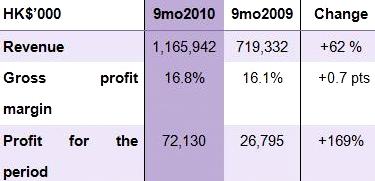

COMBINE WILL International Holdings Ltd (SGX: COMW), one of the leading one-stop ODM/OEM providers for premium and consumer products in the PRC, saw its January-September net profit surge 169% to over 72 mln hkd, led by strong sales to Europe.

Once again, the Singapore-listed firm’s ODM/OEM segment was the star performer, with the European market showing the fastest growth rate.

Combine Will, which is one of three Singapore-listed companies (the other two being China Gaoxian and Sunmart) headed for a dual listing in Korea, said that with wider margins over the period, the Group expects its ODM/OEM division to continue driving earnings going forward.

As such, it holds an “optimistic” outlook for FY2010 performance.

“Due to our high quality output and production efficiency, our customers have increased orders and plan to give us more orders in 2011. In order to cope with the upcoming wave, we have already properly equipped our production lines,” said Combine Will Executive Director Mr. Simon Chiu.

Combine Will’s revenue in the first nine months of 2010 rose 62% year-on-year to 1.2 bln hkd.

For the third quarter alone, revenue rose 20% year-on-year to 351.2 mln hkd leading to a net profit for the period of 18.6 mln hkd, up 30% from a year earlier.

Combine Will said that by focusing on R&D and continued investment in automation, the ODM/OEM division achieved additional revenue of 94.2 mln hkd in the July-September quarter, up 56% year-on-year.

On the other hand, third quarter revenue from the Moulds and Tooling division decreased by 5.5 mln hkd or 7.8%, while Machine Sales revenue dropped 56.7% to 30.9 mln hkd.

“Third quarter sales to Asia, North America and Europe reported significant increases due to the vast improvement in the OEM/ODM division. The star performer was the European market with a 43.6 mln hkd improvement, up 105.4% from a year earlier. Revenue from North America jumped 26.5% or 10.3 mln hkd while Asian sales improved by 1.8% or 3.9 mln hkd,” the company said.

The company’s third quarter administrative expenses increased by 29.4 mln hkd or 33.0% primarily due to the Korean IPO professional fees paid in the period.

According to UBS Ltd’s economic forecast, global GDP growth will achieve 4.1% in 2010 and the pace of expansion is likely to moderate to around 3.7% in each of the next two years.

"We believe the gradually recovering economy will bring us stable demand growth from customers, especially in Europe.

“The Group expects the ODM/OEM segment to continue to drive growth going forward thanks in large part to an ongoing global economic recovery and enhanced margins created by constantly improved production efficiency and stringent implementation of cost controls,” Combine Will said.

Executive Director Chiu added that Combine Will’s Korean IPO process is underway and the firm has just finished its EGM to pass share consolidation resolutions to issue up to 11,000,000 new consolidated shares in a dual listing.

See also: COMBINE WILL: Headed For High-Growth Days

------------------------------------------------------------------------------------------------------------------------

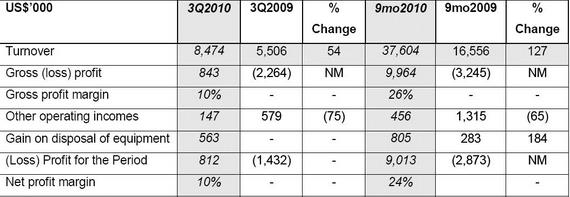

Meanwhile, Courage Marine Group Ltd (SGX: E91), a dry-bulk shipping company that transports raw materials for Asia’s growing energy needs, swung to a net profit of over nine mln usd in the January-September period.

This was thanks in large part to a 127% year-on-year increase in revenue in the first nine months to 37.6 mln usd.

The top line also saw strong third quarter performance, rising 54% year-on-year to 8.5 mln usd which helped the dry bulk shipper swing to a net profit of 812,000 usd for the period.

“These top line improvements are mainly due to an increase in capacity of the group’s fleet and better fleet utilization of around 90% in 3Q2010 given higher demand from the commodity trading especially in Greater China, compared to fleet utilization of around 51% in 3Q2009. The BDI saw some fluctuation and is currently around the 2,500 level,” Courage Marine said.

The global economy is gradually recovering from the financial crisis. The Asian economies, particularly China, has remained robust.

Dry bulk shipping is a highly leveraged play on Chinese property construction, as China makes up almost 50% of global steel production, over 50% of which is used in construction.

“Our financial performance for FY2010 will continue to be adversely affected by the current challenging economic conditions and uncertain outlook.

"However, we will maintain our cost-effective structure and focus on keeping its fleet well-deployed and running efficiently,” said Mr. Hsu Chih Chien, Chairman of Courage Marine.

See also: COURAGE MARINE: 90% Fleet Utilization Rate Key To Profitability