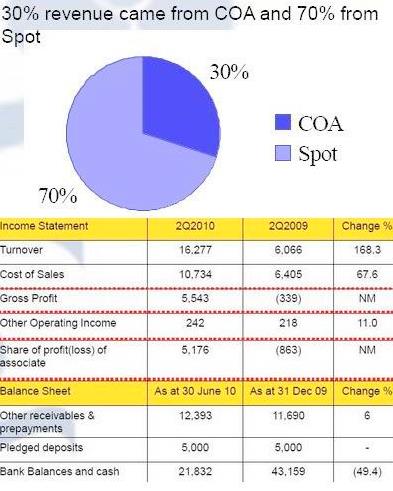

COURAGE MARINE Group Ltd (SGX: E91), a dry bulk shipper in Asia, saw its second quarter revenue surge over 168% year-on-year to around 16.3 mln usd.

This helped the nine vessel-strong firm swing to a net profit of 5.2 mln usd during the period on vastly improved margins.

Aries Consulting last week brought management together with investors during which Courage Marine’s Financial Controller said a high utilization rate was key to cost effectiveness.

Mr. Carl Yuen told the roomful of attendees from a broad spectrum of funds and brokerages that the sharply higher revenue in the April-June period was due to a quick recovery in dry bulk rates earlier this year.

And being focused primarily on shipping Asian sourced bulk commodities to Asian ports of calls, Mr. Yuen said Courage Marine is to some extent shielded from the more significant slowdowns continuing to plague both the EU zone and North America.

This also lifted second quarter gross profit margins to 34% on the back of higher freight rates and average fleet uilization of 90%. The company's cash was at approximately 21.8 mln usd.

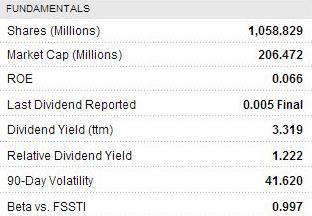

“We have very low gearing as our gross gearing ratio decreased from 6.2% in the fourth quarter last year to just 4.6% as of end-June this year,” Mr. Yuen said.

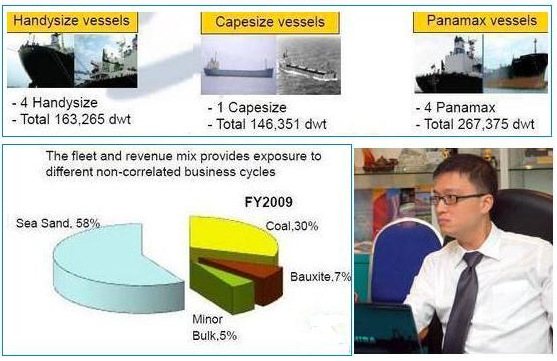

The company’s increasingly diversified fleet of four Handysize vessels, four Panamax and one recently acquired Capesize vessel for the bulkiest of loads also helps Courage Marine respond more efficiently to a vast array of different orders, each with their own timetables, volumes, destinations, cargos and of course shipping rates.

“Maintaining an integrated marketing presence in the Pacific Rim with offices in Taiwan, Hong Kong, Shanghai and Qinhuangdao enables Courage Marine to stay connected with its customers. We are quite well positioned in the high-growth coal transportation space between Indonesia and China, with charter rates along these routes remaining relatively stable,” he said.

An ability to quickly respond to new orders is also making its presence felt come earnings reporting season, as despite turnover increasing over 168% in the second quarter, the cost of sales increased by only 67.6% to 10.7 mln usd, proof that the company was finding ways to operate more cost effectively.

In fact, a big part of Courage Marine’s recent success has been supplying coal to North China’s Qinhuangdao port, with its easy access to electricity grids in the region as well as supplying coal and bauxite to the countless steel and aluminum mills that dominate heavy industry in the region.

He also said that investors appreciated the order stability that came from Courage Marine’s Who’s Who list of long-term clients including Taiwan Power, China Coal Energy, Glencore International, Cheung Kong Infrastructure unit Green Island Cement and several others.

“We are known for our credibility and good track record which has in turn won us a portfolio of established customers including multinational corporations and state-owned enterprises.”

To diversify its fleet composition to better respond to incoming orders, both spot and contract, the company recorded a cash outflow of 21.3 mln usd in the first half to acquire three vessels, a new Hong Kong office, repay bank borrowings and fund dividend payouts.

Higher margins and expanded revenue helped overcome a larger capital expenditure.

“We have managed to maintain consistent and stable EBITDA growth, and our performance has been less volatile than other shipping companies. We have a conservative cash management policy and a lower gearing ratio compared to peers. Our superior EBITDA/Assets ratio demonstrates our efficient use of assets to generate profit for our shareholders,” Mr. Yuen said.

“We will continue to adopt a prudent approach towards cash management which has strengthened our cash position and positioned us for the market recovery.”

He added that Courage Marine had been gradually reducing its gearing ratio over the past six years.

Because Courage Marine’s fleet of nine vessels were all purchased on the second-hand market, this meant substantial savings come acquisition signing time.

However, it also necessitated a heightened need for timely maintenance and repair, and Courage Marine was very well prepared for the challenge.

“The slowdown in global economic growth has resulted in lower shipbuilding and ship repair activities, presenting us with good opportunities to send our fleet for maintenance at attractive prices. And by properly maintaining and diversifying our fleet, we are better able to serve the needs of our customers when the economy recovers,” Mr. Yuen said.

He said being headquartered in Hong Kong afforded Courage Marine the ability to source for “good opportunities and financing.”

“As our operations span the region of China, Taiwan, Hong Kong, Singapore and Southeast Asia, our offices are strategically positioned to facilitate better communications between our customers and suppliers. We will continue to explore possibilities of further business development in commodity-rich North China and the industrialized South.”

Also see these recent stories:

COURAGE MARINE: Diverse Fleet Helping Boost Bulk Biz

COURAGE MARINE: Picking Up Steam On Economic Rebound

COURAGE MARINE: Buying Old Ships, Working Them Efficiently