Excerpts from latest analyst reports…..

Kim Eng Research maintains buy call on SUPER and $1.72 target price

Analyst: Gregory Yap

Super and Petra Foods have formed a joint venture to penetrate the Indonesian 3-in-1 coffee market.

We view the JV positively as (1) Super gains a new market that is the largest coffee market in Southeast Asia and (2) Petra gains a new product segment to augment its core chocolate and cocoa business.

The JV will be distributing through Petra’s vast network of 400,000 outlets throughout Indonesia. We maintain our BUY call and SOTP-based target price of $1.72.

Our View

We do not expect a significant contribution to the bottomline in the short term. But we reckon this is likely to be more exciting than Super’s 30:70 Philippines JV with San Miguel as Petra Foods’ product portfolio is more aligned to Super’s than San Miguel’s.

Recent story: SUPER: Grows FY2010 top line 18.8% to S$352m; proposes 3.6-cent dividend per share

OCBC reiterates buy on BIOSENSORS and $1.32 target price

Analyst: Andy Wong

Biosensors International Group (BIG) announced that it has obtained approval in-principle from SGX for the private placement of 216,325,800 new ordinary shares to Atlantis Investment Management Hong Kong Limited (Atlantis) and Ever Union Capital Limited (Ever Union).

Both independent investment boutique firms will get 50% of the placement shares or approximately 8.18% each of the enlarged share capital.

Maintain BUY albeit dilutive impact. The dilution factor works out to be 16.4%, which seems quite substantial, in our view. Nevertheless, we are confident that management would be able to efficiently utilise the proceeds to generate value for their shareholders.

Reiterate BUY with a revised fair value estimate of S$1.32 (previously S$1.36).

Recent story:BIOSENSORS, HI-P, CHINA FLEXIBLE: What analysts now say....

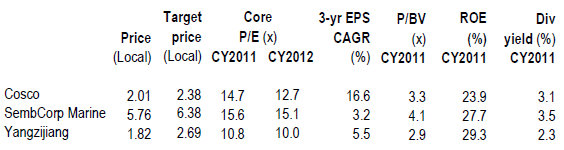

CIMB upgrades COSCO’s target price to $2.38

Analyst: Lim Siew Khee

Cosco Nantong has surprised us by signing a letter of intent (LOI) with Sevan Marine to construct two Sevan 650 drilling units for US$525m each with options for two more; we were originally expecting a contractaward for only one unit.

Upgrade to Neutral from Trading Sell. We believe the sizeable offshore orders could dispel fears over order-cancellation risks and our recent downgrade might have been an overreaction. We now peg Cosco at 15x CY12 P/E (previously 11x, its average trading band during the last crisis) in view of its order-book momentum.

This represents a 15% discount to Singapore rig builders. Accordingly, our target price climbs to S$2.38 from S$1.74. However, with the threat of rising steel prices, we only upgrade Cosco to Neutral. We see further re-rating catalysts from stronger-than-expected margins in shipbuilding and order wins.

Related story: YANGZIJIANG: A record US$2 billion contract to be inked in April/May?