Excerpts from latest analyst reports….

Kim Eng Research maintains ‘buy’ on ASL Marine on valuation grounds.

Analyst: Eric Ong

Our View

The lengthening of the existing dry dock from 260m to 340m and the addition of a second medium‐sized dry dock, which was mostly completed in 4QFY Jun10, have added new capacity to the group’s ship repair operations. We understand from management that it will be focusing more on securing higher‐value offshore and energy related conversion works.

We are more optimistic on its chartering segment where ASL intends to reflag another 20 vessels in FY Jun11 following the implementation of Indonesia’s cabotage rules. Notably, the average day rates are still higher than the international market rates due to certain entry barriers and the current mismatch between the demand and supply of vessels that are eligible to operate in Indonesian waters.

Action & Recommendation

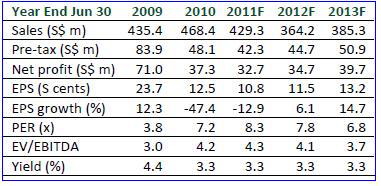

Despite a challenging outlook in the near term, ASL remains undemanding on valuation grounds at 8.3x FY Jun11 PER and 0.8x PBR.

Nevertheless, we lower our target price to $1.12, from $1.53, as we now peg the stock at 1.0x FY Jun11 NTA. Key catalysts are new shipbuildingorder wins and better‐than‐expected margin improvement.

Recent report: ASL MARINE: Best-equipped yard for ship repair in Indonesia, more jobs expected

OCBC maintains overweight on AVI-TECH and MICRO-MECHANICS amid semiconductor boom

Analyst: Kevin Tan

Under our coverage, Avi-Tech Electronics and Micro-Mechanics (MMH) had also performed according to our expectations, with sales up a healthy 30-68%.

Growth likely to sustain. For Jul, we note that worldwide semiconductor sales again grew strongly, up by 37.0% YoY (+1.2% MoM) to US$25.2b, following the 49.3% YoY growth (+0.5% MoM) seen in Jun, according to Semiconductor Industry Association.

More recently, Taiwanese foundry UMC also announced that its Aug revenue was up 20.1% YoY (+0.6% MoM). We view these developments positively, as these suggest that market demand is likely to remain healthy in 3Q10. While growth rates have started to show signs of moderation, it is consistent with our view that the semiconductor industry is likely to return to historical seasonal pattern, after several quarters of exceptional growth.

For 2010, we note that research firm Gartner has recently raised its global semiconductor growth forecast to 31.5% (27.1% previously), notwithstanding weaker-than-expected demand for PCs. As such, we remain positive on the outlook for semiconductor companies in 2H10.

Capital equipment market set for strong rebound. In addition, in the capital equipment market, several indicators are also pointing to a brighter outlook. According to SICAS, worldwide wafer fab capacity utilization in 2Q10 hit 95.6% (up from 93.5% in 1Q), despite an increase in production capacity.

North America-based semiconductor equipment manufacturers also posted US$1.83b in orders in Jul, hitting the highest level since Jan 2001. All these suggest that chip makers are likely to increase their capex spending, thus benefitting the capital equipment makers. As a note, VLSI Research had recently projected for the fab tool market to grow by 103% in 2010.

Maintain OVERWEIGHT. In view of the healthy outlook, we are maintaining our OVERWEIGHT view on the semiconductor industry. In addition, we retain our BUY ratings on Avi-Tech (S$0.24 fair value) and MMH (S$0.58 fair value), as we see them as strong beneficiaries of the industry upswing. Both companies also have strong financial positions and offer strong dividend yields.

Recent story: SEMICONDUCTOR BOOM: Beneficiaries include Avi-Tech, Serial, Hisaka