Photo: www.anchun.com

This article was posted on remisier Ernest Lim's blog, http://www.ernestlim15.blogspot.com/, yesterday and is reproduced with permission.

Since my short write-up on Anchun on 14 Feb, the company's shares have dipped from $0.215 on 14 Feb to $0.180 on 18 Mar, in tandem with the slide in the equity markets and especially the small caps. For new clients who have not read my previous write-up on Anchun, I have included a description below.

Description of Anchun

Anchun is a leading integrated chemical systems engineering and technology solutions provider to the PRC petrochemical and chemical industries, in particular, manufacturers of ammonia and methanol based products. It has three divisions, viz:

1. Chemical systems engineering and technology design services (“CET”): Designs the production system (e.g. production system for ammonia)

2. Chemical systems & component manufacturing (“CSC”): Produce chemical equipment such as pressure vessels; heat exchangers & separation equipment etc)

3. Catalysts manufacturing: To speed up the rate & efficiency of chemical reactions via oxidative and reductive catalysts.

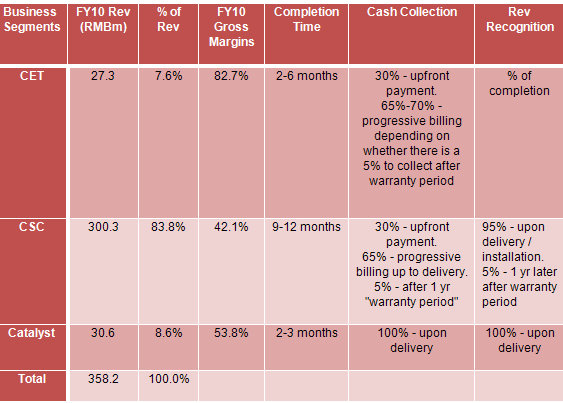

Table 1 illustrates the revenue contributions, gross margins and key aspects of the different business segments.

Investment merits

a) Sanguine industry prospects: According to China National Chemical Information Center, 83.3% of China’s ammonia producers and 85.2% of China’s methanol producers operate inefficient and pollutive plants of less than 180kt / year and 200kt / year respectively. According to a 5 Mar 11 Reuters’ report, Premier Wen Jiabao told the parliament that energy and carbon intensity would be reduced by 16% and 17% respectively by end 2015.

Existing inefficient producers have the incentive to upgrade their production facilities to increase their energy efficiency and reduce their pollution because in doing so, they would be able to reduce their operating expenses. This is especially important as there is typically a cap on the selling prices of methanol and ammonia -- thus methanol and ammonia producers typically would do their best to reduce their costs so as to increase their bottom line.

Anchun is likely to benefit as it designs and manufactures production systems for their customers in the ammonia and methanol fertilizer industry.

b) Significant barriers to entry: Anchun operates in an industry with significant barriers to entry. Anchun has a Class A national engineering design qualifications which allows it to undertake engineering investigation and design within its business scope in the nation-wide projects. (Among the four classes namely A, B, C and D, only Class A and Class B holders are allowed to undertake nationwide projects.)

It is not easy to get all the accreditations as the applicant’s track record, technical capabilities, industry reputation etc are taken into account, before he is granted such accreditations. Furthermore, government officials do visits in order to access the applicant’s capabilities. Anchun has taken more than a decade to obtain such accreditations.

While U.S. and European competitors can enter Anchun’s industry, in reality, they have difficulty competing because their equipment is more suitable for ammonia and methanol producers which use natural gas, instead of coal as raw material. Besides, the foreign players are not keen to set up manufacturing facilities to produce equipment and production systems in China as the capital expenditure and efforts required do not justify the costs.

Without a significant manufacturing presence in China, customers would not want to find a foreign player just to design the system and then have to find another manufacturer to manufacture the system (There is no guarantee that the manufacturer is able to manufacture the system using the design created by the foreign player). Such efforts would likely be costly.

Photo: Leong Chan Teik

c) Contracts likely to announce soon in the next few months: Anchun is likely to announce some contracts in the next few months due in part to China XLX’s expansion plan, as announced on SGXMasnet. XLX announced on 25 Oct that it intends to acquire and install equipment for its fourth production plant from Apr 2011 onwards.

It is also noteworthy that all three China XLX’s production plants use Anchun’s technology. Thus, Anchun is in a good stead to earn some contracts from XLX. (Note: XLX currently owns 3.88% of Anchun).

Secondly, in its 4QFY10 press release, management expressed confidence in securing more contracts and engaging in projects of a bigger scale in the foreseeable future.

d) Good operating track record: Although Anchun was listed only on 25 Oct 2010, it has established an illustrious record by winning 17 national and provincial awards / accreditations since its inception in 1993. For example, it was awarded 2009 Forbes China Up & Comers award (98th enterprise across all industries nationwide for enterprise growth potential) by Forbes China magazine.

Furthermore, in 2009, it was awarded the Underpinning Technology of the Nitrogen Fertilizer Industry – XA201 ammonia synthesis catalyst technology and methanol synthesis reactor technology.

Investment risks

a) Insufficient analyst coverage: There was only one rated NRA research report (target price: $0.410) before its IPO and a couple of unrated analysts reports. This lack of coverage means that investors and fund managers are still not familiar with Anchun’s business and prospects, thus it may take some time for Mr Market to recognize this company. However, investors who understand and believe in Anchun’s prospects now can purchase it with a considerable margin of safety.

b) Lumpy financials: Anchun has lumpy financials which make quarter-on-quarter estimation of its results tricky. This also increases the difficulty for analysts & fund managers to forecast its results with a good degree of accuracy.

c) 6 months moratorium expires in April: According to Anchun’s prospectus, the pre-ipo investors have a six months moratorium period which expires around middle to late April 2011. These hold a total of 267m shares. It is noteworthy that the investors’ cost of shares is usually much lower than the IPO price, thus even if Anchun trades below its IPO price in around middle to late April 2011, the pre-ipo investors may liquidate some shares to take profit.

d) 2012 is a more exciting year: Although management expects 2011 to be a better year than 2010, I believe more benefits would likely to accrue in 2012. Firstly, expansion plans such as the construction of the largest reductive catalyst production plant of which significant contribution would likely commence only in 2012. Secondly, for the potential contracts (if any) which Anchun may ink in the next few months, significant revenue recognition is likely to be take place only in 2012. (This is because the bulk of revenue contribution is likely to be derived from CSC business whose completion period takes about 9 – 12 months).

Furthermore, 2011 is likely to incur some one-off start up costs in the construction of the reductive catalyst plant & expansion of its CSC business. It is noteworthy that the non-recurring IPO expenses of RMB9.2m incurred in FY2010 would not be repeated in FY2011.

Conclusion

Anchun trades at a historical PE of 5.1x (using the existing number of shares outstanding of 505m, instead of weighted average number of shares, and S$/RMB exchange rate pegged at 5.20). This does not seem to be expensive if management can continue to build on its order books and execute its expansion plans smoothly.

Recent story: ANCHUN INTERNATIONAL: 2010 profit up 24%, this year to be stronger?