- Posts: 302

- Thank you received: 39

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

Straco -- gem?

- lotustpsll

- Offline

- Elite Member

-

Less

More

11 years 1 month ago #21556

by lotustpsll

Replied by lotustpsll on topic Straco -- gem?

Still churning out the cash!.

Key risk is water contamination. Management must ensure water quality is kept at optimal level.

Keen to hear their strategies on the Flyer. I am confident this investment will do well.

Key risk is water contamination. Management must ensure water quality is kept at optimal level.

Keen to hear their strategies on the Flyer. I am confident this investment will do well.

Please Log in to join the conversation.

11 years 1 month ago - 11 years 1 month ago #21576

by Poh

Replied by Poh on topic Straco -- gem?

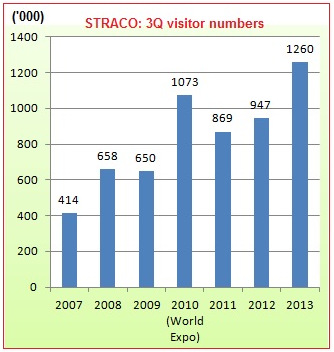

My mouth opened wide just looking at the 3Q visitor growth.

in 3Q 2014, the visitor number was 1.650 million, an increase of 31% y-o-y.

infopub.sgx.com/FileOpen/Straco3Q14resul...cement&FileID=324799

According to max figs from my research, the max is 20K + 16 K for Straco's 2 aquariums = 36 K per day = 3.24 million in 3Q.

Taking 20% cut in order to preserve nice visitor experience, the max could be 2.6 million in 3Q.

Still a long way before max is maxed. The other quarters are of course full of room to grow. Only thing is, can crowds shift to the non-peak quarters?

in 3Q 2014, the visitor number was 1.650 million, an increase of 31% y-o-y.

infopub.sgx.com/FileOpen/Straco3Q14resul...cement&FileID=324799

According to max figs from my research, the max is 20K + 16 K for Straco's 2 aquariums = 36 K per day = 3.24 million in 3Q.

Taking 20% cut in order to preserve nice visitor experience, the max could be 2.6 million in 3Q.

Still a long way before max is maxed. The other quarters are of course full of room to grow. Only thing is, can crowds shift to the non-peak quarters?

Last edit: 11 years 1 month ago by Poh.

The following user(s) said Thank You: BNN

Please Log in to join the conversation.

11 years 3 weeks ago - 11 years 3 weeks ago #21616

by BNN

Replied by BNN on topic Straco -- gem?

Singapore Flyer is doing an excellent job on its Facebook page. Lots of v lovely pictures -- and lots of positive vibes from people from everywhere.

Check it out: www.facebook.com/singaporeflyer

Check it out: www.facebook.com/singaporeflyer

Last edit: 11 years 3 weeks ago by BNN.

Please Log in to join the conversation.

11 years 2 days ago #21746

by zane

Replied by zane on topic Straco -- gem?

I am hungry for any analysis of Straco's 4Q result. The Singapore Flyer did contribute revenue but there is no specific figure in the announcement. Core aquarium business looking fine and undoubtedly contributed large cash inflow as expected.

Please Log in to join the conversation.

10 years 11 months ago #21767

by Rock

Replied by Rock on topic Straco -- gem?

Straco 4Q revenue was $19.42 million, an 32.8% increase compared to the revenue of $14.63 million for 4Q2013 but 4Q2014 profit was $4.62 compared to the profit of $5.87, an decrease of 21.3%. Taking into consideration of one-off expenses of increased $6.02 million, Straco 4Q2014 profit should increased over 4Q2013 profit. The one-off expenses was attributable to the expenses incurred by SLPL as it took over the operation of Singapore Flyer from 28th November 2014.

The other positive factor is Straco operating cash flow of $37 million generated in FY2014.

Straco may face short term share price weakness because of fall in 4Q profit but taking into consideration of one-off expenses and the fact that Straco able to generating cash flow of $37 million in FY2014 speak volume. As the group took over the operation of the Singapore Flyer from 28th November 2014, the performance of the Singapore Flyer will only unfold in 1Q2015. The group has yet to review its plan for the Singapore flyer.

The other positive factor is Straco operating cash flow of $37 million generated in FY2014.

Straco may face short term share price weakness because of fall in 4Q profit but taking into consideration of one-off expenses and the fact that Straco able to generating cash flow of $37 million in FY2014 speak volume. As the group took over the operation of the Singapore Flyer from 28th November 2014, the performance of the Singapore Flyer will only unfold in 1Q2015. The group has yet to review its plan for the Singapore flyer.

The following user(s) said Thank You: 1668

Please Log in to join the conversation.

10 years 11 months ago #21877

by Rock

Replied by Rock on topic Straco -- gem?

Straco this week attract investor interest and closed at 79 cts. This comes just after Nextinsight article on 1st March 2015:

STRACO: S'pore Flyer profitable, not considering one-off expenses

I believe issues listed below and inprovement made, Singapore Flyer will definitely be the next cash-cow for Straco.

Singapore Flyer - Some issues tackled, 'enormous upside' ahead:

1. Tour operators who had tour desks at the Flyer profiteering from discount tickets to walk-in visitors.

2. Tour Agencies were allowed to pay through credit cards resulting in the Flyer incurring credit charges of 2.5% to 5%.

3. Tenants rentals were less than 50% of the market rate and under the reciever the tenants pay market rate.

4. Function halls have left sitting idle, this place has enormous upside and the receiver decided not to commit to new major leases in order not to place the incoming new owner of the Flyer in an onerous situation.

5. So far for the first seven months of 2014, the Flyer's revenue rose 9% y-o-y while earnings before interest, taxes, depreciation and amortisation (Ebitda) margins increased 50%.

Tim Reid, partner at Ferrier Hodgson:

"If we can improve Ebitda, with tenants paying less than 50% of the market (price), and function halls that people are wanting to take which we have left sitting idle, (then) this place has enormous upside.

"I have enormous confidence that this business will do significantly better under the new owner than what we have done, which is only tweaking."

STRACO: S'pore Flyer profitable, not considering one-off expenses

I believe issues listed below and inprovement made, Singapore Flyer will definitely be the next cash-cow for Straco.

Singapore Flyer - Some issues tackled, 'enormous upside' ahead:

1. Tour operators who had tour desks at the Flyer profiteering from discount tickets to walk-in visitors.

2. Tour Agencies were allowed to pay through credit cards resulting in the Flyer incurring credit charges of 2.5% to 5%.

3. Tenants rentals were less than 50% of the market rate and under the reciever the tenants pay market rate.

4. Function halls have left sitting idle, this place has enormous upside and the receiver decided not to commit to new major leases in order not to place the incoming new owner of the Flyer in an onerous situation.

5. So far for the first seven months of 2014, the Flyer's revenue rose 9% y-o-y while earnings before interest, taxes, depreciation and amortisation (Ebitda) margins increased 50%.

Tim Reid, partner at Ferrier Hodgson:

"If we can improve Ebitda, with tenants paying less than 50% of the market (price), and function halls that people are wanting to take which we have left sitting idle, (then) this place has enormous upside.

"I have enormous confidence that this business will do significantly better under the new owner than what we have done, which is only tweaking."

The following user(s) said Thank You: BNN

Please Log in to join the conversation.

Time to create page: 0.246 seconds