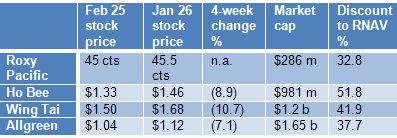

WHILE THE market has seen a steep correction in the past few weeks as the Mideast/African political situation turned nasty, Roxy-Pacific has stayed on an even keel: It stock price closed at 45 cents last Friday (Feb 25), unchanged from where it was on Jan 26.

Shares of a number of other property developers have tanked (see table below). Several factors have supported Roxy's stock, including:

1) Roxy-Pacific announced its 2010 turnover and net profit had hit record levels of $216.9 million (up 33% year on year) and $42.8 million (up 53%), respectively.

And it is proposing a final dividend of 1.5 cents a share (1.0 cents in FY09).

2) After the results announcement, the CFO and executive director, Koh Seng Geok, bought 100,000 shares in two transactions at 43 cents and 46 cents, respectively.

That’s a positive signal about the earnings prospects – and it is not the first time coming from various members of the management or the board, which in fact has been steadily buying shares of the company.

3) Despite the new set of government price-cooling measures, Roxy-Pacific has done well in its two most recent residential property sales, reaping a total of $327.2 million by Feb 17.

This is a significant sum as it will account for 60.6% of the $540 million revenue to be recognized from this quarter all the way to late FY2014. (The $540 million represents all its property sales to date that have not been recognized in its profit & loss statement.) Roxy-Pacific does enjoy high earnings visibility.

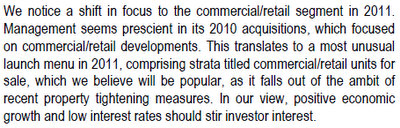

4) Roxy-Pacific will have a busy 2011 with four property launches scheduled for this year – three of these are commercial/retail developments and are unaffected by the government’s price-cooling measures.

5) Bullish analyst reports.

a) Kim Eng Research analyst Ooi Yi Tung, in a Feb 22 report, noted the steep discount to RNAV that Roxy-Pacific shares (45.5 cents) were trading at.

The RNAV, which takes into account only the increase in the fair value of Roxy’s hotel property, is $0.67 a share, so the stock trades at more than 30% discount.

The discount is steeper if the RNAV includes development profits which are yet to be booked from its pre-sale revenue of $540 million.

The latter RNAV was not estimated in the Kim Eng Research report, so we turned to Koh Seng Geok (Roxy-Pacific). His estimate: about 87 cents a share, in which case the stock is trading at a discount of 48%.

b) SIAS Research in a Feb 24 report said it expects Roxy to maintain its growth momentum on an impressive order book of $540 million. “We maintain our Increase Exposure rating and upgrade our intrinsic value to 72 cents,” said SIAS Research.

Investment risks

According to SIAS Research, the key risks to Roxy’s future growth are property market cooling measures that affect its property development and investment segment.

Standard & Poor’s says: “Our primary concern with RPH remains the need for a consistent replenishment of landbank, which has its inherent challenges. In addition, policy uncertainties prevail in the Singapore property market unless marked signs of the market cooling become apparent. This will affect buyer sentiment. Likewise cashflow management remains critical for small to medium size developers like RPH, as a tightening of the credit market will impact RPH’s ability to raise funds.”

Recent stories:

ROXY-PACIFIC: After record profit in 2010, 4 projects for launch this year

Hot stocks on the first day of trading: JUKEN, XINREN, CHINA GAOXIAN, SUNVIC, ROXY-PACIFIC