THE CASH offer made by Depa Interiors for Design Studio Furniture Manufacturer shares has gotten the thumbs down - from the independent directors of Design Studio and from their appointed adviser, PrimePartners Corporate Finance.

THE CASH offer made by Depa Interiors for Design Studio Furniture Manufacturer shares has gotten the thumbs down - from the independent directors of Design Studio and from their appointed adviser, PrimePartners Corporate Finance.

As background, Dubai-based Depa has offered to pay 55 cents cash a share for all of the Design Studio shares it doesn’t own.

Since the offer was announced on June 28, most of the open market trades done involving Design Studio shares have been at prices above 55 cents, suggesting that the market values the stock higher than Depa's offer.

The stock closed at 57 cents yesterday (Friday, July 29)

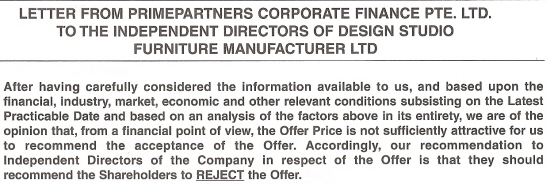

In a circular dated July 29 to shareholders, PrimePartners’ wording of its recommendation was:

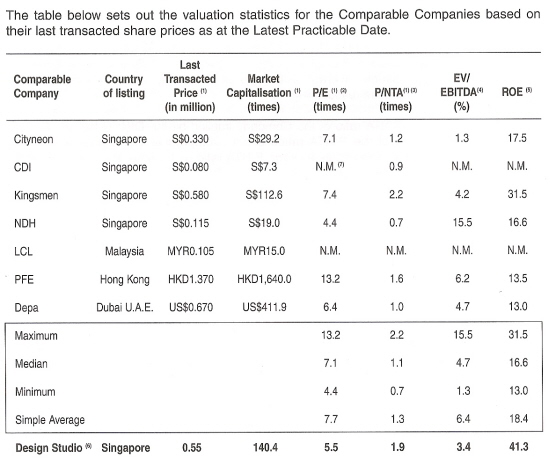

The analysis that PrimePartners did to arrive at its recommendation is contained in the circular, a copy of which was given to NextInsight by a shareholder.

It is lengthy and we don’t have the space to show you everything, except for the following table, a central basis for its recommendation:

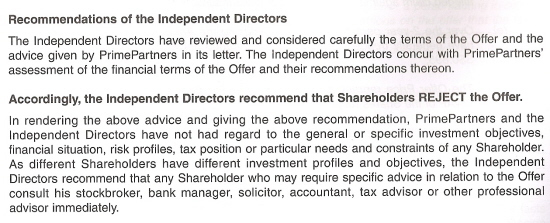

Taking into account PrimePartners’ recommendation, the independent directors have recommended to shareholders to reject the offer.

The unattractiveness of the Depa offer has been pointed out by NextInsight readers in our forum. Click here.

The interesting question now is: Will Depa raise its offer price?

Kim Eng Securities has also written that the offer is unattractive. Read: DESIGN STUDIO takeover: 'Depa could increase its offer, stay earnings-accretive'