TECHCOMP HOLDINGS has just reported record revenue and profit for the first half of this year of US$39.8 million and US$1.4 million, respectively.

Investors not familiar with Techcomp may estimate the full-year performance by simply multiplying the first-half numbers by two.

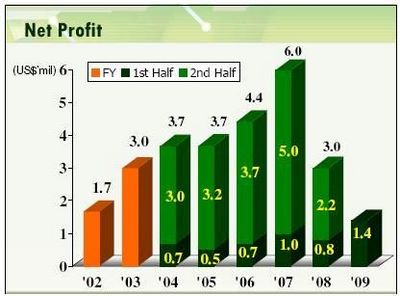

However, Techcomp has consistently derived much higher profit and revenue in the second half, as the charts on the right show.

The second half typically accounts for about 60% of the full-year revenue. For net profit, the second half accounted for more than 80% of the full-year figure.

On an annual basis, Techcomp has shown revenue growth at a brisk 20+% in past years. And its net profit margin has stayed at between 7.7% and 9%, except in 2008 because of forex losses. (Techcomp has put in place measures to insulate itself from forex volatility. See our earlier report).

Given its track record, Techcomp appears to have the characteristics of a steady and predictable grower, which enable investors to try some back-of-the-envelope forecasts for this year's numbers.

Now, if Techcomp’s revenue grows at 20% for the full FY09, and the net profit margin returns to its norm, then the net profit could come to US$7.8 million, or earnings per share of 7.3 Singapore cents.

That translates into a PE ratio of 3.9X for FY09 based on a recent stock price of 28.5 cents and 155 million issued share capital.

To back a step, investors may ask: Why does Techcomp's profit margin rise in the second half?

While the company's sales typically rise in the second half, business expenses are evenly spread throughout the year, said Mr Gilbert Sin, the CFO, at a briefing for analysts and investors yesterday (Aug 14) at Raffles City Convention Centre.

As a result, the profit margin goes up in the second half, with 7.7-9% being the range since 2003 (see table below).

The net profit margin achieved in the first half of this year was 3.6%, which may seem unimpressive but it is a sharp jump from the 2.6% of last year and from previous years'.

| Techcomp | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 |

| Revenue (US$’000) | 38,752 | 41,917 | 44,617 | 54,842 | 65,819 | 81,029 |

| Net profit (US$’000) | 2,991 | 3,667 | 3,687 | 4,350 | 6,011 | 3,008 |

| Net profit margin | 7.7% | 8.7% | 8.3% | 7.9% | 9.1% | 3.7 |

| EPS (US cents) | 2.99 | 3.15 | 2.73 | 3.22 | 4.30 | 1.99 |

Techcomp’s financials in the second half look set to receive a boost from its acquisition of a 75%-stake in HCC Group of France as Techcomp expands its European footprint. (See recent announcement on SGX website).

HCC had US$10 million sales last year and net profit of 0.26 million euros.

Responding to an analyst’s comment that the profit looked small, Mr Richard Lo, president and CEO of Techcomp, said: “The company was always at the break-even point. As soon as the revenue goes up, their profitability will turn around very fast.”

How HCC's revenue can rise was the subject of another question later. The following are some of the questions and answers from the briefing:

Q The gross margin slipped 1.5 percentage points because of the appreciation in the yen which increased the cost of purchases denominated in yen. I thought you had sorted this matter out.

Richard: There was some carryover from the old contracts. I can see our margins improving quarter by quarter and month by month, and hopefully by end of this year, we can catch up to our normal margin.

Q Can you explain the French acquisition in terms of how you intend to improve the revenue?

Richard: We can enhance the value of HCC in a few ways. First, help them bring down their costs. For faster result, we will use their network and brand name to add on our product line, and offer them a much broader product offering. I believe their revenue will grow very fast. And I believe we can help them enhance their sales in Asia.

Q The HCC acquisition will bring your cash level down from US$10 million to US$7 million. Do you see cash coming back in? Your inventory looks like it will stay at the same level?

Richard: We have been trying very hard to improve our working capital and we see some progress. This year, we anticipate reasonable growth and get back our normal profit margin. We believe we will have relatively good operating cashflow. We believe the balance sheet will be quite healthy in terms of cash.

Q At this stage, what sort of visibility do you have for the rest of the year for your business?

Richard: Normally, the sales cycle is about nine months. Looking at the projects in the pipeline and our orderbook, we are quite optimistic about this year.

Q You have the capacity? At what point would you need to expand?

Richard: We don’t need too much capital investment but we have to train up more people, line up more vendors, and we are doing the preparation to support future growth.

Q I always ask this question: dividends. Assuming you achieve the same margin you achieve last year, will we see a better dividend payout?

Richard: It’s the same answer - It’s up to the board to decide.

Gilbert Sin, CFO: We have an advantage by not having a fixed dividend policy. In 2008, we maintained the dividend level (of 1.2 cents).

Recent stories:

TECHCOMP: "Record sales so far this year"

TECHCOMP: From HK$50K to S$70 million in 20 years (The story of Richard Lo)