Excerpts from latest analyst reports …..

UOB Kay Hian highlights CHINA NEW TOWN’S strong land sales of Shanghai Luodian Project

Analyst: Singapore Research Team

What’s new

China New Town Development (CNTD) announced it sold two pieces of land in Shanghai Luodian Project with land area of151,151 sqm or 90,690 sqm GFA (0.6x plot ratio). In proximity to a golf course, the twolow-rise residential land pieces were sold at ASP of Rmb20,948 per sqm GFA or Rmb12,569per sqm land area.

Our take

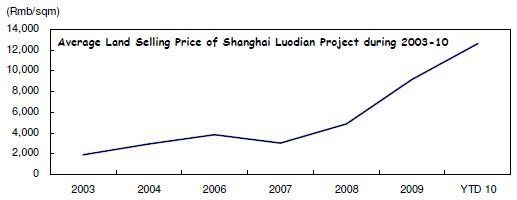

Land selling price is about 38% higher than average land price last year. Despite the slowdown of land market in Shanghai, the latest land price of Rmb12,569 per sqm land area is 37.5% higher than average land selling price of Rmb9,153 per sqm land area in 2009 and is also close to peak level land sales price of Rmb13,685 per sqm land area recorded in Sep09. This should relieve investors’ concern on the slowdown of Shanghai land market.

The land sales to improve earnings visibility of CNTD this year. Based on the profit sharing ratio of 64% in Shanghai Luodian Project, the management expects the attributable land sales proceeds of Rmb1.22b to be recognized this year. This has been higher than the company’s total sales revenue of Rmb1.09b last year.

The completion of Shanghai-Nanjing High Speed Rail will increase the value of CNTD’sproject in Wuxi. With the operation of Shanghai-Nanjing High Speed Rail starting last month, it shortens the travel time between Wuxi and Shanghai from previous two hours to only half an hour.

Moreover, there is one station of the high speed rail in Wuxi New District where CNTD’s project is located. We believe the improved infrastructure in the district will enhance the land value of CNTD project.

Still trading at deep discount. The stock is trading at about 45% discount to end-10 NAV of S$0.21 vs China property sector average of 35% discount to NAV. The strong land sales in Shanghai should be a stock catalyst in near term.

Recent story: CHINA NEW TOWN: Support from govt policy on accelerated urbanisation

Samsung Securities says ‘join the Man Wah party!’ with HK$10.60 target price

Analysts: Matthew Marsden & Summer Wang

Since listing on Apr 9 Man Wah has gained 24%, outperforming the HSI by 27%. The stock gained as much as 12% during Aug 4 trading, and closed up 9% on the day to finish at HK$8.44, a new high.

Full steam ahead

We spoke with management after the market closed; there was no specific news on Aug 4, but management shared three thoughts with us:

1. There was no stock price gain after the Jul 22 announcement of the new contracts worth HK$145m to supply railway vehicle companies CNR, CSR, and CRV with furniture as part of China’s high-speed rail network expansion. Man Wah expects to gain more orders of this nature in future—eg, supplying sofa beds, sofas, tables and chairs to the fast growing PRC railway sector, and perhaps even recliner sofas to cinemas, which should strengthen the brand and act as a new engine of growth.

2. Man Wah’s share price of HK$8.44 is still way below the average brokers’ target price of HK$10.66 (according to Bloomberg).

3. Management told us that more brokers are interested in covering Man Wah (only four brokers cover the stock now). The company also organized a visit for 14 investors and analysts at its headquarters in Huizhou on Aug 5.

We agree with these sentiments. We believe that as the market becomes familiar with the story, the stock will continue to appreciate. According to Bloomberg’s measure of consensus, Man Wah trades on a P/E of 10.1x in calendar 2010E, yet the market expects a net profit CAGR of 42% over 2009-2011E.

NRA Capital raises target price of SERIAL SYSTEM to 19 c

Analyst: Jacky Lee

Sales powered up by 62% yoy in 1H10 on a strong recovery in demand for electronics products in South-East Asian markets (+80% yoy), especially Singapore, Thailand and Malaysia. North Asia (China, Korea and Taiwan) continued to perform well, led by more new customers in China and higher sales to existing customers in South Korea and Taiwan.

Gross margins increased 0.6% pt yoy to 9.6% in 1H10 on the back of a better product mix. With a focus on cost efficiency and benefits from scale, EBITDA margins expanded 1.9% pts yoy to 3%. Despite higher financial costs and forex losses (S$1.5m), pretax and net profits jumped 407% and 446% yoy, respectively.

Net gearing increased from 27% as at end-Dec 09 to 60%, as a result of:1) higher working-capital requirements in preparation for more business in 2H10; and 2) its subsidiary’s purchase and installation of a LED advertising display media wall at Grand Park Orchard. Cash conversion cycle slightly increased by four days yoy to 60 days.

S$1bn revenue target for next year. Management displayed confidence in achieving S$1bn revenue next year through a continued focus on lucrative markets such as China, Korea and Taiwan and expansion in emerging markets like India and Vietnam. The Semiconductor Industry Association (SIA) is projecting worldwide chip sales growth of 28.4% yoy to US$290.5bn for this year. The growth forecast for next year is 6.3% yoy to S$308.7bn, followed by 2.9% yoy growth in 2012 to US$317.8bn.

Raising forecasts and maintain Buy. We raise our FY10-12 earnings forecasts by 20-54% to factor in more robust GDP numbers for Singapore and the region. As such, our fair value rises from S$0.14 to S$0.19, still pegged at 10x FY10 PER. We maintain our Buy recommendation. Although management indicated that it is likely to maintain a 40-50% dividend payout this year, we maintain our dividend forecast of 0.5 cent for now, implying a 25% payout.

Recent story: SERIAL SYSTEM: 448% surge in 1H profit to $6.5 m