Excerpts from latest analyst reports....

DBS Research initiates coverage on Biosensors with Buy recommendation; target price S$ 1.20.

DBS Research is initiating coverage on Biosensors with Buy recommendation and target price of S$ 1.20, which offers 43% potential upside.

"Our analyst projects earnings CAGR of 24% over the next two years, driven by market share gains led by leading product, BioMatrix, the first biodegradable polymer DES."

Catalysts ahead include securing approvals for sale of BioMatrix in Japan and China, with collective market size of US$800m – US$1bn.

Biosensors is also a prime target for take-over. The upcoming MicroPort’s HK IPO serves as rerating catalyst.

DBS Research maintains 'buy' call on Hi-P

One of Hi-P’s key customers, Research In Motion (RIM), has reported better-than-expected results. RIM's outperformance is positive for Hi-P. DBS Research estimates RIM to account for 30-35% of Hi-P's sales.

Hi-P has reported broad-based strength from RIM, Apple and other consumer electronics Seagate and Gillette during the last quarter's results announcement and have guided for a strong H2.

"We believe there is a chance of outperformance for Hi-P should the strength of both Apple and RIM turned out to be stronger than expected. No change to Buy call for Hi-P and TP of S$0.94."

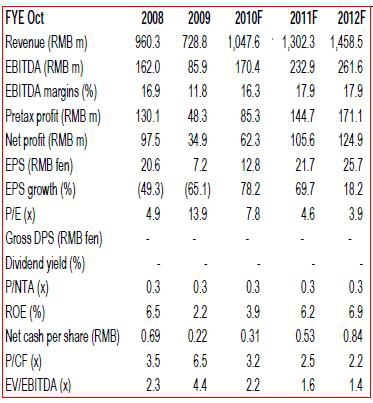

CIMB maintains ‘buy’ call on China Flexible

Analyst: William Tng

• Maintain BUY. Target price, S$0.34.

• Metallised CPP, a new product is expected to contribute positively to earnings in coming years.

• Earnings recovery remains intact and share price continues to trade at too big a discount to book. CY10 P/BV is just 0.3x.

• Resumption of dividend payment could improve share price. The Company is likely to have little capex for the remaining fourth quarter and FY11.

Affected by repair charges

• Turnover grew 41%/33% yoy for 9M10/3Q10. However, gross profit fell 32% yoy to RMB 21.1m even though 9M gross profit rose 33% yoy. This was due to a RMB 13.7m charge for repair to its equipment. Excluding this, gross profit would have risen by 12% yoy to RMB 34.8m. We understand the repairs are one-off in nature.

• Margin was also affected by higher oil prices.

• Balance sheet remains in good shape with zero borrowings and a net cash position.