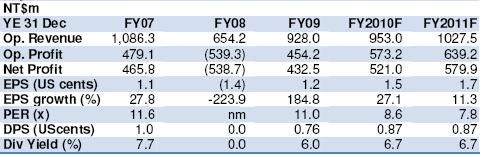

Hotung Investment Holdings reported 1QFY2010 results with a 779% YoY surge in net profits to NT$78.5m on the back of a 104% YoY increase in operating revenue to NT$189.5m largely due to an 87.8% YoY increase in gains of NT$168.0m on the disposal of available-for-sale investments as Hotung took advantage of the improving financial market conditions to realize gains in its investment portfolio.

Hotung Investment Holdings reported 1QFY2010 results with a 779% YoY surge in net profits to NT$78.5m on the back of a 104% YoY increase in operating revenue to NT$189.5m largely due to an 87.8% YoY increase in gains of NT$168.0m on the disposal of available-for-sale investments as Hotung took advantage of the improving financial market conditions to realize gains in its investment portfolio. As a result of improved profitatbility in 1QFY2010, Group NAV was lifted to NT$6.98 per share as at 31 Mar 2010, compared to NT$6.95per share as at 31 Dec 2009.

Thriving exit market conditions in the M&A market… In light of a healthy credit market, improving equity and economic market conditions, low interest rate environment and stronger corporate balance sheet, the momentum for merger & acquisition activities remains strong in 2010.

Particularly in Asia, Asian companies are growing in confidence and coupled with the strengthening Asian currencies, are seeking to expand beyond the domestic borders, increasing the amount of intra-Asia deals.

At the same time, non-Asian companies are looking to acquire Asian targets to tap the Asian consumption growth. As about 78% of Hotung’s investments (based on book value) are based in Greater China, a growing M&A prospects in Asia will augur well for Hotung, providing greater opportunities to realize values in investee companies and enhancing Group returns.

Source: NRA Capital

…as well as in IPO market. Despite concerns about the volatile market conditions at the beginning of the year, global IPO activities soared in the first quarter of 2010 with the thriving Asian markets driving the growth. For the rest of 2010, global IPO activity is expected to show signs of continuing momentum, further led by the Asia Pacific markets, due to robust growth in China and India. A thriving IPO market will provide an additional exit market for Hotung’s investee companies.

Recovery in the technology sector. The recent strong quarterly resultsand upbeat forward guidance of technology companies are signaling apromising recovery in the technology sector. The trend augurs well for Hotung which has about 75% of its investee companies (based on book value) in the technology sector. Improved performance in the investee companies will command higher valuations and returns when realised.

Valuation and Recommendations. We maintain our earnings forecast but raised our valuation on Hotung to 23.2UScts (previously 22.7UScts) ensuing from translation gains. Since our previous report dated 4 March 2010 Hotung’s share price has appreciated about 18%.

However, we see further re-rating of the share in view of further improvements to the exit market conditions and improving prospects in the technology sector. Accordingly, we raised our P/B to 0.65x (previously P/B of 0.6x), which is still relatively conservative compared to P/B of 0.9x of industry peers, to arrive at a target price of 15.0 UScts.

We upgrade our recommendation to a Long-term BUY.

Isamu Sakakibara, chairman & joint MD; Ms Tsui-Hui Huang, joint MD

(Hotung Investment Holdings (www.hotung.com.tw), a venture capital firm with operations in Greater China and the U.S., was listed on the Main Board of SGX-ST in August 1997.

It is the first and only Taiwan venture capital firm listed on the Singapore Exchange.)