Excerpts from latest analyst reports…

Phillip Research initiates coverage of Hu An Cable (43 cent) with 53-c target price

Analyst: Chan Wai Chee

One positive take-away from secondary listings is the existence of an underwriter. Although it is not stated anywhere in announcements of this nature, one should be able to assume that there is a certain amount of due diligence done by the underwriter. This is in addition to Hu An already having a reputable external auditor, Ernst & Young.

Still from an investment angle, Hu An is located in an industry that we find under-analysed overlaid by a country that is over-analysed. We would like to be invested in an industry rather than just falling in love with a country or economy. We like the fundamentals of its industry.

Hu An manufactures and sells various cables and wires out of Yixing, which houses the “biggest wire and cable manufacturing base in the PRC” and the company believes it is “amongst the top 3” there (per prospectus). In a recent announcement, it also states that it is “amongst the top 10 largest wire and cable manufacturers in PRC”.

We believe that Hu An is poised to take advantage of the changing dynamics of its industry. It should improve its relative position as it expands into high-voltage (HV) and ultra-high voltage (UHV) segments from its existing low- to mid-voltage ones. The HV and UHV segments are now dominated by imports. Continuing state investment in power infrastructure for the next 10 years will also favour the HV and UHV segments.

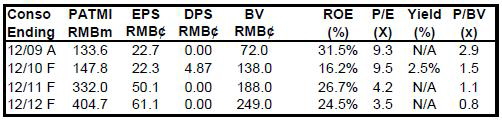

For now, and for safety in numbers: Including the proposed dilution arising from the possible TDR listing, the price per book would come to 1.2X. Tagging the most comparable of its Taiwanese peers’ forward P/E of 18 and factoring a ‘stubborn’ discount of 33% to get a 12 P/E, we arrive at a target price of SG 53¢.

We visited the company in the first half of the year.

Phillip's full report can be accessed here.

Recent story: HU AN CABLE: Powering up for greater investor interest

CIMB initiates coverage of Combine Will with 50-c target price

Analyst: William Tng

To complement this business, Combine Will has also grown into a leading supplier of plastic injection and die-cast moulds for internal usage and for the growing automobile industry. Its third arm is involved in the distribution and installation of advanced machines and precision tools for the mould related industry.

Catalyst 1 – earnings ramp in FY10. A new customer for automatic soap dispenser is expected to boost sales and profit in FY10. The customer’s product is already on sale in the US and is slated to go on sale in Europe soon. This is a mass volume product.

Given that Combine Will is currently the sole source for this product, margins and volume allocation will be good. It took Combine Will 3 years to clinch this business and as such, it could also take a while before new suppliers are qualified by the customer.

Catalyst 2 – Korea listing. Combine Will also hope that its proposed Korean dual listing will improve valuation and help penetrate into Korean customers. Prior to the Korean listing, Combine Will will undergo a share consolidation exercise. Every 10 shares will be consolidated into 1 share.

Initiate with BUY and target price of S$0.50. With the return of demand from existing customers and contribution from new customers, earnings could see double growth for FY10-FY11. We derive a target price of S$0.50, based on a 10% discount to our regional tech sector average CY12 P/E of 7.8x.

OCBC Investment Research says Avi-Tech may be due for a re-rating

Analyst: Kevin Tan

We believe Avi-Tech would continue to benefit from the continued growth in the global semiconductor sales.

Although one of its customers AMD had recently cut down its sales outlook amid softer-than-expected consumer demand, we note that other customers such as Infineon and Texas Instruments had narrowed or raised their revenue guidance. As such, we maintain our view that Avi-Tech is likely to achieve our 1QFY11 forecasts.

Engineering Services segment may be on recovery track. While its Engineering Services segment was impacted by low levels of capital expenditure by its customers in the past few quarters, management revealed in the results announcement that it is beginning to receive healthy orders and enquiries for its engineering and repair services. Moreover, we understand that its groundwork into the medical and life sciences industry is starting to bear fruits, with orders for new equipment likely to pick up in tandem with the macro economy. Hence, we believe a recovery in orders from the segment may just be around the corner.

Infineon's expansion plan into Asia is a positive. Of late, Infineon had announced its intention to sell its wireless business unit to Intel for ~US$1.4b (expected to complete in 1QCY11) and to use the proceeds to reinvigorate its in-house manufacturing capacity. We note that one of the directions by Infineon management was to expand its operations in Asia strongly over the next three years to service the robust growth there. We believe that there is potential for Avi-Tech to capture more business from Infineon going forward. Therefore, we would not be surprised to see its sales accelerate, possibly in FY12.

Maintain BUY. With the capital equipment segment on the cusp of recovery, we believe Avi-Tech may be due for a rerating. Despite the recent rise in share price, Avi-Tech still lags its peers YTD (17.9% total returns as opposed to an average of 42.5% from its peers). We raise our fair value from S$0.24 to S$0.28 as we peg it to 1.5x FY11F NTA (1.2x previously; still a 50% discount to its peak valuation of 3x) on this improved outlook. Looking at a total expected return of 36%, we maintain our BUY rating.

Recent story: ASL MARINE, AVI-TECH, MICRO-MECHANICS: What analysts say now.....