LONG REPUTED TO be a property developer with a niche interest in the East Coast area, Roxy-Pacific Holdings has recently revisited the area – it has entered into an agreement to acquire a freehold site on Lorong N Telok Kurau for $14.2 million.

The buildings on the freehold site are known as 103, 103A, 103B, 105, 105A and 105B.The site is zoned for residential usage and has a total land area of 1,313.4 sq m and a plot ratio of 1.4 for development.

Announced on May 5, the acquisition was funded through its internal funds and bank borrowings, and marks a continued steady accumulation of landbank by Roxy-Pacific.

Indeed, earlier, on April 12, the developer announced it had entered into an agreement to acquire a freehold site at 131, Mackenzie Road for S$24,550,800.

The site, where Mackenzie Mansion now sits, is located just across the road from the perimeter fence of the sprawling Istana, the official residence of the President of Singapore.

It has a total land area of 1,198 sq m and a maximum plot ratio of 2.1 for residential development.

The contract is conditional upon an Order for Sale from the Strata Titles Board or the High Court (as the case may be) approving this sale and purchase.

Asked for Roxy-Pacific's plans for these two sites, executive director Koh Seng Geok said the Mackenzie site would be redeveloped into a 6-storey building with about 50 apartments (currently it has 16 units on four storeys) whilst the new Telok Kurau development would be 5 storeys housing about 40 units.

The breakeven Average Selling Prices at the moment are estimated to be $1,500 and $1,300 per sq ft, respectively, said Mr Koh.

Prior to the announcements regarding the two sites, Roxy-Pacific had four projects slated for launch this year and next:

* Marine House which comprises 60% offices and 40% residences.

* Singapura Theatre (55, Changi Road) which is to be developed for strata-title sale – primarily for retail because it is next to Geylang Serai Market.

* 116 Changi (Everitt Building) which Roxy said is suitable as an office block but the ground floor may have retail spaces.

* Toh Tuck Apartments, which is slated for residential redevelopment.

1Q results: Revenue down, net profit up

Standard & Poor’s, in a report, said Roxy-Pacific’s 1Q11 results came in within its expectations.

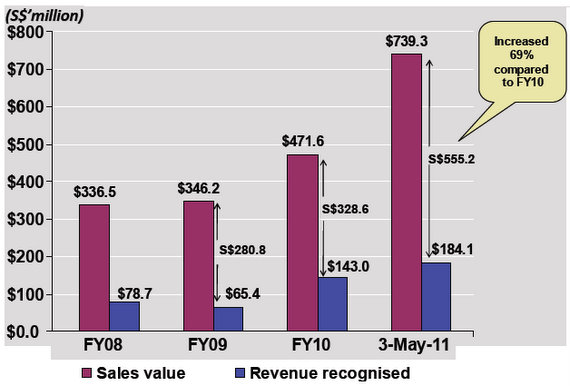

Revenue was down 17.2% year-on-year due to lower progress receipts recognized from property sales in 1Q11. Net profit, however, improved 11.2% year-on-year to $10 million as gross profit margin rose 4 percentage points to 32%.

Revenue from the property development division accounted for 75% of total at SGD37.9 mln.

The group’s hotel division was buoyed by strong tourism inflows into Singapore, leading to revenue improving 15% year-on-year to $11.8 m at the Grand Mercure Roxy Hotel.

The hotel, which is sited opposite Parkway Parade shopping centre, experienced a slight decline in average occupancy to 91.6% from 93.5%.

This was offset by a 22% year-on-year increase in average room rate to $185.90.

Roxy-Pacific's 1Q presentation slides can be accessed here.

Recent stories:

ROXY-PACIFIC, YANGZIJIANG: What analysts now say....

ROXY-PACIFIC: Why the stock price is resilient