Article contributed by a reader

| Boustead Singapore (SGX: F9D) recently traded around S$1.60, giving the company a market capitalization of about S$800 million (based on roughly 500 million shares). It's a story of solid businesses trading at a steep discount. With net cash of S$326 million on the balance sheet, the enterprise value (EV) drops to just S$475 million—or about S$0.95 per share. That's compelling, especially when one division of Boustead alone could justify the entire price. |

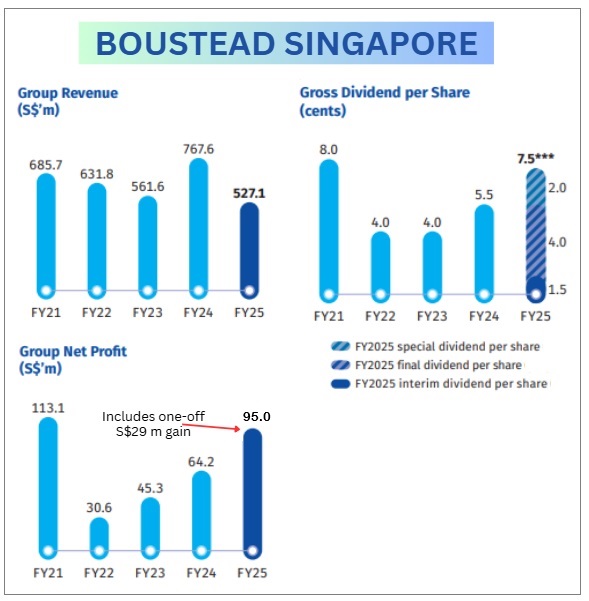

Here's a snapshot of some key metrics of the company:  Source: annual report

Source: annual report

| What does Boustead do? |

Boustead is a diversified conglomerate with roots stretching back nearly 200 years. It operates four main divisions, each solving real-world problems in niche areas.

First, the Geospatial Division. This arm distributes Esri's ArcGIS software, a powerful tool for geographic information systems (GIS).  It helps governments and businesses map and analyze data—like planning city infrastructure, tracking natural resources, or optimizing supply chains.

It helps governments and businesses map and analyze data—like planning city infrastructure, tracking natural resources, or optimizing supply chains.

Exclusive in markets like Singapore, Malaysia, Australia, and Indonesia, it generated S$221.4 million in revenue for FY2025 (ended March 2025), up 4% year-over-year, with operating profits around S$52 million.

It's a high-margin, recurring business, as clients rely on subscriptions and updates for mission-critical tasks.

Next, Real Estate Solutions. Here, Boustead designs and builds eco-friendly industrial parks and business spaces.

Imagine modern warehouses or logistics hubs that are energy-efficient and sustainable.

They've developed over 3.7 million square meters across Asia, serving big names from Fortune 500 lists.

FY2025 revenue was S$134.3 million (down due to project cycles), but the portfolio includes valuable assets like the Boustead Industrial Fund, valued at S$812 million.

Then there's Energy Engineering, focusing on engineering services for oil, gas, petrochemicals, and now renewables like water treatment.

Simply put, they build and optimize systems for energy industries to run efficiently and greenly.

With projects in 93 countries, revenue hit S$158.9 million in FY2025, backed by a S$126 million order backlog.

Finally, Healthcare is the smallest but growing: It provides solutions for chronic diseases, rehab, sleep issues, and sports science—think equipment that helps patients recover faster or manage age-related health problems. Revenue rose 14% to S$12.1 million last year.

| Valuation |

Overall, FY2025 revenue was S$527 million (down 31% from project timing), but net profit jumped 48% to S$95 million, boosted by a one-off S$29 million gain from transferring real estate fund management to UIB—a new pan-Asian platform for logistics and data centers where Boustead holds a 20% stake.

Adjusting for that, Boustead's core profits grew 8%.

|

Stock price |

$1.68 |

|

52-wk range |

90.5 c –$1.72 |

|

PE (ttm) |

8.6 |

|

Market cap |

$826 m |

|

Dividend |

3.27% |

|

1-yr return |

70% |

|

P/B |

1.4 |

|

Source: Yahoo! |

|

Now, the Geospatial Division alone, with S$50 million in annual pre-tax profits, could be worth S$500 million at a conservative 10x P/E—more than the entire EV.

That means real estate (S$600-800 million in assets), energy (valued around S$250 million), and healthcare come essentially "free."

Excluding cash, earnings per share are about S$0.15, trading at a cheap 6.5x P/E despite being a diversified group with a solid track record.

Historically, Boustead's P/E ranged 10-12x, implying a fair value of S$1.50-1.80 from earnings alone.

Add back S$0.65 per share in cash, and you're looking at S$2.15-2.45— which represents 30-50% upside from S$1.60.

Proposed REIT Structure: The IPO involves creating a REIT for listing on the SGX-ST, sponsored by UIB. REIT's IPO Portfolio: The REIT's initial assets would include Boustead's stakes in select Singapore-based logistics and industrial real estate properties, plus other unrelated assets not owned by Boustead. Boustead's Stake in UIB: Boustead, via its Real Estate Solutions Division (Boustead Projects Limited), owns an effective 20% shareholding in UIB, giving it indirect exposure to the REIT sponsor. |

It appears that Boustead offers stability through diversification and undervaluation, with OCBC Investment Research pegging a $2.00 fair value on the stock.

|

|||||