轉勢,買盤可以影都無埋。紙上富貴,不外好夢一場。反而應逢高獲利,趁仍有流通性時, 且戰且走,換入防守大股、增加現金水平,方為正途。

期權輸有限贏無限

但升市尾聲,最為熣燦,袖手旁觀,於心何忍?要搏到尾,亦無不可。檢查清單最後八字:「與羊共舞,期權最好。」期權長倉(買call、買put),是市場中少數具非線性(non-linear)回報的工具。簡單講,買咁多,輸哂咁多;賺無上限,蝕極有譜。由於具槓桿效應,動用本金比買正股低;具保護作用,持倉過夜比期指安全。買期權坐到尾,實屬小注搏大贏的不二法門。

整理清單,時刻檢查。小心防意外,好事自然來。

請閱讀: 中國中冶: 值得關注