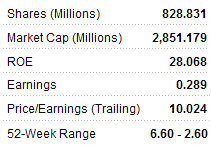

CMS ‘Buy’ on SIJIA, TP 6.00 hkd, on margin growth expectations

China Merchants Securities is reiterating its ‘Buy’ call on Sijia Group Co (HK: 1863) thanks to stronger expected margin growth and recent healthy results for the reinforced polymer products maker.

Sijia achieved 2010 revenue of 970 mln yuan, an increase of 69.2% and was in line with our expectations. Gross margin was 45.3%, remaining stable during 2010. Because the company started new product development and market expansion in Q4 for Phase II Fuzhou factory and Shanghai production base, selling and administrative expenses increased.

In 2010, the company’s net profit was 22 mln yuan, up 26.9%.

The decline of 2010 gross margins was mainly due to rising raw material prices. Based on our forecast of PVC prices, we expect the company to improve its gross margins in the first half of 2011. In addition, the company can maintain stable gross margins by adjusting product structure.

Selling and administrative expenses in 2010 increased by 472.9% and 207.7%, respectively. The increasing selling expenses were mainly caused by a series of new product launches and R&D activities, which we believe are one-time expenses.

The increasing administrative expenses were mainly caused by IPO expenses and employee stock options and costs for upgrading and improving existing products and R&D of new materials.

If we phase out one-time expenses, net profit for 2010 would be 290 mln yuan, up 68.3% and in line with our previous forecast.

We expect that the company’s revenue and net income for 2011-2013 will grow at a CAGR of 38.2% & 39.0%, respectively, to reach 2.5 bln yuan and 690 mln.

See also: HK-LISTED SIJIA Issues Positive Profit Alert, CHALCO Gets Ungraded On Aluminum Price Rise

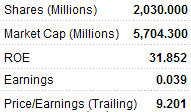

BOCOM staying ‘Buy’ on REGENT MANNER

BOCOM is staying ‘Buy’ on high-tech electronics component supplier Regent Manner (HK: 1997) with a 3.88 hkd target price (40.6% upside) thanks to strong results.

March sales reached a record high of 123.3 mln usd, representing a year-on-year growth of 45.9%. First quarter sales amounted to 324 mln usd, up 35.5% y-o-y, and our estimated FY11 revenue is 1.39 bln usd.

We consider 1Q sales figures satisfactory.

Regent enjoys a strong competitive advantage.

It possesses a strong competitive edge on low production costs, largely due to its economy of scale. Regent is able to achieve lower production costs than its clients and peers as it has lower procurement costs and higher production efficiency.

Regent is well-positioned in the industry chain, engaged in SMT service for LCD panel ICs, LED bars and TV mainboard products.

The Japan earthquake does not have a direct impact on Regent as its major clients are from Taiwan, Korea and the PRC.

See also: CHASEN To Reap Business From Japanese Companies Post-Crisis?

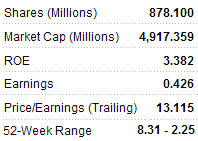

BOCOM maintains ‘Buy’ on EVA PRECISION with 8.38 hkd TP (60.5% upside)

Metal stamping and plastic injection moulds maker Eva Precision Industrial Holdings (HK: 838) saw 2010 revenue increase 66% year-on-year to 1.7 bln hkd while net profit soared 860% to 303 mln.

Revenue for mould sales jumped 161.57%, reaching a record high in 2010 with the revenue of all its business segments reporting strong growth from last year.

In particular, revenue from mould sales surged 161.6% year-on-year to 324 mln hkd, with revenue of metal moulds up 170.1%.

The strong growth in mould sales laid a solid foundation for Eva’s future earnings growth.

It should be noted that sales to Toshiba might be slightly affected by the earthquake.

We believe that the company will benefit from a transfer of advanced capacity to China over the long term after Japan’s earthquake.

See also: BRIGHT WORLD, MIDAS, MINZHONG FOOD: What Analysts Now Say...