- Posts: 185

- Thank you received: 8

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

Special Situation stocks

6 years 7 months ago - 6 years 5 months ago #24857

by Garak

Replied by Garak on topic Special Situation stocks

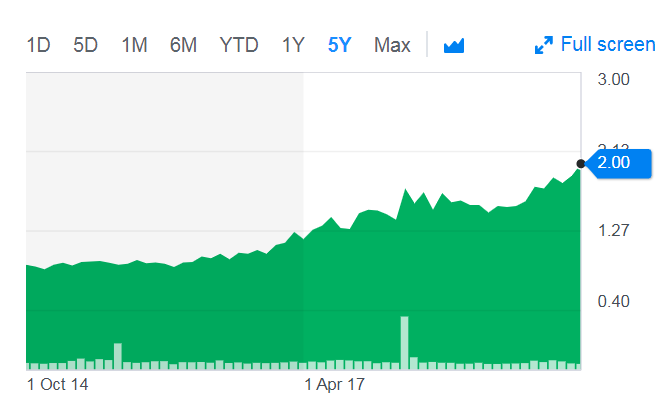

POWERMATIC DATA SYSTEM: Net Cash per share = $1.005.

Let’s do a little math here. Their EPS for 2019 was $0.20. Say we value them at a PE ratio of 8X. That equals to $1.60. Their cash holdings is $1.00 per share. Their investment property is worth about $17mil, which is $0.488 per share.

Add them up and you get $3.00.

So says TheMossPiglet: themosspiglets.com/2019/05/27/powermatic...l-year-results-2019/

Let’s do a little math here. Their EPS for 2019 was $0.20. Say we value them at a PE ratio of 8X. That equals to $1.60. Their cash holdings is $1.00 per share. Their investment property is worth about $17mil, which is $0.488 per share.

Add them up and you get $3.00.

So says TheMossPiglet: themosspiglets.com/2019/05/27/powermatic...l-year-results-2019/

Last edit: 6 years 5 months ago by Garak.

Please Log in to join the conversation.

6 years 5 months ago #25024

by Garak

Replied by Garak on topic Special Situation stocks

Please Log in to join the conversation.

6 years 3 months ago - 6 years 3 months ago #25071

by Garak

Replied by Garak on topic Special Situation stocks

Big re-rating today for POWERMATIC DATA SYSTEMS.

Undervalued becos: Net Cash per share = $1 per share.

Their investment property's market value is about $1 per share.

The EPS for 2019 was $0.20. Say we value them at a PE ratio of 8X. That equals to $1.60.

Add them up and you get $3.60.

(Share price currently is about $2.40)

Undervalued becos: Net Cash per share = $1 per share.

Their investment property's market value is about $1 per share.

The EPS for 2019 was $0.20. Say we value them at a PE ratio of 8X. That equals to $1.60.

Add them up and you get $3.60.

(Share price currently is about $2.40)

Last edit: 6 years 3 months ago by Garak.

Please Log in to join the conversation.

6 years 2 months ago #25126

by Garak

Replied by Garak on topic Special Situation stocks

Broadway cheong this morning.50%

Ready to sell property in Shnezhen worth S$50+million? Ready to dispose of HDD business > then diversify into something else?

links.sgx.com/FileOpen/BIGL%20-%20Strate...cement&FileID=587729

Ready to sell property in Shnezhen worth S$50+million? Ready to dispose of HDD business > then diversify into something else?

links.sgx.com/FileOpen/BIGL%20-%20Strate...cement&FileID=587729

Please Log in to join the conversation.

5 years 11 months ago #25270

by pine

Replied by pine on topic Special Situation stocks

Anchun is worth watching, as it has reported another year of profitabiility.

About 11.6 m RMB in 2019, versus 10.5 m RMB in 2018. What is really notable is it has proposed a dividend for the first time in a long time from its large cashpile.

The dividend is 12RMB cents, equiv to 2.4 SG cents. which makes the yield about 10%.

EPS 23RMB cents =4 SG cents, so PE ratio is 6X.

NAV 6 RMB ! compared to stock price of 26 singapore cents.

About 11.6 m RMB in 2019, versus 10.5 m RMB in 2018. What is really notable is it has proposed a dividend for the first time in a long time from its large cashpile.

The dividend is 12RMB cents, equiv to 2.4 SG cents. which makes the yield about 10%.

EPS 23RMB cents =4 SG cents, so PE ratio is 6X.

NAV 6 RMB ! compared to stock price of 26 singapore cents.

Please Log in to join the conversation.

Time to create page: 0.238 seconds