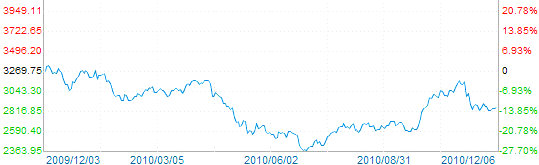

CHINA’S A Shares added 0.5% today to close at 2,857.18 on strength in oil firms buoyed by rising futures prices.

However, jitters over tougher policy in the real estate sector tempered gains.

Thanks to two-year highs for crude oil futures, Chinese petroleum companies carried the Shanghai Composite well into positive territory.

New York Mercantile Exchange light, sweet crude futures for January delivery traded at 89.66 usd per barrel, up 47 US cents from Friday marking over two-year highs.

Futures rose in large part due to early-arriving snowstorms blanketing much of the Northeast.

PetroChina added 4.7% to 11.77 yuan while China Petroleum & Chemical rose 2.0% to 8.34 yuan.

Other big gainers in the oil sector included China Oilfield Services Ltd (SHA:

However, the property sector had a much bluer Monday thanks to a report in the official media that new anti-speculative measures may be forthcoming for the industry.

Xinhua News Agency reported that President Hu Jintao recently announced that Beijing would more proactively administer economic affairs next year, hoping to reach a more balanced growth trajectory, and many interpreted this as meaning the government would do more to ease bubbles in various sectors such as real estate.

Also, the China Securities Journal reported today that economic regulators have pressured commercial banks to halt new property loan issuances to state-owned enterprises that have property development as their core operations.

This would put a serious damper on cash flowing into the sector, and developers’ shares were hit hard today.

Jinshan Development & Construction dropped 3.8% to 10.35 yuan while Shanghai New Huang Pu Real Estate was down 3.3% at 10.49 yuan.

Analysts anticipate the Shanghai Composite trading within the 2,800-2,900 range this week prior to an expected big jump in November inflation, with the CPI to be announced on December 13.

See also:

CHINA SHARES Lower On Lingering Rate Worries